What is a Stock Split and How Does it Affect Tesla?

A stock split is a corporate action in which a company increases the number of its outstanding shares by issuing additional shares to existing shareholders. This process lowers the individual share price while keeping the company's overall market value unchanged.

Tesla has carried out stock splits to enhance accessibility for both employees and retail investors. The split reduces the share price, making it easier for a wider range of investors to buy shares, but it does not affect the company's fundamental value.

Tesla's stock has been split twice in the past:

These actions were taken to increase liquidity and broaden the investor base.

The Tesla Stock Split: History and Rationale

Tesla, Inc. has strategically implemented stock splits to make stock ownership more accessible to both employees and investors. The company's first stock split was a five-for-one exchange on 31 August 2020, followed by a three-for-one split on 25 August 2022. These stock splits were designed to reduce the share price, making it more attractive to retail investors and improving overall liquidity.

Tesla's management believes that stock splits can help manage the share price and promote accessibility, as highlighted in their quarterly reports. The Securities and Exchange Commission (SEC) regulates and oversees the stock split process, ensuring compliance with relevant laws and regulations. Tesla's common stock is listed on a major stock exchange, and the company is committed to maintaining transparency in its investor relations.

The stock split plans are designed to benefit both employees and investors, as stated by Tesla's management in their forward-looking statements. The expected timing of the stock split is typically announced in advance, allowing investors to prepare for the change. After the completion of each stock split, Tesla began trading on a stock split-adjusted basis, reflecting the new share price.

The company's management is responsible for managing the risks identified in their quarterly reports, ensuring that the stock split aligns with their overall business strategy. By making stock ownership more accessible, Tesla aims to foster a broader investor base and enhance market liquidity.

Factors Influencing the Tesla Stock Split Decision

Factors Influencing Tesla's Decision to Split Shares

Stock splits are typically undertaken to:

Enhance liquidity by increasing the number of shares available for trading

Improve accessibility for a broader range of investors

Manage share prices, making them more attractive to retail investors

However, Tesla's share price fluctuations following previous splits suggest that another stock split may not be imminent. Although stock splits remain popular among major US corporations—such as Apple and NVIDIA—they are not guaranteed to drive long-term price growth.

Implications of Stock Splits for Investors

While stock splits do not change a company's underlying value, they can influence market perception. Some key considerations for investors include:

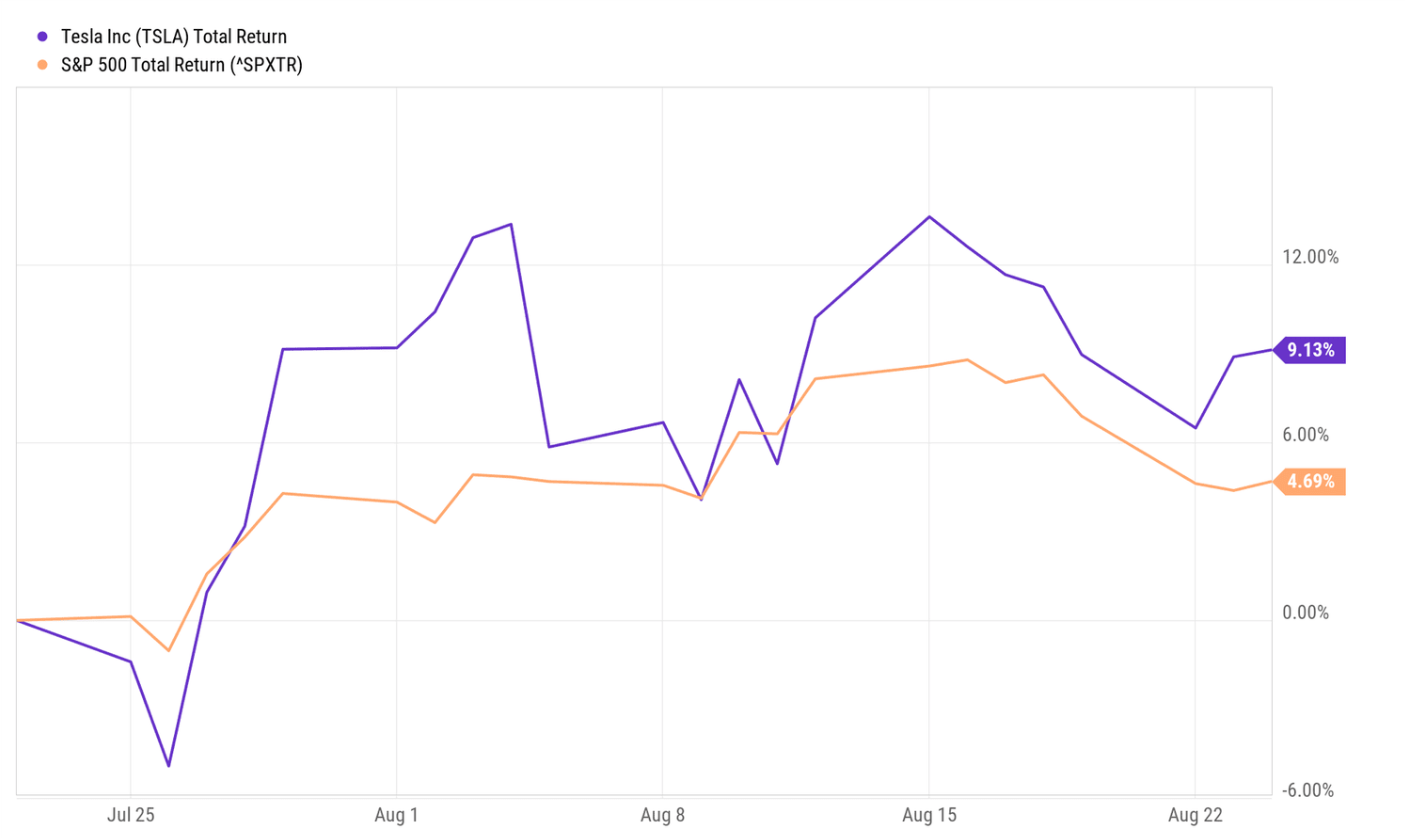

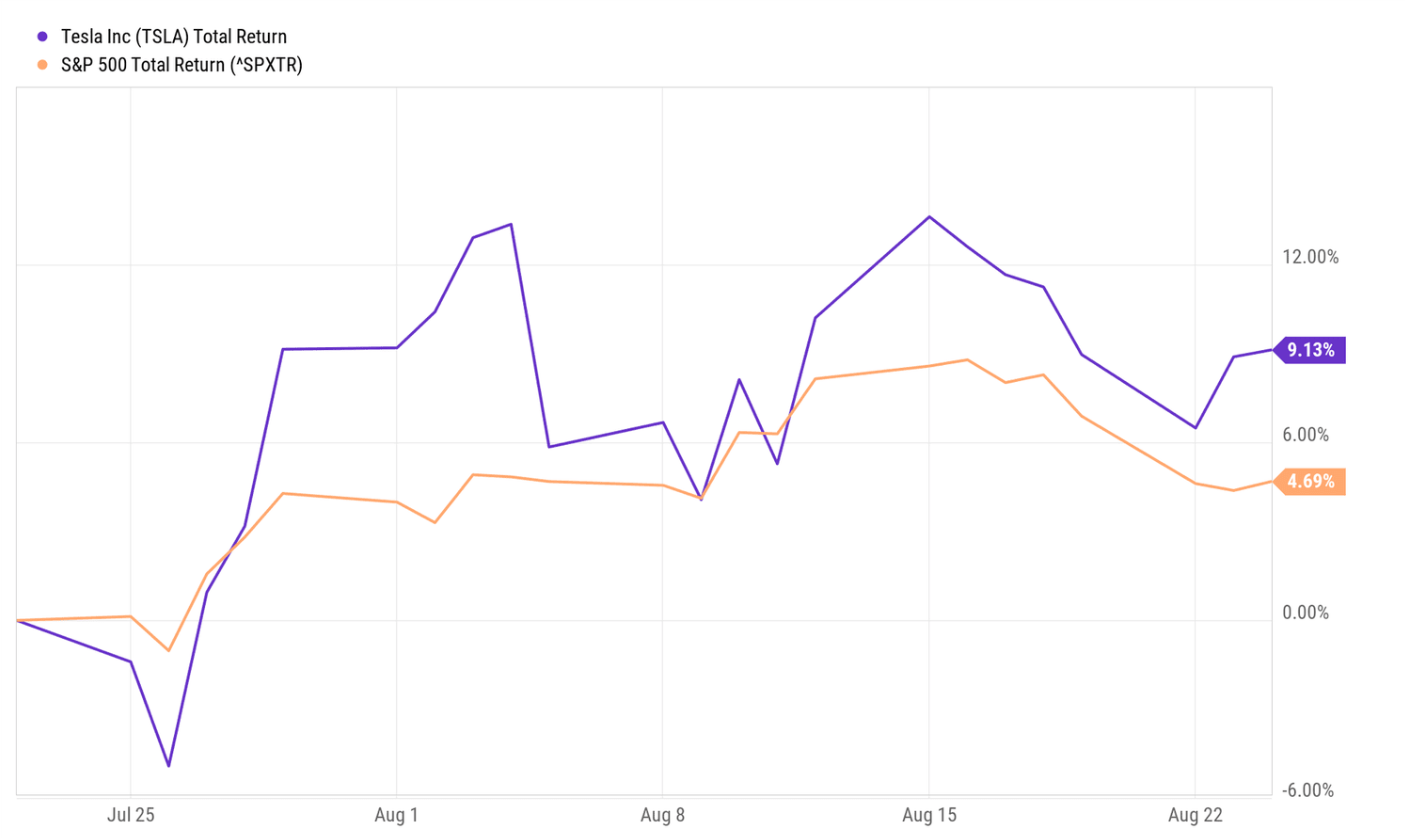

Short-term price movements – Stock splits can drive temporary price increases due to heightened investor interest.

Market sentiment – Lower share prices can attract retail investors, boosting liquidity.

Long-term fundamentals – Tesla's future stock performance depends more on its business strategy, competition, and financial performance than on stock splits.

Key Considerations for Tesla Investors

Investors should be aware of the potential risks and uncertainties associated with stock splits, as outlined in Tesla's quarterly reports. The stock split plans may impact the share price, and investors must consider the expected timing and potential implications.

Tesla's common stock is subject to market fluctuations, and investors should be prepared for potential changes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.