The dollar drifted lower in the Asia session

2023-12-12

Summary:

Summary:

The dollar drifted lower in the Asia session on Tuesday as traders turned their focus on US inflation data and a slew of central bank meetings ahead.

EBC Forex Snapshot

12 Dec 2023

The dollar drifted lower in the Asia session on Tuesday as traders turned

their focus on US inflation data and a slew of central bank meetings ahead.

Economists polled by Reuters expect headline inflation to have been flat for

November, and core inflation to keep steady at an annual pace of 4%.

Markets see a roughly 50% chance the first Fed rate cut will come as soon as

March, according to the CME's Fedwatch tool.

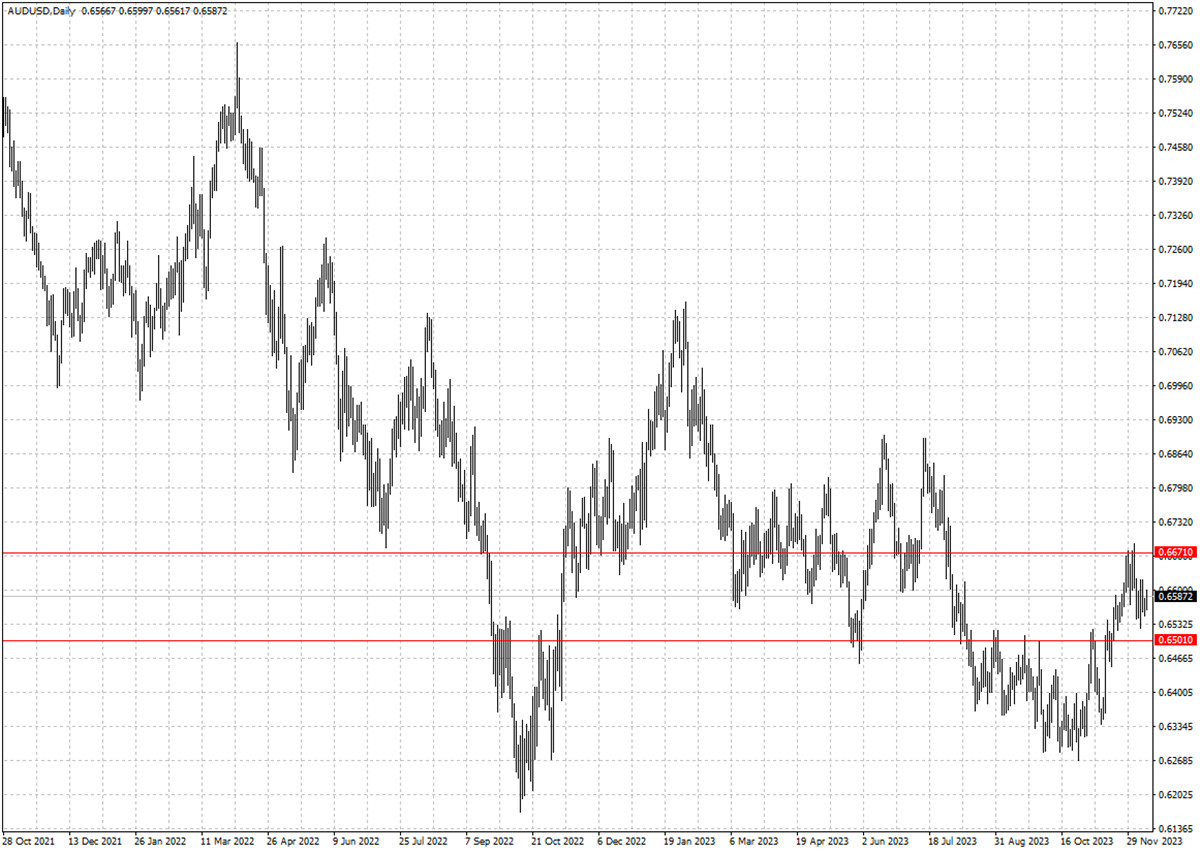

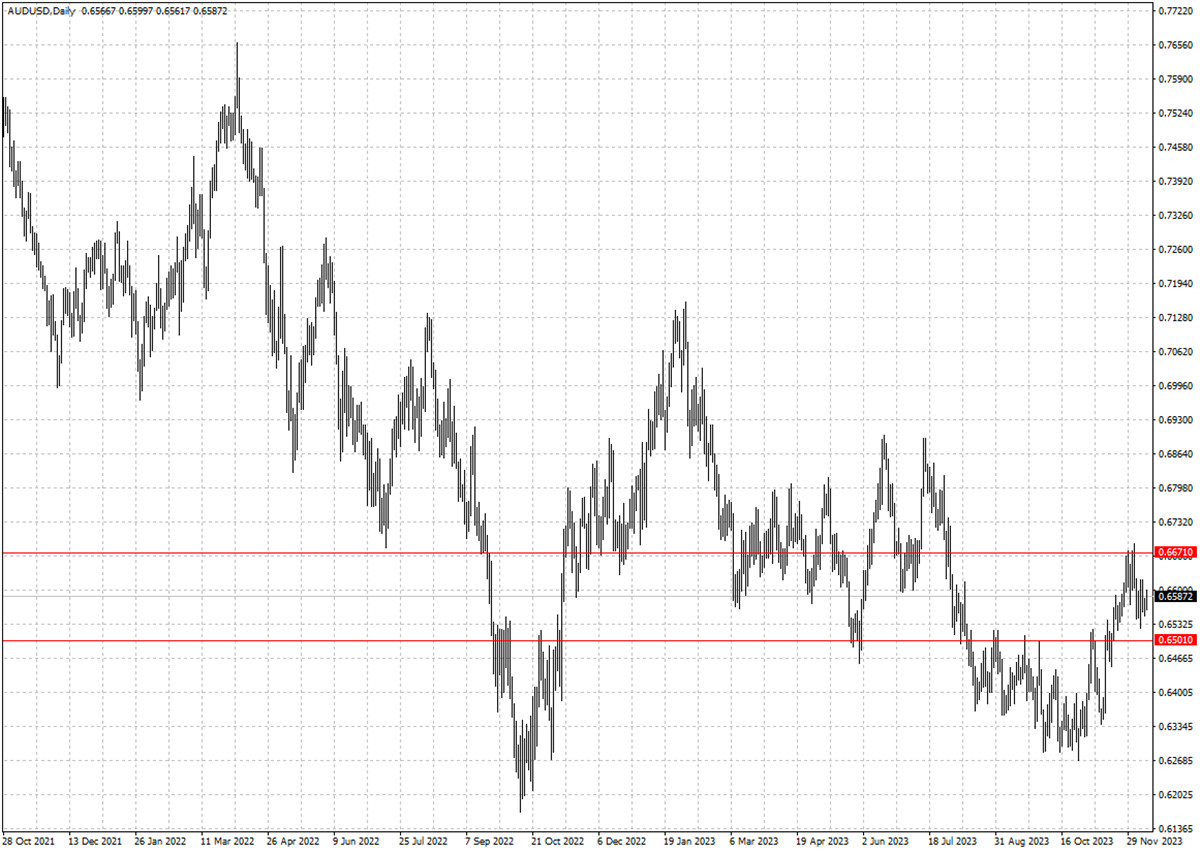

Higher iron ore prices and a rebound in Chinese property shares helped push

the Australian dollar higher. The commodity climbed by almost two-fifths since

May, driven by a surge in Chinese steel production

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 1 Dec) |

HSBC (as of 11 Dec) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0852 |

1.102 |

1.0650 |

1.0945 |

| GBP/USD |

1.2347 |

1.2746 |

1.2417 |

1.2704 |

| USD/CHF |

0.8684 |

0.8957 |

0.8682 |

0.8892 |

| AUD/USD |

0.6522 |

0.6750 |

0.6501 |

0.6671 |

| USD/CAD |

1.3417 |

1.3695 |

1.3454 |

1.3742 |

| USD/JPY |

146.70 |

151.91 |

141.17 |

149.21 |

The green numbers in the table indicate an increase in data, the red numbers indicate a decrease in data, and the black numbers indicate that the data remains unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.