Dollar Rebounds Ahead of Key PPI Release

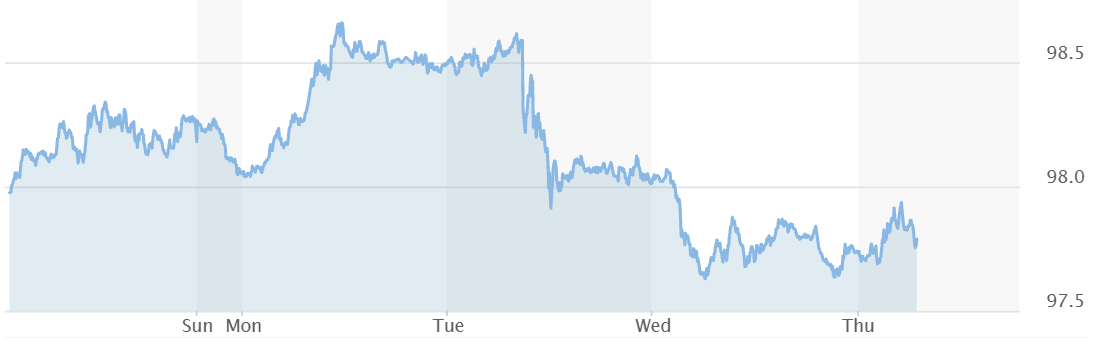

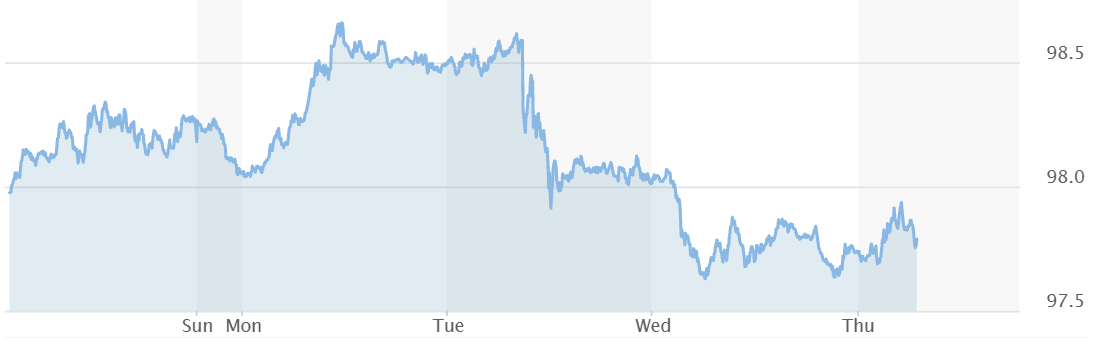

The US dollar index (DXY) climbed to around 97.80 during the European session on Thursday, largely driven by anticipation of the forthcoming Producer Price Index (PPI) data. PPI figures are closely watched as they often influence Federal Reserve monetary policy decisions, with market participants increasingly focused on economic releases amid uncertainty over interest rates.

Inflation Signals Point to Possible Fed Easing

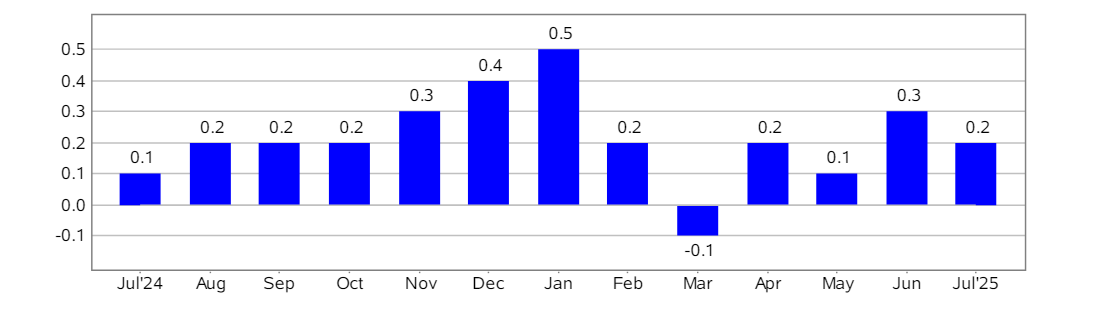

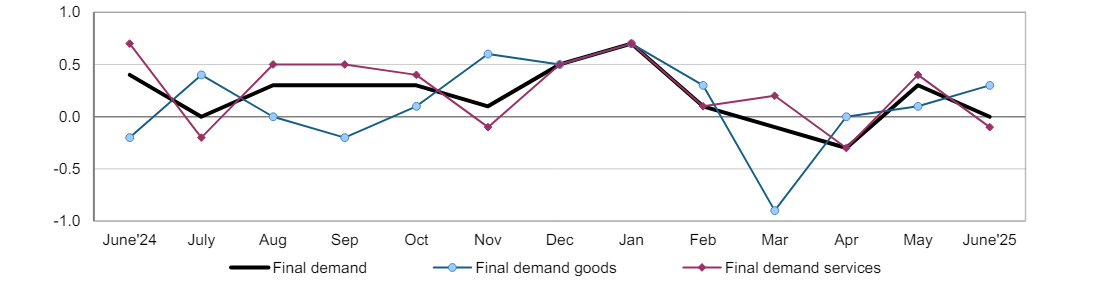

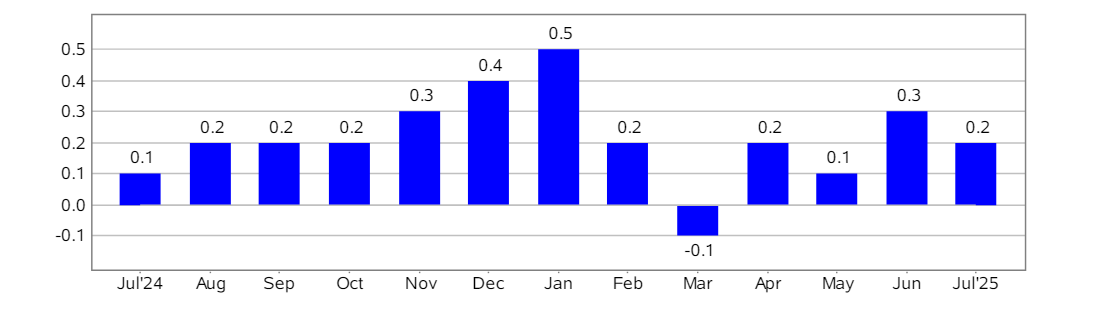

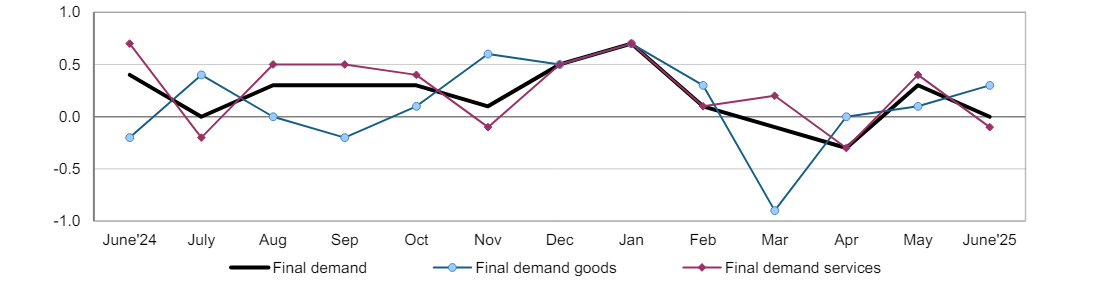

Recent inflation data has shown signs of moderation. The July Consumer Price Index (CPI) rose 0.2% year-on-year, down from June's 0.3% increase. This suggests that US price pressures remain contained, strengthening expectations for potential rate cuts. Prominent policymakers have echoed this view: Treasury Secretary Scott Bessent suggested short-term rates should fall 1.5–1.75 percentage points, while former President Trump advocated rates near 1%, adding to market speculation of easing.

Technical Analysis: Dollar Index Shows Rebound Potential

From a technical standpoint, the dollar index is signalling a short-term upswing. Bollinger Bands indicate that the DXY has surpassed the mid-band, with support at 97.6130 and resistance at 97.8920. A breakthrough above this resistance could extend gains towards 98.1650.

The RSI currently sits at 50. reflecting neutral sentiment; a rise above 60 may confirm a stronger upward trend.

Key Levels to Watch:

Support: 97.6130

Resistance: 97.8920. 98.1650

RSI: 50 (watch for move above 60 to confirm bullish trend)

Market Sentiment: Caution Amid Fed Speculation

Despite the dollar's rebound, market sentiment remains cautious. The CME FedWatch tool shows nearly 96% probability of a 25-basis-point cut in September. Falling US Treasury yields could weigh on the dollar as capital flows out of US markets. The fear and greed index remains neutral, but the PPI release could trigger rapid changes in sentiment.

Outlook: Bullish vs Bearish Scenarios

Bearish: Failure to break resistance, combined with continued Fed easing, could see the DXY retreat towards 97.40. Lower yields and rising debt may accelerate capital outflows, increasing downside pressure.

Conclusion: PPI Set to Influence Dollar Direction

The US dollar shows signs of technical rebound, yet expectations of Fed rate cuts present downside risks. Traders will closely monitor PPI data and Fed policy developments. Strong PPI figures could support a firmer dollar, while weaker data may prompt more aggressive easing, pressuring the currency further.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.