Wednesday's Retail Sales Data Hits Dollar

2024-06-19

Summary:

Summary:

The dollar rose on weak retail sales data, hinting at Fed rate cuts; sterling climbed as UK inflation hit 2% for the first time in nearly 3 years.

EBC Forex Snapshot, 19 Jun 2024

The dollar recovered some ground on Wednesday after soft retail sales data

reinforced bets of imminent Fed rate cuts, while sterling edged up as British

inflation returned to 2% for the first time in nearly 3 years.

US retail sales barely rose in May and data for the prior month was revised

considerably lower, suggesting that economic activity remained lacklustre in the

second quarter of this year.

The Bank Of England will likely keep interest rates unchanged on Thursday. Markets are

pricing in an about 50% chance of a first rate cut by August and almost half a

percentage point in monetary easing in 2024.

|

Citi (as of 11 Jun) |

HSBC (as of 19 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0700 |

1.0981 |

1.0631 |

1.0880 |

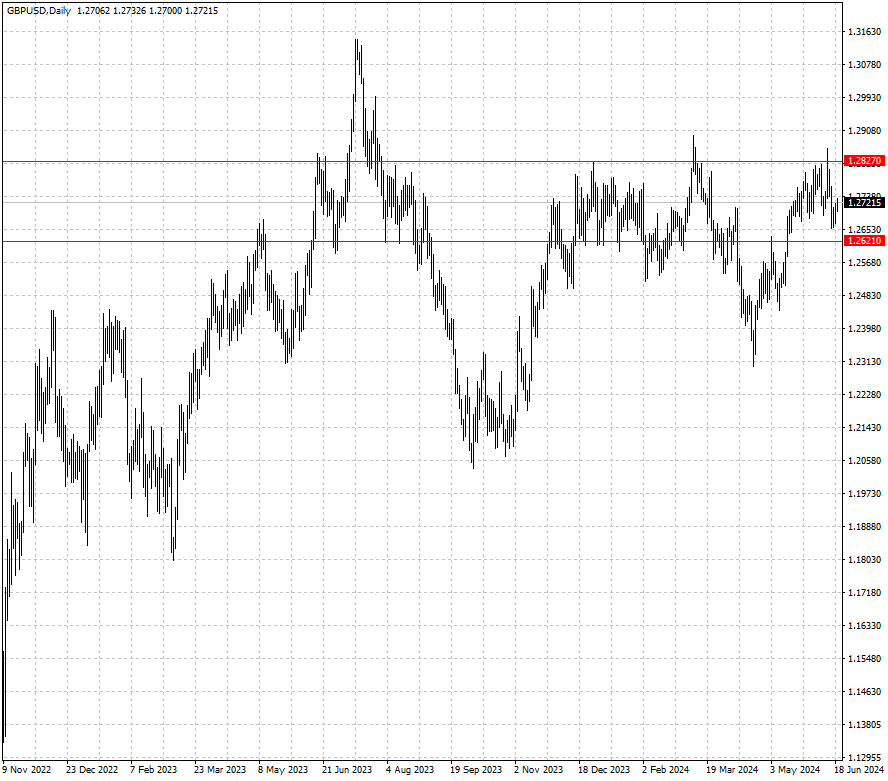

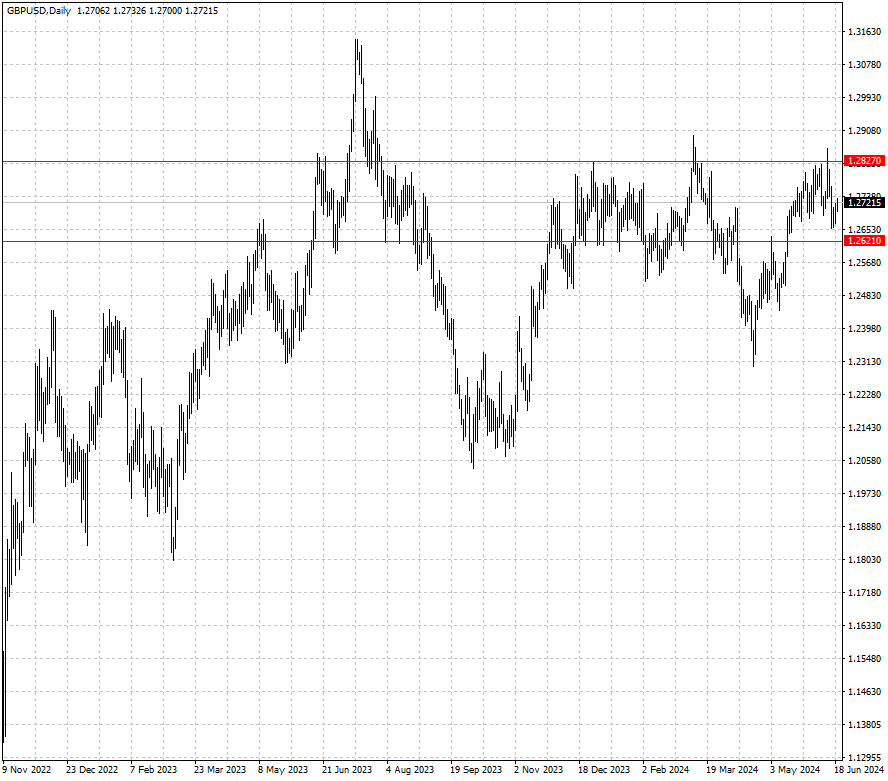

| GBP/USD |

1.2300 |

1.2827 |

1.2621 |

1.2827 |

| USD/CHF |

0.8885 |

0.9158 |

0.8730 |

0.9047 |

| AUD/USD |

0.6562 |

0.6729 |

0.6585 |

0.6715 |

| USD/CAD |

1.3577 |

1.3846 |

1.3614 |

1.3805 |

| USD/JPY |

151.86 |

157.71 |

155.50 |

159.20 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.