The dollar hovered near a one-month peak

2024-01-18

Summary:

Summary:

Thu saw the dollar near a one-month peak post strong US retail sales, signaling persistent inflation. The market still expects a 150 bps cut in 2024.

EBC Forex Snapshot

18 Jan 2024

The dollar hovered near a one-month peak on Thu after robust US retail sales

data was indicative of inflation stubbornness. The market is still pricing in a

likely 150 bps for 2024.

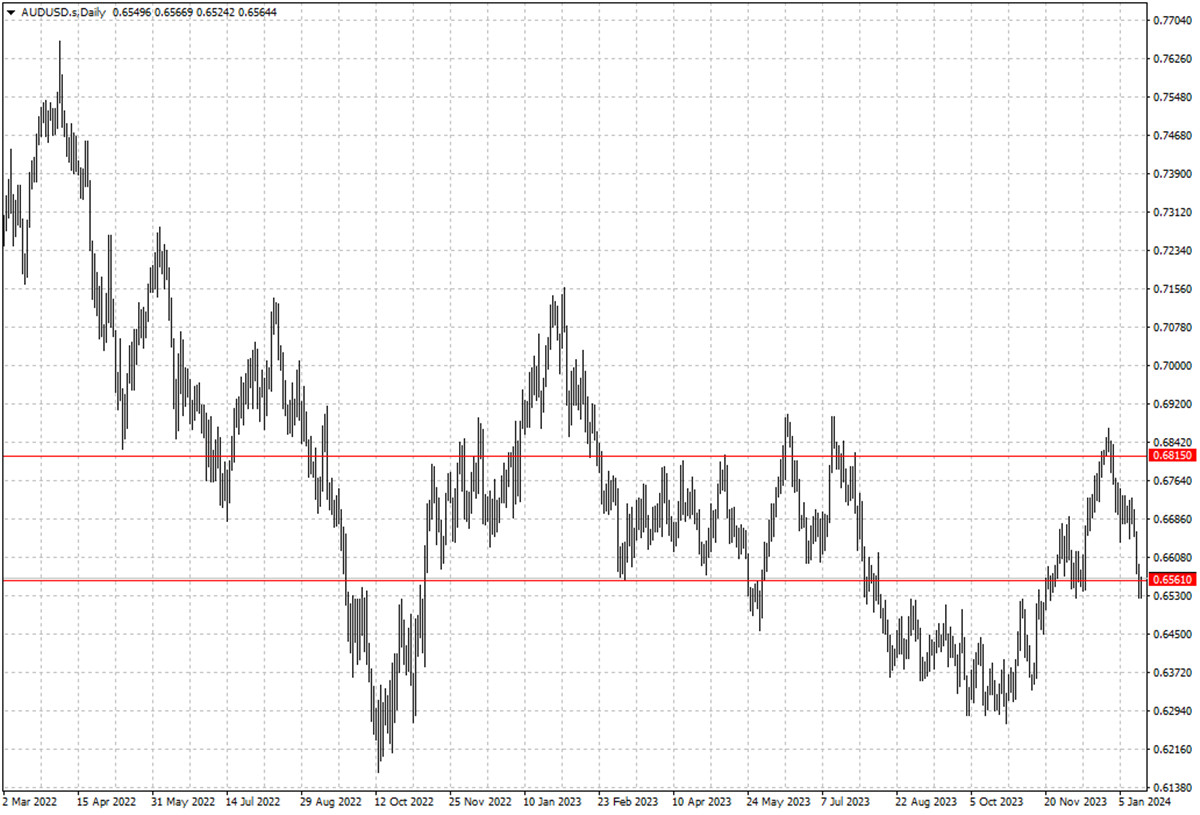

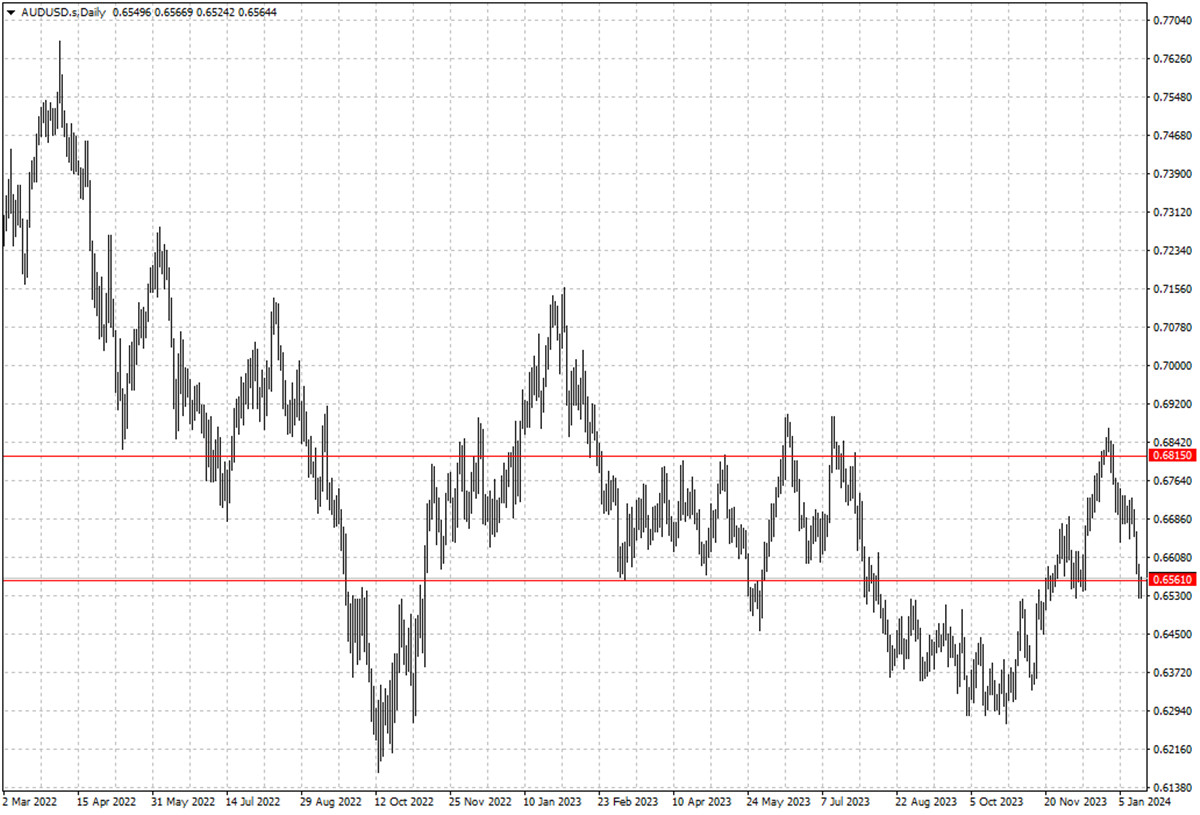

The Australian dollar was little changed after data showed an unexpected drop

in employment in December. A net loss of 65,000 jobs was seen though

unemployment rate held steady at 3.9%.

Rio Tinto Group, the world’s top iron ore exporter, sees increased stimulus

measures in China driving iron ore demand into a gradual recovery this year. The

commodity has experienced a sharp pullback since the new year began.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 8 Jan) |

HSBC (as of 16 Jan) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0833 |

1.1150 |

1.0836 |

1.1100 |

| GBP/USD |

1.2536 |

1.2848 |

1.2612 |

1.2832 |

| USD/CHF |

0.8333 |

0.8667 |

0.8398 |

0.8644 |

| AUD/USD |

0.6641 |

0.6900 |

0.6561 |

0.6815 |

| USD/CAD |

1.3177 |

1.3483 |

1.3246 |

1.3529 |

| USD/JPY |

139.48 |

144.96 |

141.84 |

148.01 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.