Dollar Stays Near Eight-Week Low

2024-06-07

Summary:

Summary:

The dollar hovered near an 8-week low Friday, awaiting a key US jobs report for Fed policy clues. Markets expect a 50 bps cut by year-end.

EBC Forex Snapshot, 7 Jun 2024

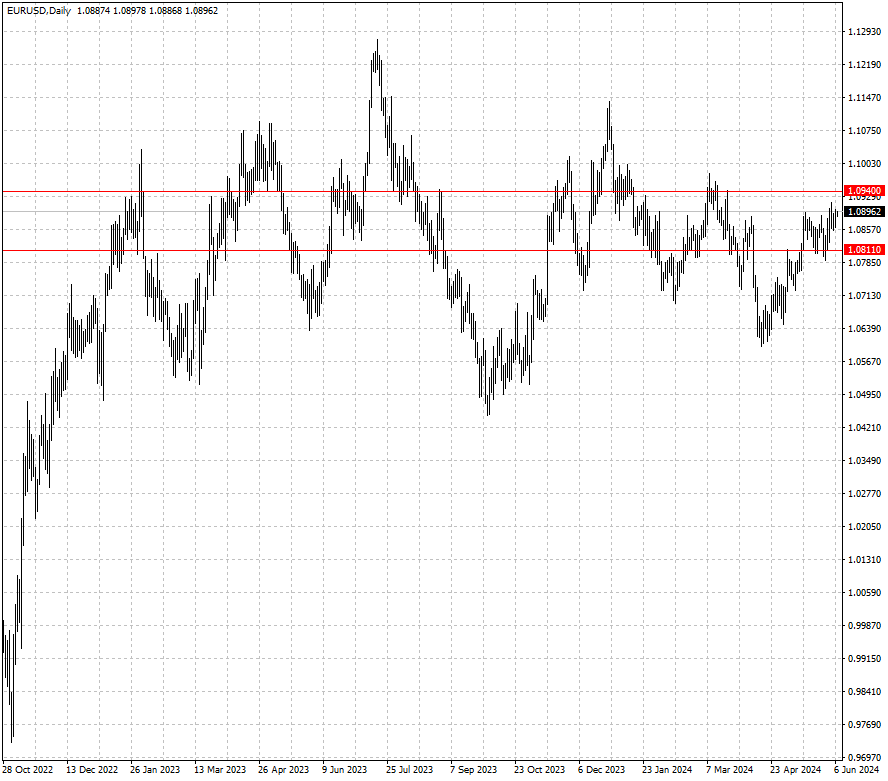

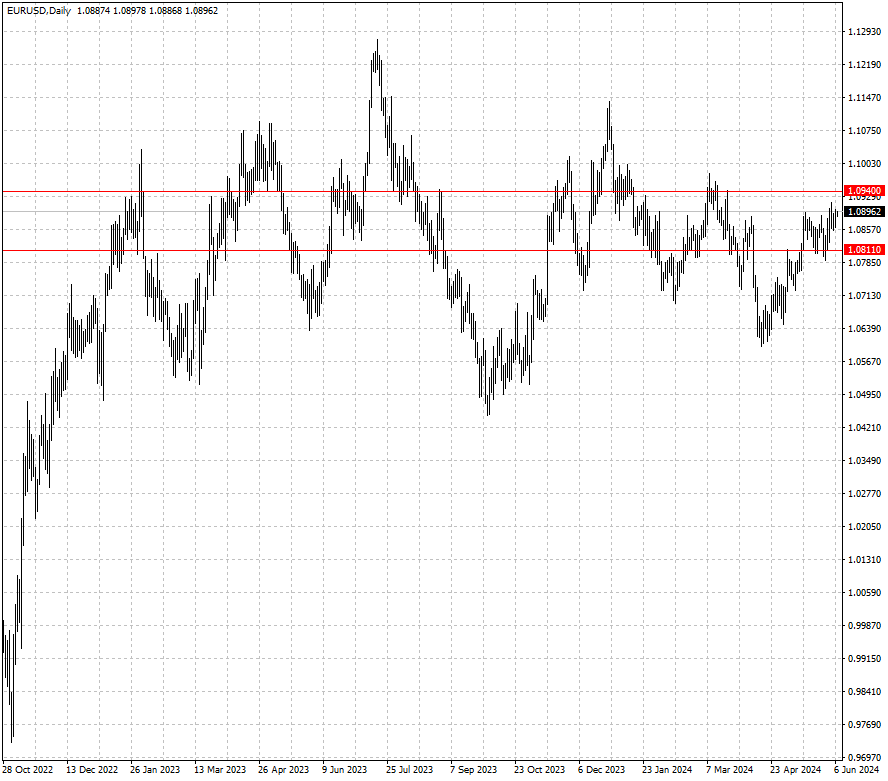

The dollar hovered close to an eight-week low on Friday ahead of a crucial US

jobs report that could provide clues on the Fed's monetary path. Markets

currently price in 50 bps of cuts by year end.

The euro held on to overnight gains after the European Central Bank reduced rates in a

well-telegraphed move - the first reduction in five years. Inflation is

projected to reach 2.5% in 2024, higher than the previous forecast for 2.3%.

Policymakers offered few hints about the next move. Analysts say the decision

is unlikely to be followed by a series of fast cuts as sticky inflation will

limit the room for additional loosening.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 3 Jun) |

HSBC (as of 7 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0788 |

1.0895 |

1.0811 |

1.0940 |

| GBP/USD |

1.2300 |

1.2803 |

1.2704 |

1.2845 |

| USD/CHF |

0.8988 |

0.9158 |

0.8796 |

0.9073 |

| AUD/USD |

0.6563 |

0.6729 |

0.6599 |

0.6720 |

| USD/CAD |

1.3577 |

1.3846 |

1.3593 |

1.3743 |

| USD/JPY |

152.12 |

158.44 |

154.17 |

157.40 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.