The dollar edged broadly lower on Thursday

2024-02-22

Summary:

Summary:

The dollar dips as traders await business surveys to assess major economies. The Fed rate cut odds for May at around 30%.

EBC Forex Snapshot, 22 Feb 2024

The dollar edged broadly lower on Thursday as traders awaited a slew of

business activity surveys to gauge the health of major economies. Traders are

currently pricing in just about a 30% chance of Fed’s rate cuts in May.

Most Fed officials cautioned against cutting rates too quickly at their last

policy meeting as they continue to look for convincing evidence that inflation

is returning to their 2% target, the latest minutes showed.

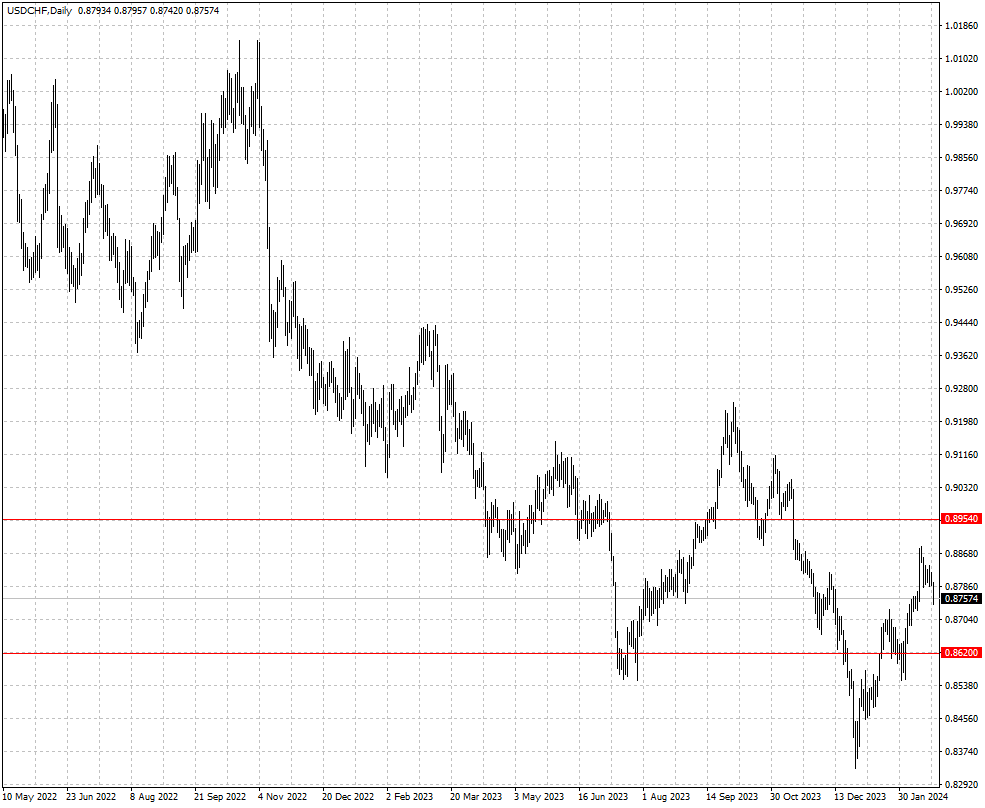

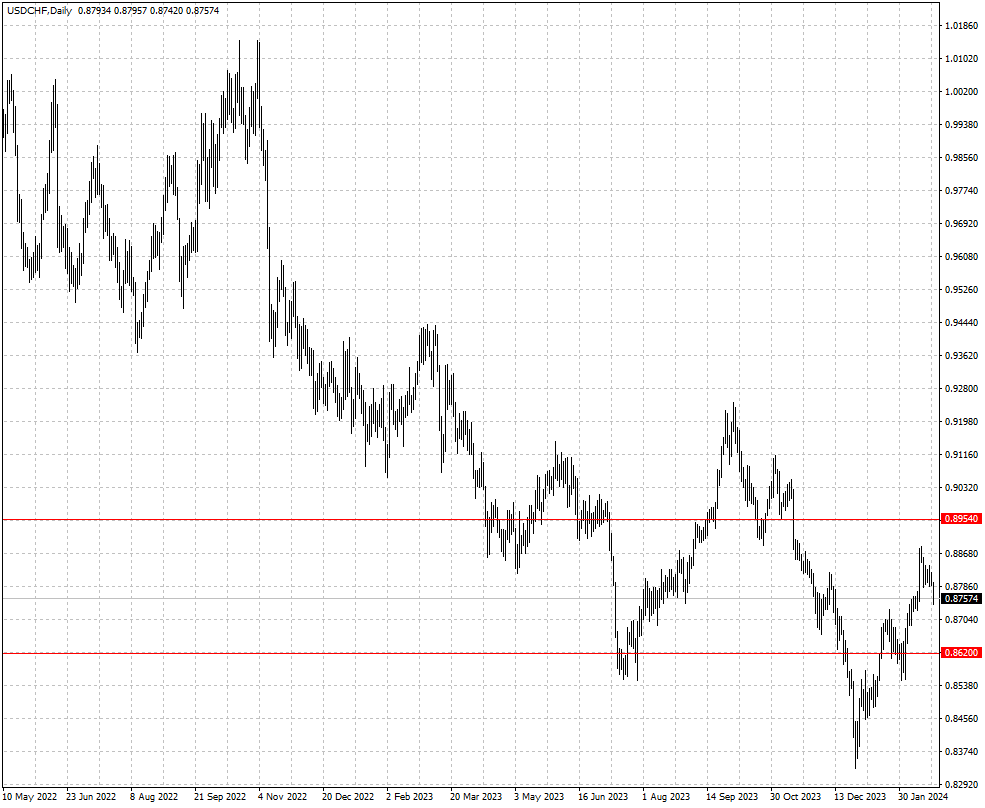

The Swiss franc strengthened to its high within more than a week. The annual

inflation fell further to 1.3% in Switzerland last month, paving the way for

earlier cuts by the SNB.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 5 Feb) |

HSBC (as of 20 Feb) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0724 |

1.1139 |

1.0681 |

1.0885 |

| GBP/USD |

1.2487 |

1.2827 |

1.2481 |

1.2738 |

| USD/CHF |

0.8333 |

0.8728 |

0.8620 |

0.8954 |

| AUD/USD |

0.6500 |

0.6900 |

0.6449 |

0.6618 |

| USD/CAD |

1.3379 |

1.3552 |

1.3372 |

1.3595 |

| USD/JPY |

146.09 |

148.80 |

147.03 |

152.03 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.