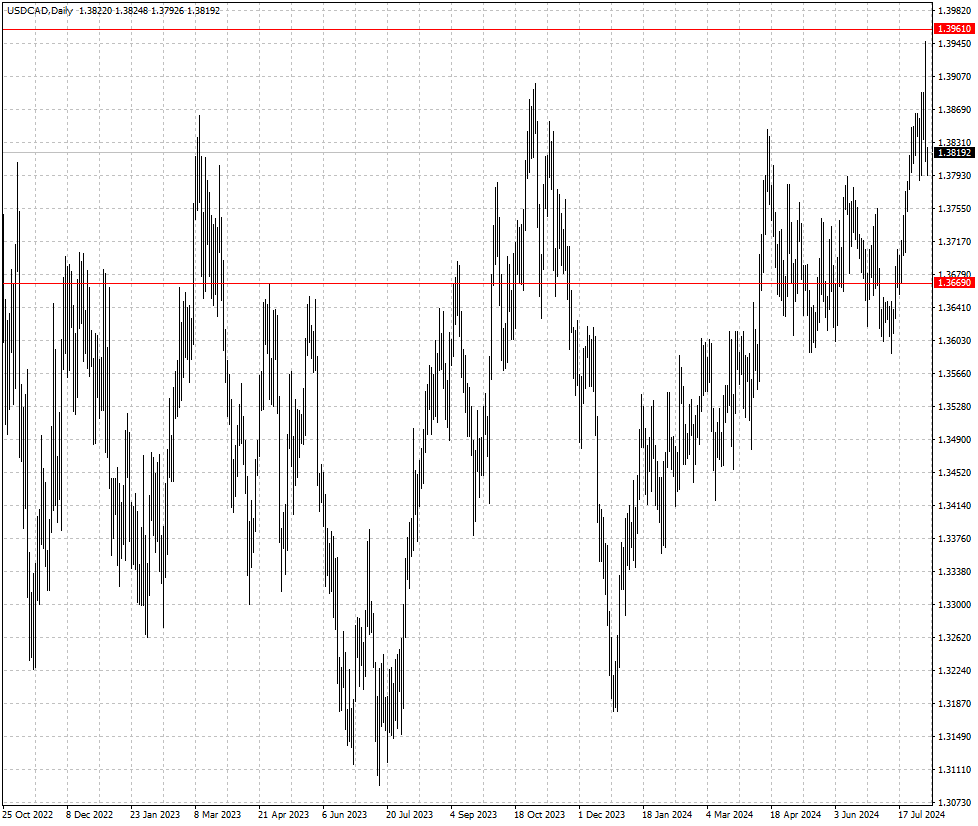

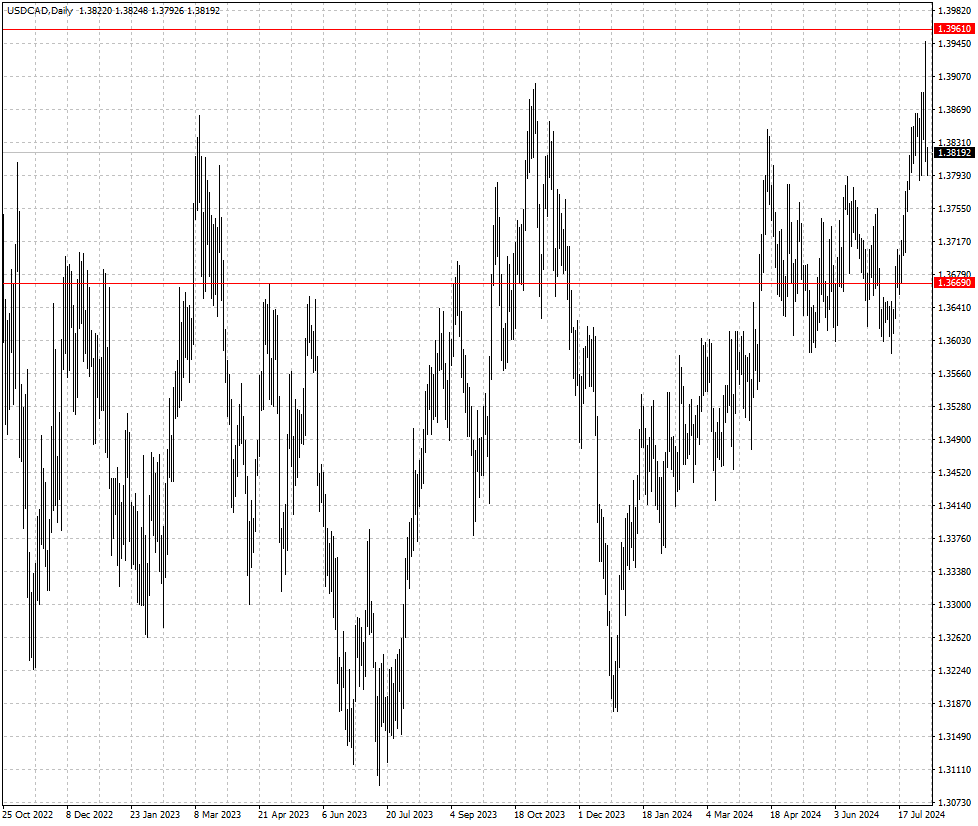

The Canadian recovered from a 21-month low

2024-08-06

Summary:

Summary:

The US dollar was nursing steep losses on Tuesday as the ISM service PMI rebounded from a four-year low in July amid an increase in new orders.

EBC Forex Snapshot, 6 Aug 2024

The US dollar was nursing steep losses on Tuesday as the ISM service PMI

rebounded from a four-year low in July amid an increase in new orders.

Fed officials pushed back on Monday against the notion that

weaker-than-expected jobs data means the economy is in recession, but also

warned that cut rates are needed to avoid such an outcome.

The Canadian recovered from a 21-month low as risk-on mood returned. The

economy kept growing despite a slowing pace through Q2, according to preliminary

data.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 29 Jul) |

HSBC (as of 6 Aug) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0796 |

1.0981 |

1.0815 |

1.1048 |

| GBP/USD |

1.2860 |

1.3045 |

1.2637 |

1.2977 |

| USD/CHF |

0.8743 |

0.9050 |

0.8320 |

0.8835 |

| AUD/USD |

0.6465 |

0.6799 |

0.6309 |

0.6717 |

| USD/CAD |

1.3590 |

1.3899 |

1.3669 |

1.3961 |

| USD/JPY |

151.53 |

155.00 |

137.68 |

154.63 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.