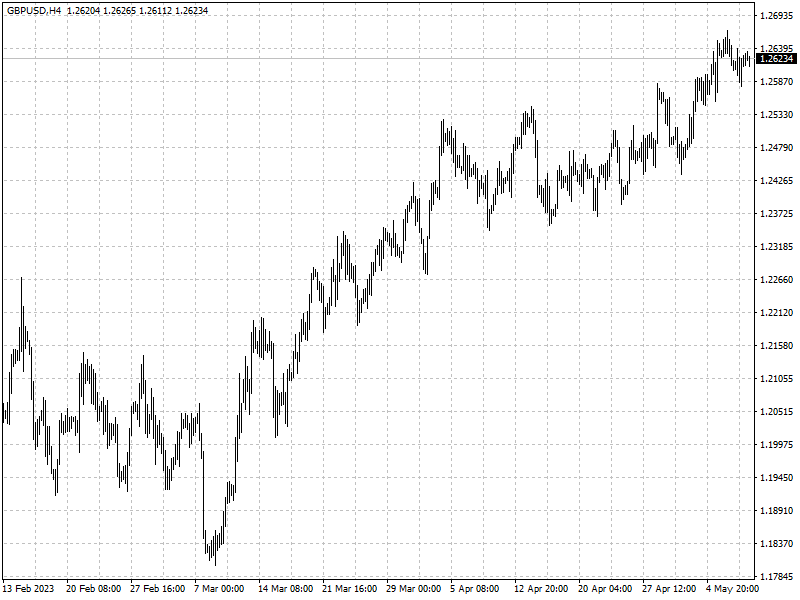

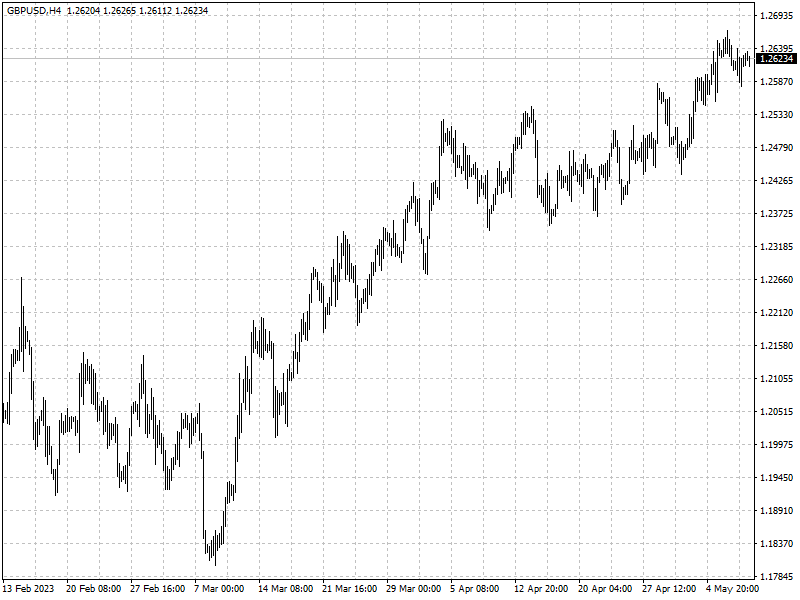

Sterling’s strength

GBP/USD was trading at 1.2618 on Tuesday, close to the 1.2688 it hit on

Monday, its highest level since April 2022. EUR/GBP fell to 0.8698, the lowest

level since mid-December.

Analysts believe that conditions are in place for the pound’s recovery to

continue as U.K. economy proves to be stronger than expected.

Many traders, who had been betting against the pound around the start of the

year amid forecasts of a deep recession, have been closing out their bets in

recent weeks.

Last month traders turned positive on the pound for the first time in 14

months, CFTC data shows.

Brighter economic outlook

Themos Fiotakis, head of FX research at Barclays, said a brighter economic

outlook in the UK combined with persistently sticky inflation meant “the BoE

needs to be one of the more hawkish central banks”.

Markets have priced in a near certainty of a 0.25bp rate rise, in line with

the Fed and the ECB last week.

Swaps markets are currently pricing in two and possibly three more rate rises

by September, while the Fed signalled possible end of rate hikes.

NatWest expects sterling to strengthen to 1.30 by the end of the year. ‘We

feel lending in the US will be more impaired than in the UK,’ NatWest’s Robson

said.

He added the fact that the UK economy is more reliant on services than

manufacturing compared with other countries also acted as a tailwind.

U.K. banks recently saw significant deposit outflow despite of few signs of

systemic risk which hit the U.S. financial sector.

Citi said it expected EUR/GBP to keep trading in the range of £0.87 to £0.89

in the near term ahead of the BoE rates decision, but said GBP/USD “would

continue to appreciate in our base case”.

Christian Kopf, head of fixed income at Union Investment, expects the euro to

weaken further against sterling from its current level of 0.87 to 0.83 by the

summer of 2024.

Political risks

The signing of the “Windsor framework”, intended to smooth implementation of

post-Brexit trading rules in Northern Ireland, has also played to sterling’s

advantage in recent months.

The deal sets out the agreed changes to be made to the Protocol relating to

customs, VAT, regulation in goods, state aid regime, as well as addressing the

democratic deficit.

‘The truth is that, with the Rishi Sunak administration, a number of tail

risks have been reduced, we’ve got the agreement on Northern Ireland, better

co-operation with the EU and political stability, particularly compared with

what happened last year,’ said Athanasios Vamvakidis, head of G10 foreign

exchange strategy at Bank of America.

Kevin McCarthy on Tuesday said there was no movement from either side in debt

limit negotiations as a crucial deadline on the matter looms following a meeting

with Joe Biden.

A failure to find a resolution to the US debt ceiling standoff presents a

genuine risk to the standing of the dollar, according to Goldman Sachs.