The Australian Dollar was Unaffected on Wednesday

2024-05-29

Summary:

Summary:

Wednesday saw the dollar rise as the Fed might delay rate cuts. The Aussie dollar stayed flat after strong inflation data.

EBC Forex Snapshot, 29 May 2024

The dollar was bolstered on Wednesday by rising expectations the Fed is

unlikely to cut rates until later this year. The Australian dollar was little

changed following a strong inflation report.

Data showed US consumer confidence unexpectedly improved in May after

deteriorating for three straight months. A rate cut in September is now priced

in at 44%, the CME Fed Watch tool showed.

Australian CPI unexpectedly rose to a five-month high in April, adding to

risks the next move in interest rates might be upward. The most significant

contributor to the rise was housing.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 27 May) |

HSBC (as of 29 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0793 |

1.0895 |

1.0753 |

1.0925 |

| GBP/USD |

1.2300 |

1.2803 |

1.2535 |

1.2892 |

| USD/CHF |

0.8988 |

0.9244 |

0.9020 |

0.9193 |

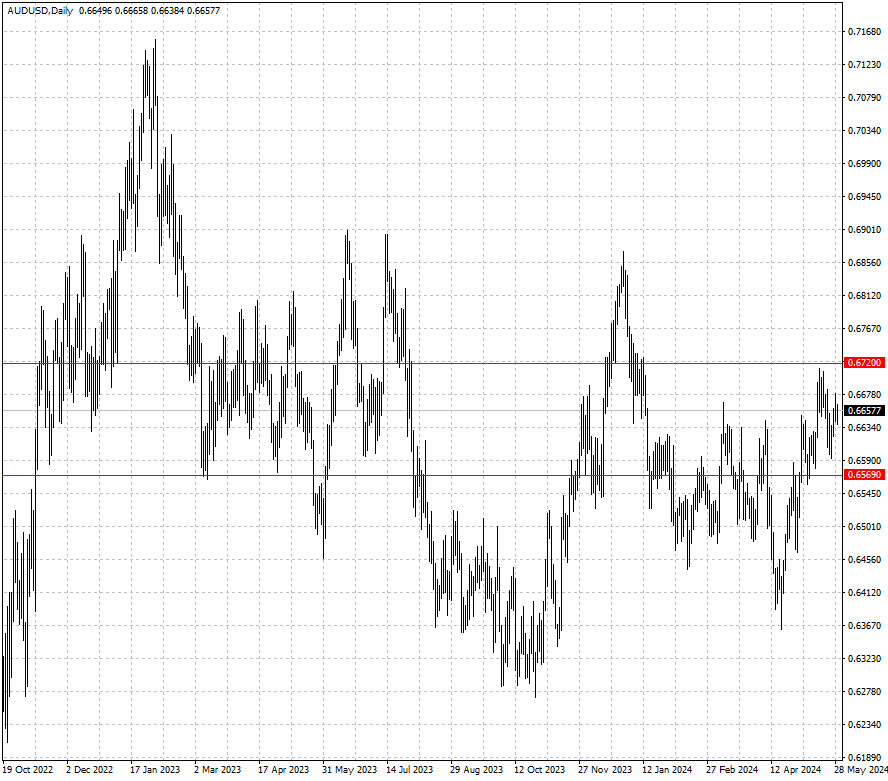

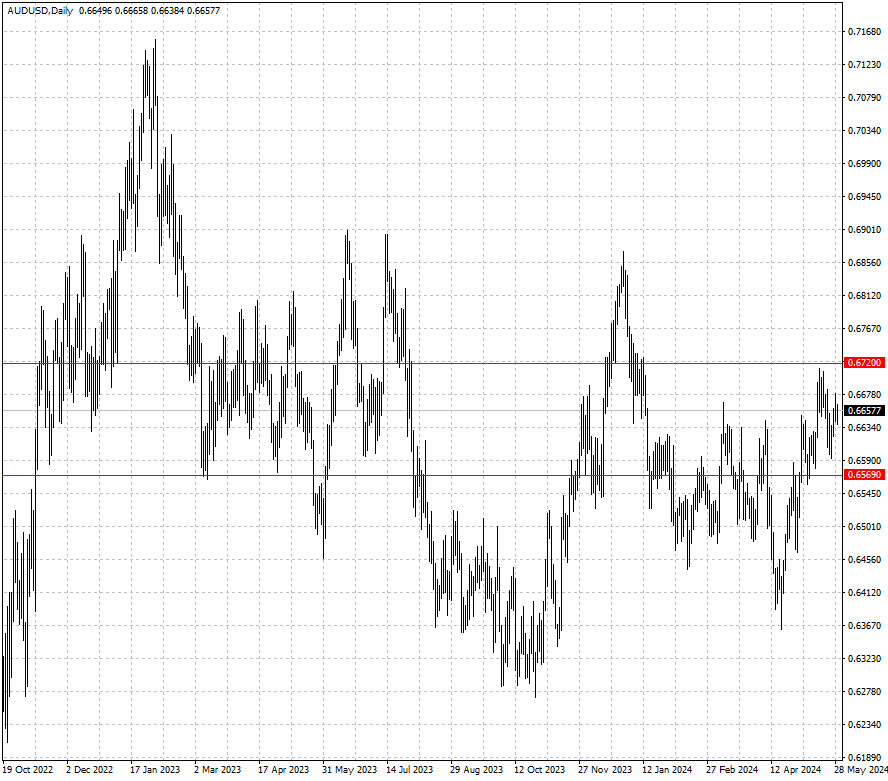

| AUD/USD |

0.6563 |

0.6729 |

0.6569 |

0.6720 |

| USD/CAD |

1.3478 |

1.3846 |

1.3574 |

1.3730 |

| USD/JPY |

152.12 |

157.68 |

154.69 |

158.52 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.