Pound rises from fall to rise

2024-04-17

Summary:

Summary:

Fed Chair Powell's comments on Wednesday drove a modest dollar gain, citing limited progress on inflation goals. Traders predict a 40-bps cut by 2024.

EBC Forex Snapshot, 17 Apr 2024

The dollar was slightly higher on Wednesday as Fed Chair Jerome Powell said

there was a lack of further progress on returning to its inflation goal. Traders

now anticipate 40 bps of cuts in 2024.

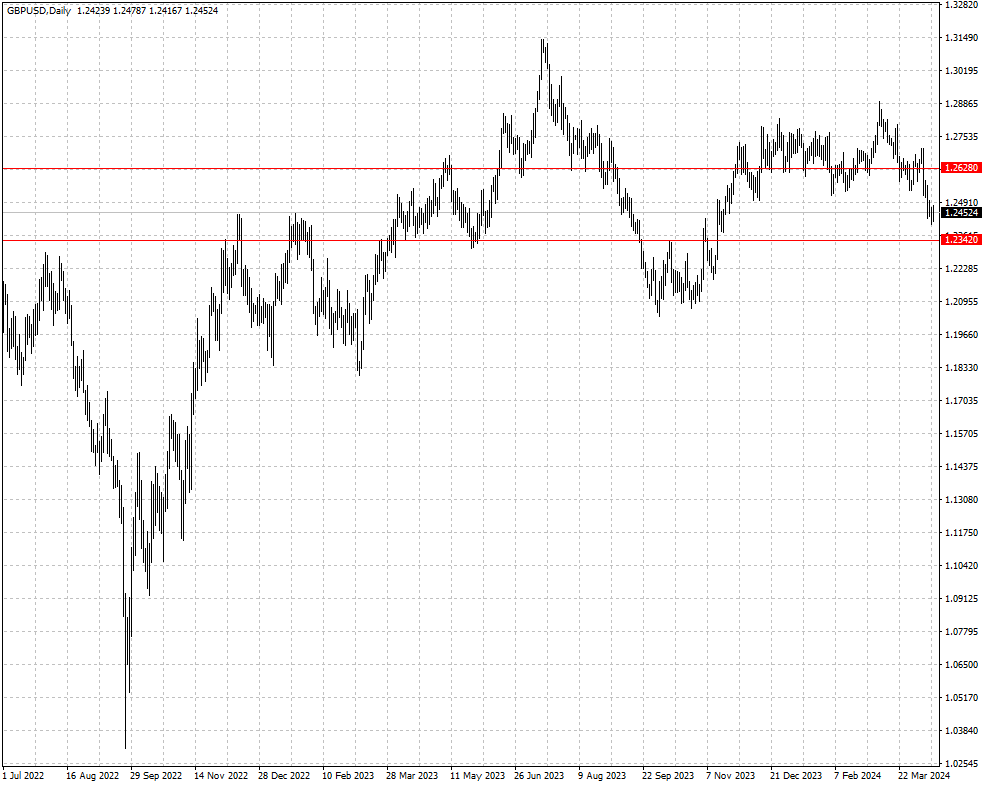

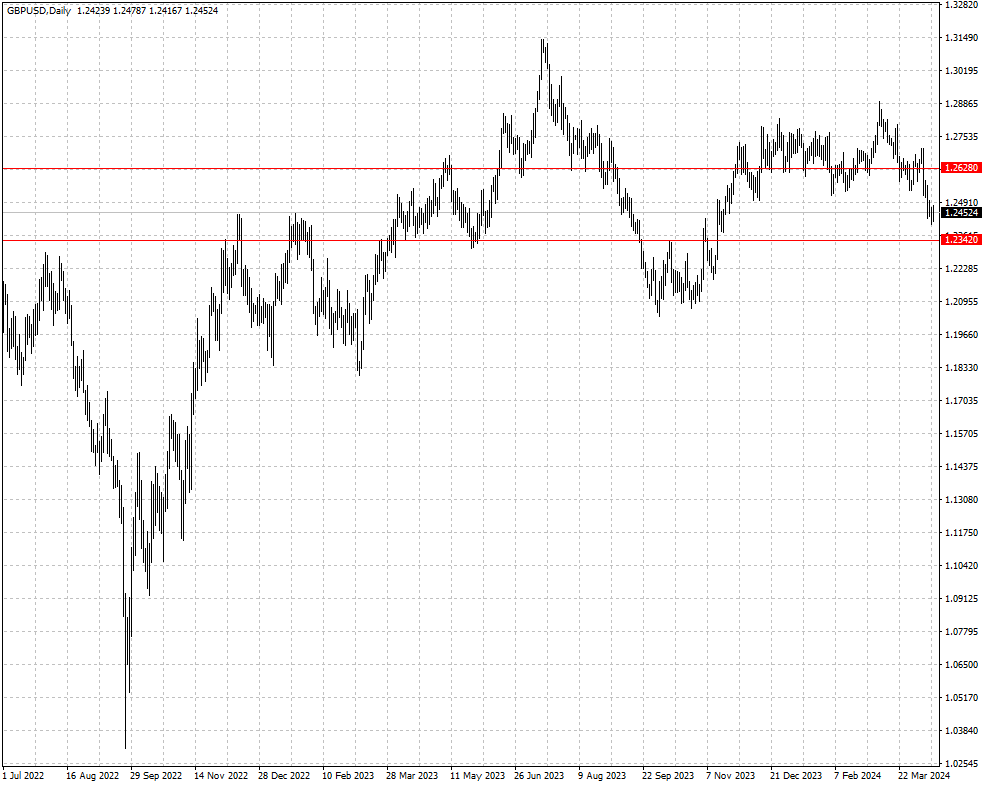

Sterling reversed its earlier losses after data showing inflation in the UK

cooled less than expected in March. The core figure stayed firmly above 4%,

which puts a June rate cut in doubts.

Last week, BOE Governor Andrew Bailey said he saw “strong evidence” that

higher interest rates were working to tame inflation. But it appears the UK may

be going in the US direction.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 15 Apr) |

HSBC (as of 16 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0517 |

1.0865 |

1.0529 |

1.0800 |

| GBP/USD |

1.2337 |

1.2709 |

1.2342 |

1.2628 |

| USD/CHF |

0.8999 |

0.9148 |

0.9023 |

0.9178 |

| AUD/USD |

0.6443 |

0.6668 |

0.6360 |

0.6583 |

| USD/CAD |

1.3478 |

1.3855 |

1.3576 |

1.3896 |

| USD/JPY |

150.88 |

153.39 |

151.90 |

155.54 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.