Options trading has become a popular tool in the financial world for investors looking to add to their arsenal. Options are special financial instruments that give you flexibility and the ability to play the market without having to buy the underlying stock. An option contract is a leveraged instrument that allows you to profit from price movements in underlying assets. Here we will go over the basics of options trading, types of options and some common strategies for both new and experienced traders.

What are the Options?

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a specified date (expiration date). They are available on various financial products, equities, indices and ETFs. They are called "derivatives" because their value is derived from the underlying asset. Unlike owning the actual stock, owning an option doesn't give you ownership of the underlying security nor does it entitle you to any dividend payments. Options can be bought and sold at any time before their expiration, so you can adjust your position based on market conditions. When executing a trade, brokers fulfil orders at the prevailing market price or a limit price set by the trader, adding an extra layer of complexity to options trading.

What is Options Trading?

Options trading involves contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset within a certain time frame. This underlying asset can be stocks, commodities or indexes, so options are very versatile and useful for traders in all financial markets.

Options are classified into two types:

Call Options: Give the buyer the right to buy an asset.

Put Options: Give the buyer the right to sell an asset. Traders anticipating that a stock price falls may opt to buy put options, allowing them to profit from the decline while limiting their losses to the premium paid.

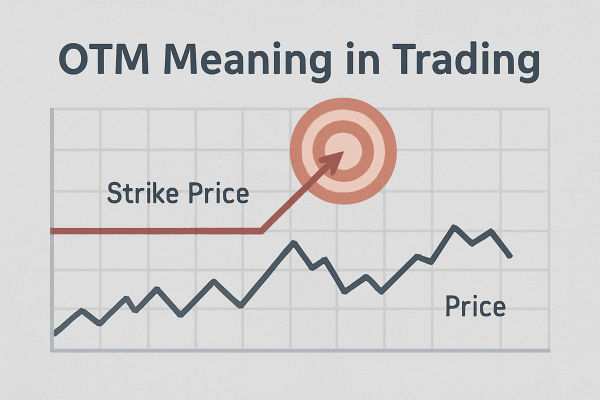

Stock options allow you to profit regardless of stock price movements and introduce different contract styles like call and put options. The price at which an asset can be bought or sold is called the "strike price" and the cost of purchasing the option is called the "premium". Options are time bound, they expire after a certain period.

Why Trade Options?

Options are powerful tools for traders and investors looking to hedge or speculate on future market movements. The underlying asset price affects the value of options and the outcomes for different market scenarios. Here are some reasons to trade options:

Hedging: Options can be used to protect an investment portfolio against adverse price movements.

Leverage: Options allow you to control a larger position with a smaller upfront investment compared to buying the asset outright.

-

Flexibility: Options offer multiple strategies to suit different market outlooks, whether bullish, bearish or neutral.

Getting Started with Options Trading

Options trading can be a complex and intimidating topic for beginners. However, with the right guidance and preparation, anyone can get started with trading options. In this section, we will cover the essential steps to help you get started with options trading.

Assessing Your Readiness

Before diving into options trading, it's crucial to assess your readiness. This involves evaluating your financial situation, risk tolerance, and investment goals. You should also have a basic understanding of options trading concepts, including call and put options, strike prices, and expiration dates.

To assess your readiness, ask yourself the following questions:

What are my investment goals, and how do I plan to achieve them?

What is my risk tolerance, and how much can I afford to lose?

Do I have a solid understanding of options trading concepts?

Do I have a Trading plan in place, including entry and exit strategies?

If you've answered these questions and feel confident in your readiness, it's time to move on to the next step.

Choosing a Broker and Getting Approved

To trade options, you need to open an account with a reputable online broker. When choosing a broker, consider the following factors:

Fees and Commissions: Look for a broker with competitive fees and commissions.

Trading Platform: Choose a broker with a user-friendly trading platform that meets your needs.

Customer Support: Ensure the broker offers reliable customer support and educational resources.

Options Trading Approval: Check if the broker offers options trading approval and what levels of approval are available.

Once you've selected a broker, you'll need to get approved for options trading. This typically involves filling out an options trading application and providing financial information. The broker will then assess your suitability for options trading and assign you an approval level.

How to Trade Options

Options trading involves buying or selling contracts that give you the right to buy or sell a stock at a certain price by a certain date. To get started you need to open an options Trading Account with a broker and get approved for options trading. This process involves providing your investment objectives, trading experience, personal financial information and the types of options you want to trade. Based on your answers the broker will assign you an initial trading level that reflects the level of risk you can take on. Once approved you can start trading options by selecting which contracts to buy or sell, the option strike price and the option time frame. Options trading can be used to speculate on the direction of a stock's price, generate income in a sideways market or hedge against potential losses in a portfolio.

Basic and Advanced Options Trading Strategies

Options trading offers many strategies that traders can use based on their market outlook and risk level. Here are a few:

Covered Call: In this strategy, traders hold stock and sell call options against it. This generates extra income from the premium but may limit the upside if the stock price rises.

Protective Put: To protect against a potential fall in a stock they own, traders buy put options. This limits losses in a bearish market, and it is essentially an insurance policy.

Straddle: This involves buying a call and a put option with the same strike price and expiration date. Useful when a trader expects high volatility but is unsure of the direction of the price movement.

Iron Condor: This advanced strategy involves selling a call and a put at different strike prices and buying a call and put at further strike prices. It works in a low-volatility market and can generate profits in a sideways market. Advanced strategies like this require a good understanding of the complexities involved, and the trader needs to be on high alert throughout the trading day.

-

Bull Call Spread: Traders buy a call option with a lower strike price and sell one with a higher strike price. This is used when a trader expects a moderate price rise in the underlying asset.

Maximizing Returns in Options Trading

Options trading offers a range of strategies to maximize returns. Here are some tips to help you get the most out of your options trading:

Understand the Underlying Asset: Before trading options, it's essential to have a solid understanding of the underlying asset, including its price movements and volatility.

Choose the Right Strike Price: The strike price is a critical component of options trading. Choose a strike price that aligns with your investment goals and risk tolerance.

Use Advanced Trading Strategies: Advanced trading strategies, such as spreads and iron condors, can help you maximize returns and manage risk.

Monitor and Adjust: Continuously monitor your options trades and adjust your strategy as needed to maximize returns.

Options Trading Risks

While options trading offers flexibility and the potential for profit, it also comes with significant risks. The complexity of options strategies requires a solid understanding and experience. New traders may find options trading confusing because it involves more than just buying at the market price or a set limit price, like with stocks. The added layers of strategy can make it trickier. Another risk is time decay, where the value of an option decreases as the expiration date nears. Additionally, options come with leverage risk, where high leverage can magnify both potential gains and losses. If the market moves against your trade, the losses could exceed the premium you paid.

Is Options Trading Right for You?

Options trading is not suitable for everyone. Before diving in, it's important to assess whether it's right for you. Consider your risk tolerance, as options trading involves the possibility of losing money. You should also think about your investment goals, as options can help achieve objectives like income generation or capital appreciation. Additionally, options trading requires a time commitment, as it involves monitoring trades and adjusting strategies. Finally, ensure you have a stable financial situation with enough capital to invest, as this can impact your ability to manage the risks involved.

If you've considered these factors and feel that options trading is right for you, it's time to get started. Remember to always educate yourself, set clear investment goals, and manage risk to maximize your returns in options trading.

Options trading adds an extra layer of complexity to traditional trading and investing but offers opportunities for hedging and speculating. With the right strategies and risk management options, trading can be used to benefit from market movements without buying or selling the underlying asset.

However, all trading involves a good understanding of the market, strategies and risks. Beginners should start with basic strategies and consider using a demo account to practice before making real money. Experienced trader options provide a way to manage risk, optimize returns and add more tools to their arsenal in today's fast-paced financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.