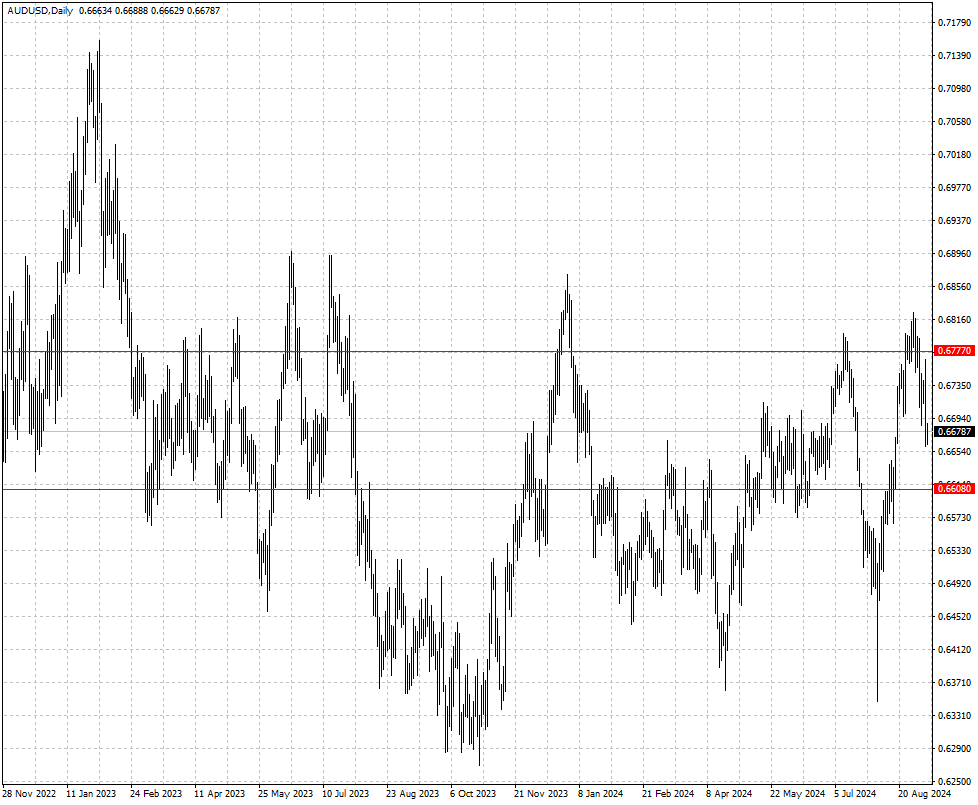

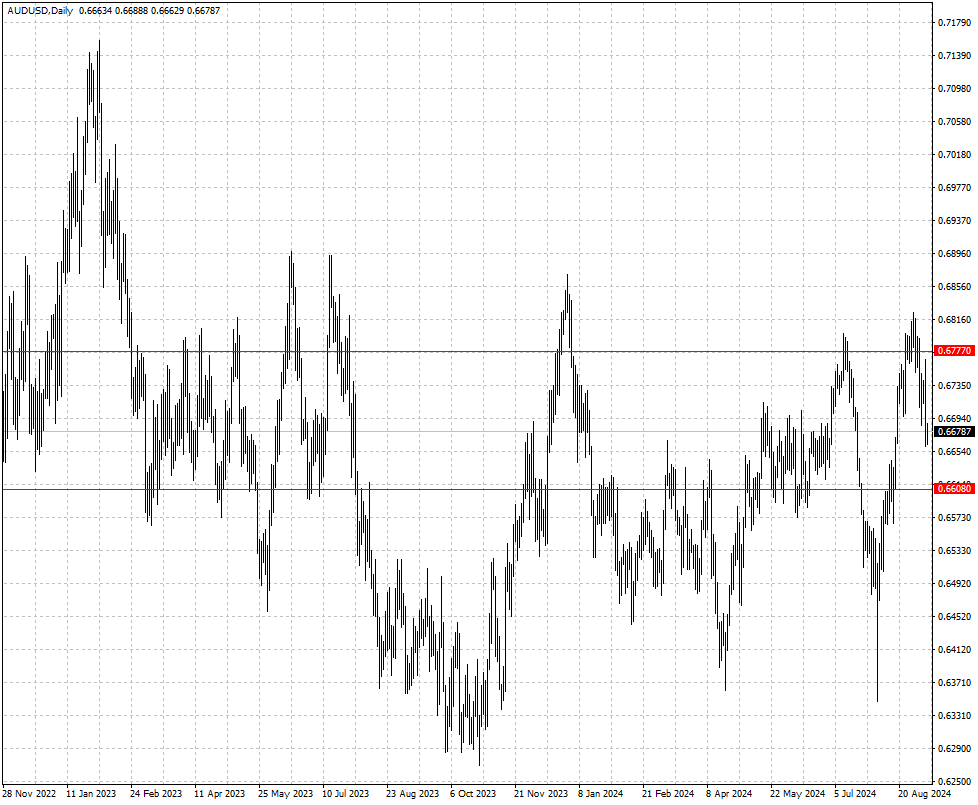

The Australian dollar rebounded from a recent low

2024-09-09

Summary:

Summary:

The dollar stayed in tight ranges Monday as investors awaited US inflation data for clues on the Fed's expected rate cut later this month.

EBC Forex Snapshot, 9 Sep 2024

The dollar held to tight ranges on Monday as investors were undecided on the

scale of a Fed rate cut expected later this month and looked to this week's US

inflation reading for more clues.

Futures show a 35% chance that the central bank could ease rates by 50 bps

next week. Policymakers on Friday signalled they are ready to kick off a series

of interest rate cuts.

The Australian dollar recovered from a roughly three-week low. Iron ore fell

below $90 a ton for the first time since late 2022, weighed down by immediate

challenges facing China’s steel sector.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 2 Sep) |

HSBC (as of 9 Sep) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0832 |

1.1202 |

1.1005 |

1.1181 |

| GBP/USD |

1.2860 |

1.3266 |

1.2974 |

1.3268 |

| USD/CHF |

0.8333 |

0.8827 |

0.8323 |

0.8583 |

| AUD/USD |

0.6659 |

0.6871 |

0.6608 |

0.6777 |

| USD/CAD |

1.3420 |

1.3792 |

1.3459 |

1.3662 |

| USD/JPY |

141.70 |

149.39 |

140.25 |

145.82 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.