When the Dow hit 40,000 on Thursday, the news was splashed across the US. It

is known as an imperfect barometer of stock performance, but Americans have

grown fully aware of the bullish run.

Professional investors always prefer the S&P 500 to the achronistic index

dating back to the 1890s. And their sentiment is turning more bullish like those

whose financial knowledge is limited.

Brian Belski, BMO Capital Markets' chief investment strategist, lifted his

year-end forecast on the US equity benchmark to 5,600 - the highest among Wall

Street soothsayers tracked by Bloomberg.

The latest CPI reading cooled in April for the first time in six months,

which added to optimism around rate cuts. Strong corporate earnings have also

helped drive the rally, said Belski.

He was one of the few correctly predicting last year's strong performance.

Just two months ago, he reaffirmed a call for a drip to 5,100 on concerns that

the market had gone too far.

The average year-end target price on the S&P 500 currently is around

5,087. That came even after some ratcheted up their targets to keep pace with

the uptrend at the beginning of the year.

Profit revisions

Earnings forecasts for the current quarter are revised up at the swiftest

pace in two years, suggesting that the worst of Corporate America's profit slump

may be firmly in the rear-view mirror.

A resilient economy and robust consumer demand are poised to support earnings

growth for a third straight quarter. Earnings-revision momentum has reached its

highest level since September, BI data show.

The benchmark gauge for American equities is on track to post 7.1% earnings

growth for Q1, nearly doubling analysts' preseason estimates. However, earnings

outlook for the whole year remains unchanged.

The reason is that analysts are hesitant to revise their outlooks for the

second half of the year as only roughly 25% of S&P 500 companies have

provided quarterly guidance.

Historically, stocks react more to guidance than to results. Wall Street sees

companies in the S&P 500 earning around $245 per share in 2024 with the

economic backdrop showing some cracks of late.

Belski anticipates a "significant pullback at some point", just from a higher

level than previously expected while leaving his EPS projections for the

benchmark index unchanged at $250.

Ballooning valuation

As of May 10 the forward price-earnings multiple for the S&P 500 was

20.4, above the five-year average of 19.1 and the 10-year average of 17.8. As

such poor reports appeared less tolerable.

According to FactSet, S&P 500 companies that reported negative

first-quarter earnings surprises suffered a stock-price decline of 2.8% in the

four-day period, exceeding the five-year average of 2.3%.

The time period for that is from two days before the earnings release through

two days after the release. In contrast, surprises to the upside resulted in an

average decline of 0.9%.

Goldman Sachs chief US equity strategist David Kostin predicted the S&P

500 would end the year at 5,200 on valuation concerns. He noted a GDP growth

more than 3% had been priced in.

Growth stocks are especially expensive, he said. The Russell 1000 Growth

index has climbed 36% in the past 12 months, doubling the Russell 1000 Value

index despite of high interest rates.

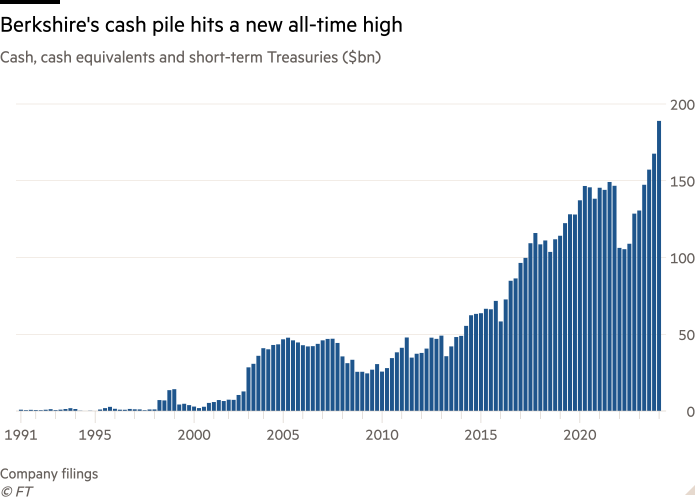

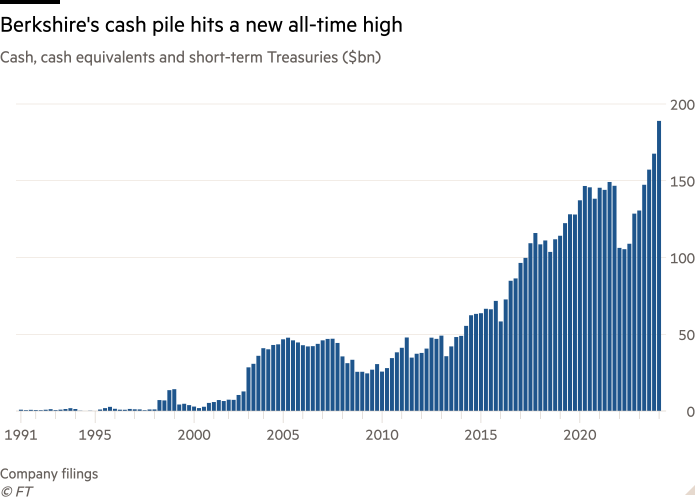

Apparently Warren Buffett was not excited either as Berkshire Hathaway's cash

pile neared $200 billion in Q1. "We won't spend it unless we think they're doing

something that has very little risk and can make us a lot of money."

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.