What Are Penny Stocks?

Penny stocks are typically small-company shares that trade at low prices, usually under £5 per share, often on less regulated markets like the over-the-counter (OTC) exchanges or smaller platforms. These companies are usually in their early stages of development, which is why their Stock Prices are so low. For many traders, such low-cost stocks can feel like an opportunity to get in on the ground floor of the next big thing. After all, if you purchase shares at such a low price, the potential for profits is huge, right?

But such low-cost stocks aren't just about getting in early. The very qualities that attract traders—low prices and high potential—are also what make such stocks so volatile. These companies are often less stable and may have limited financial histories or even question marks surrounding their business models. Many penny stocks are speculative, and you can't always trust that the company behind the stock has what it takes to survive in the long term.

Top Penny Stocks to Watch in 2025

Here's a look at some penny stocks that have the potential to be big players in 2025. Keep in mind that investing in these stocks requires careful analysis and a higher risk tolerance.

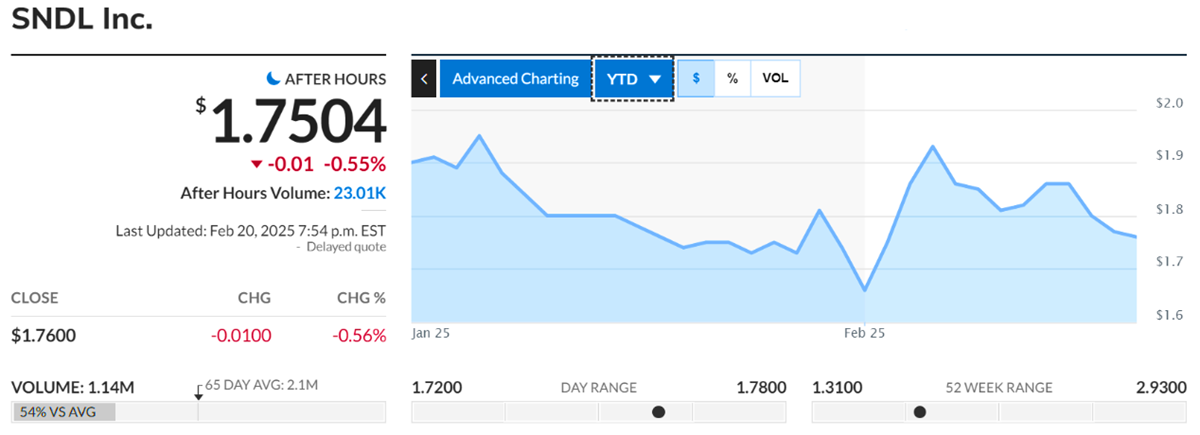

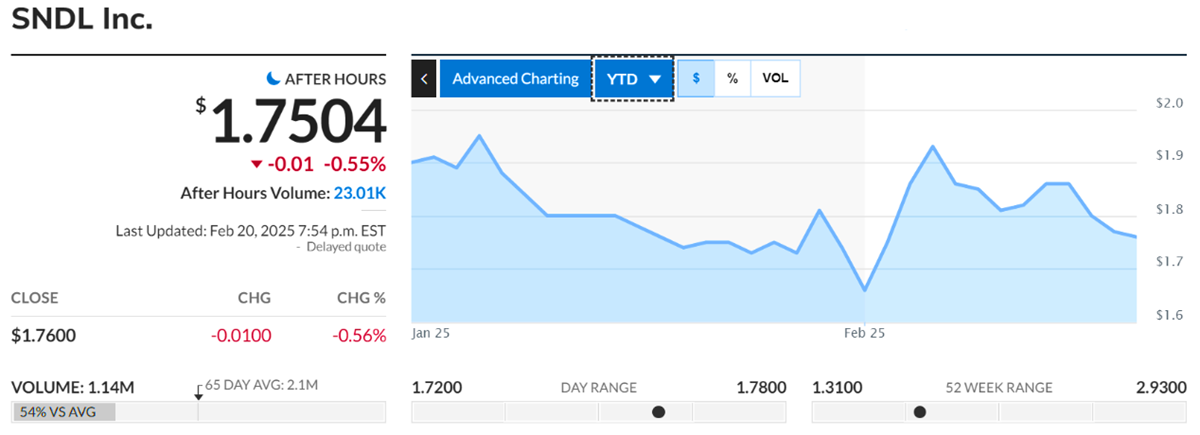

Sundial Growers Inc. (SNDL)

Sector: Cannabis

Current Price: Around $1.76

Sundial Growers has been making strides in the cannabis industry and is positioning itself to take advantage of the growing demand for legal marijuana. The company is expanding its operations and diversifying its product offerings, which could lead to impressive growth in the coming years.

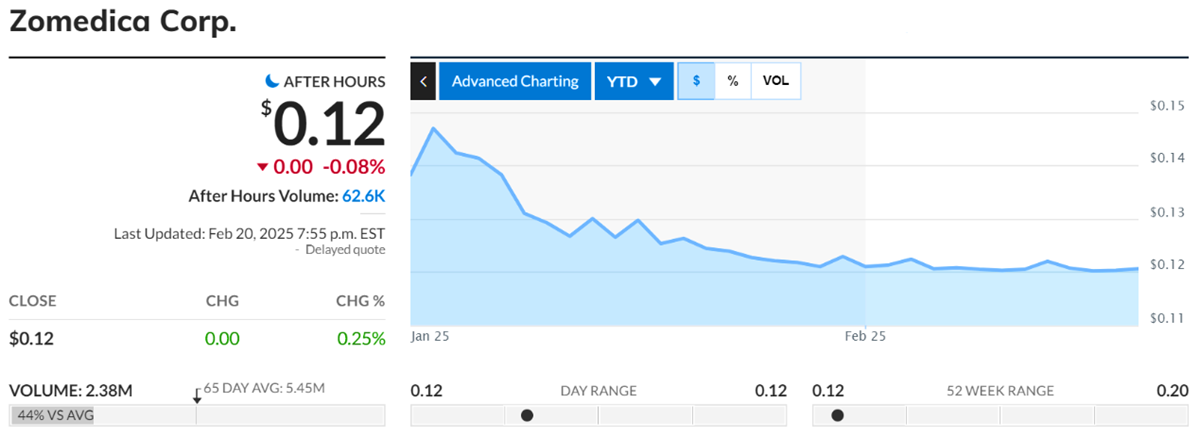

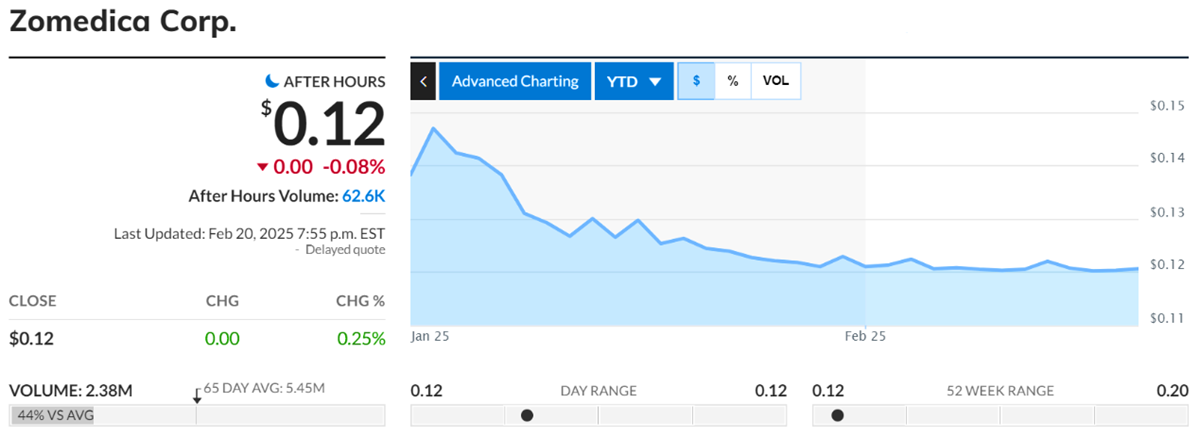

Zomedica Corp. (ZOM)

Zomedica Corp. (ZOM)

Sector: Veterinary Health

Current Price: Around $0.12

Zomedica focuses on creating innovative solutions for the veterinary market. With new product launches and a growing focus on animal health, the company could see growth as pet ownership continues to rise globally.

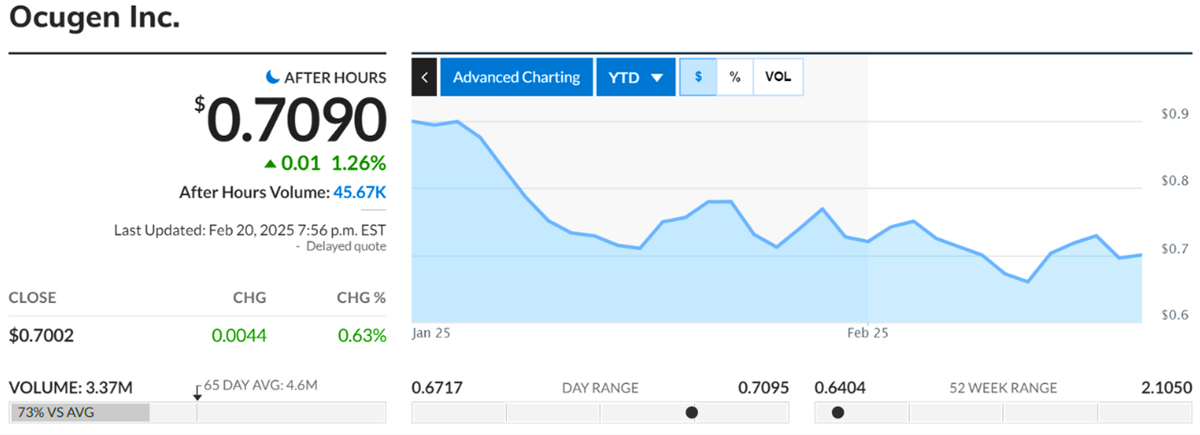

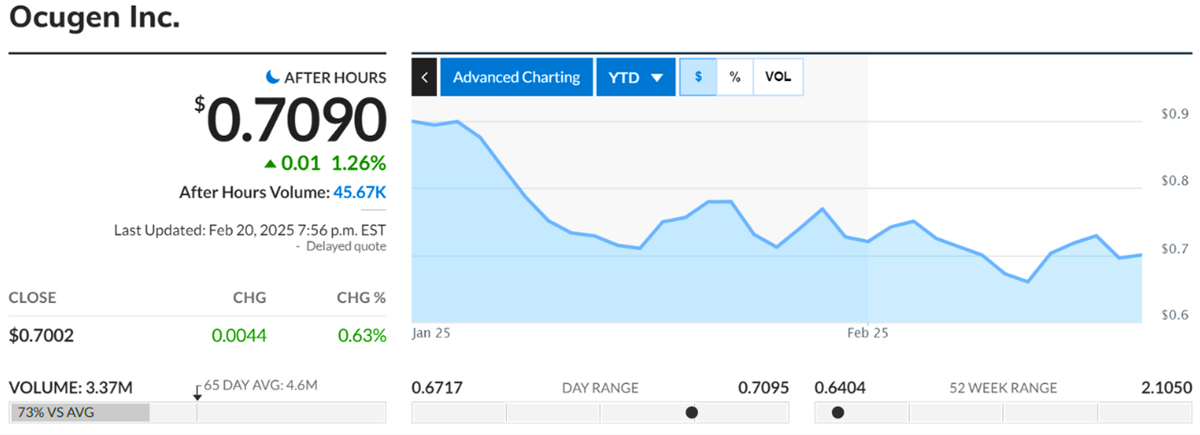

Ocugen Inc. (OCGN)

Ocugen Inc. (OCGN)

Sector: Biotechnology

Current Price: Around $0.70

Ocugen is a biotech company with a focus on gene therapies for serious diseases. Although still in the early stages, the company's partnerships and ongoing research into treatments for conditions like COVID-19 and eye diseases could provide substantial upside potential.

Naked Brand Group Limited (NAKD)

Naked Brand Group Limited (NAKD)

Sector: Consumer Goods (Apparel)

Current Price: Around $0.71

Naked Brand Group has been making moves in the e-commerce space, shifting from physical stores to a fully digital model. As it continues to streamline its operations, the company could see significant growth in the online retail market.

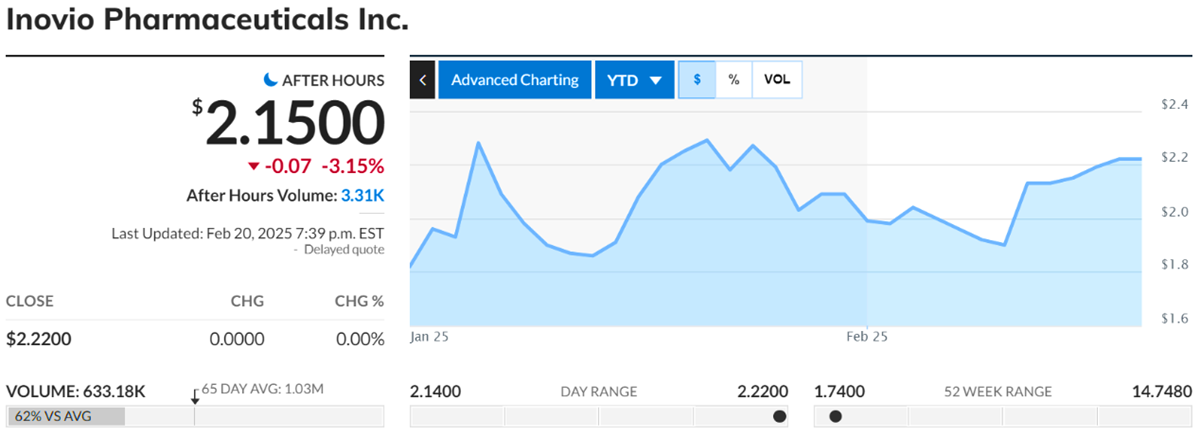

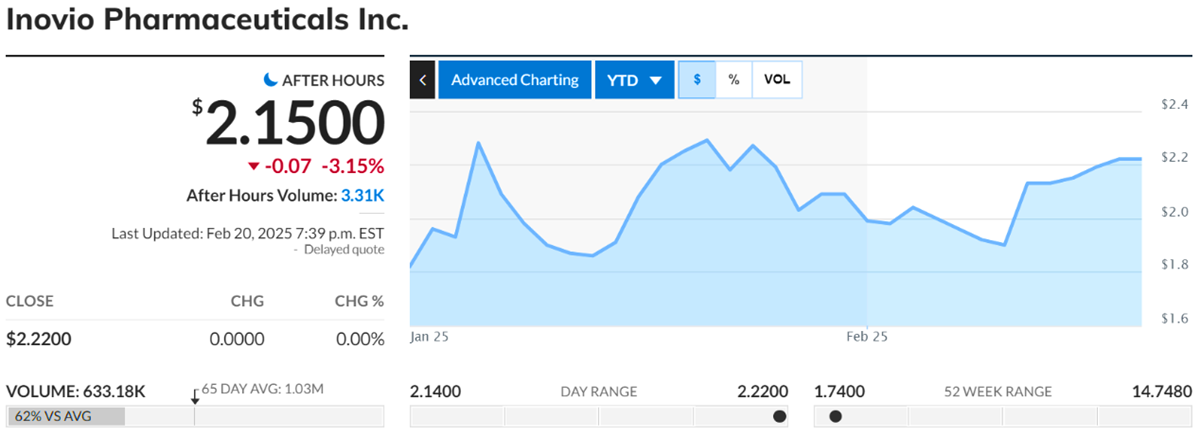

Inovio Pharmaceuticals (INO)

Inovio Pharmaceuticals (INO)

Sector: Biotechnology

Current Price: Around $2.22

Inovio is known for its work on DNA medicines, particularly in the area of vaccines. With a strong pipeline of clinical trials and a focus on treating viral diseases, Inovio is one to keep an eye on, especially as the biotech sector continues to grow.

How to Identify Penny Stocks with Potential

How to Identify Penny Stocks with Potential

Picking the right ones to trade in isn't as simple as just choosing the cheapest ones. Here are some factors to consider when evaluating penny stocks:

Company Fundamentals: Do they have a strong business model? Are they generating revenue, or are they still in the early stages?Understanding the company's financial health is crucial.

Market Trends: Does the company operate in a growing industry? For example, sectors like biotechnology, green energy, and cannabis are attracting significant attention, offering opportunities for high returns.

Management Team: A strong leadership team with experience and a clear vision can make all the difference for a small company's future.

Volume and Liquidity: Penny stocks can be volatile, and trading volume plays a huge role in how easily you can buy or sell shares. Stocks with low trading volumes can be difficult to get in or out of, especially during volatile periods.

Risks Associated with Penny Stocks

Before rushing into penny stocks, it's essential to weigh the risks carefully. These investments are often characterised by their volatility. Such low-cost stocks can rise rapidly, but they can also plummet just as quickly. For instance, a stock could double in value one week but lose 30% of its value the next. This volatility is often a result of speculative trading, which can drive prices to unsustainable levels.

Another risk to keep in mind is liquidity. Because many penny stocks trade in low volumes, it can be difficult to buy or sell shares without affecting the stock's price. If you're looking to exit a position, you might find that there aren't enough buyers at the price you want to sell at, which can leave you holding onto your stock longer than you'd intended.

Perhaps the most concerning risk for penny stock traders is the lack of reliable information. Many of these stocks are not required to file the same level of financial disclosure as larger companies. This means there's often very little information available about a company's operations, making it harder to assess its true financial health. This lack of transparency can make it easy for companies to hide poor performance or even engage in fraudulent activity.

Conclusion

Penny stocks can be an exciting and lucrative opportunity for those willing to do their homework, but they are far from a guarantee. Their low prices can create the illusion of easy profits, but they come with considerable risks that traders need to understand. By doing thorough research, diversifying your investments, staying updated on market trends, and practicing patience, you can maximise your chances of success. Just remember, these low-cost stocks are not for the faint of heart, and investing in them requires a well-thought-out strategy and a clear understanding of the inherent risks.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Zomedica Corp. (ZOM)

Zomedica Corp. (ZOM) Ocugen Inc. (OCGN)

Ocugen Inc. (OCGN) Naked Brand Group Limited (NAKD)

Naked Brand Group Limited (NAKD) Inovio Pharmaceuticals (INO)

Inovio Pharmaceuticals (INO) How to Identify Penny Stocks with Potential

How to Identify Penny Stocks with Potential