Dollar Reaches Two-Week High vs Euro

2024-09-02

Summary:

Summary:

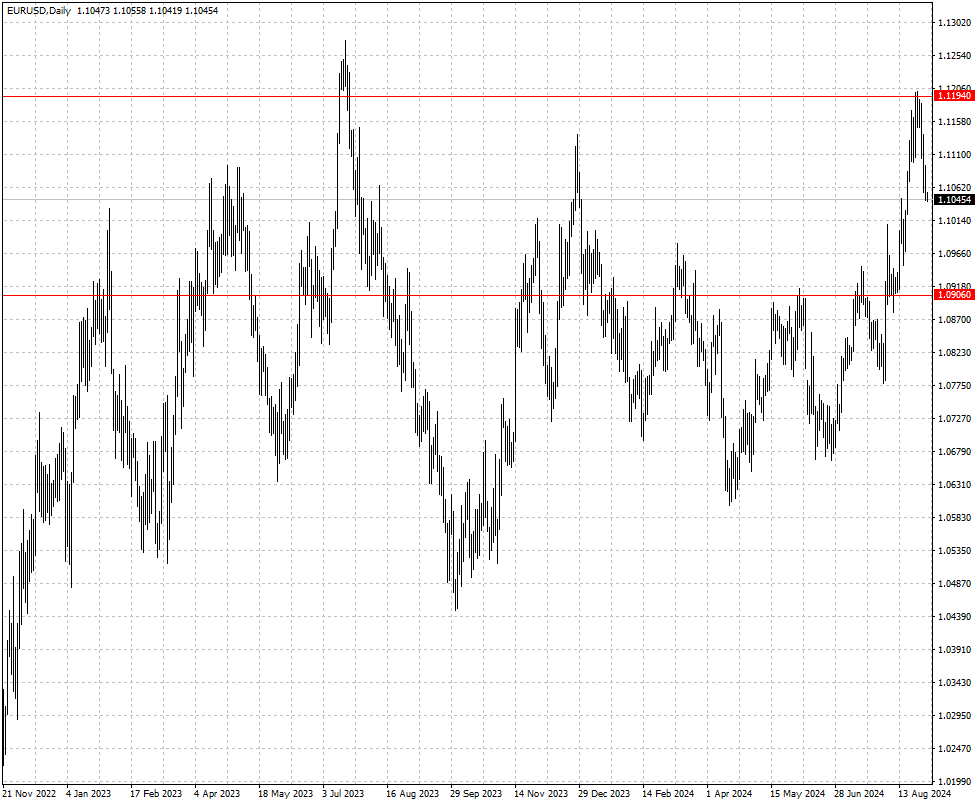

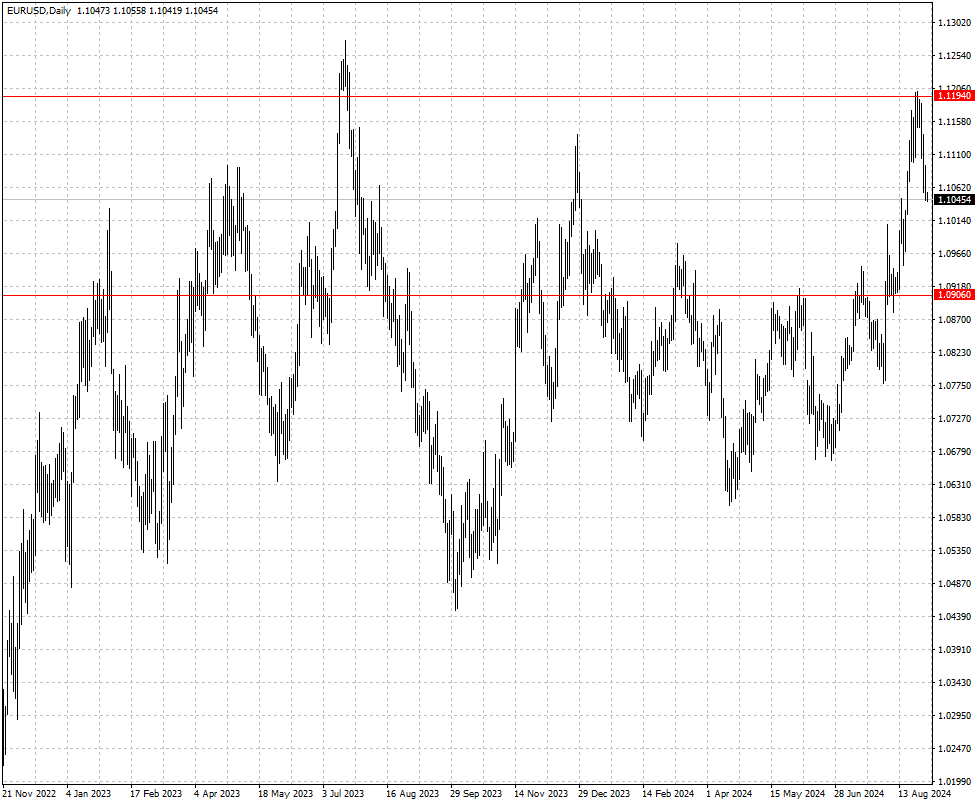

The dollar rose to a two-week high against the euro as traders reduced Fed easing bets, focusing on this week's key US jobs report.

EBC Forex Snapshot, 2 Sep 2024

The dollar climbed to a two-week top against the euro on Monday as traders

pared bets for aggressive policy easing by the Fed with the focus now moving to

a crucial US jobs report at the end of this week.

Traders currently lay 33% odds of a 50-bp Fed rate cut this month, versus 67%

probability of a 25-bp cut. A week earlier. long-term Treasury yields to the

highest since mid-August.

The ECB is increasingly likely to lower borrowing costs again at its meeting

next month, but what happens beyond that is less certain, Governing Council

member Madis Muller said.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 19 Aug) |

HSBC (as of 2 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.1068 |

1.0906 |

1.1194 |

| GBP/USD |

1.2673 |

1.2946 |

1.2833 |

1.3342 |

| USD/CHF |

0.8333 |

0.8827 |

0.8348 |

0.8698 |

| AUD/USD |

0.6363 |

0.6799 |

0.6614 |

0.6868 |

| USD/CAD |

1.3597 |

1.3946 |

1.3372 |

1.3681 |

| USD/JPY |

145.89 |

150.00 |

143.26 |

149.22 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.