Last week, almost everyone was wiped out by the shooting of Japanese Prime Minister Shinzo Abe. Many investors have found that on the day of the incident, the Japanese stock market plummeted, and the Nikkei 225 futures fell to a low of 26400 yen. Investors flocked to safe assets, and the Japanese yen played its safe haven role, immediately rising 0.5% and stabilizing around 135.60 per dollar. It must be acknowledged that the assassination of the former Japanese Prime Minister has significant economic impact.

There are countless cases of presidential assassinations in history, and almost all of them will cause significant waves in the financial market in the short term, with the most typical being reflected in the performance of stock prices.

For example, on March 30, 1981, President Ronald Reagan was assassinated and his stock price fell by 1.2%; President Richard Nixon resigned on August 8, 1974, and his stock price fell by 1.3%; On September 23, 1998, the hedge fund Long Term Capital Management Company went bankrupt, and its stock price fell by 2.2%.

But if we rank the severity of stock market volatility, the assassination of President John F. Kennedy on November 22, 1963 caused S&PThe 500 plummeted by nearly 3%, which is definitely among the top in Wall Street history.

Today, EBC Finance takes you closer to the 1963 assassination case of US President John F. Kennedy

Murder has a significant impact on the stock market, but the time is brief:

Kennedy was assassinated in Dallas, and the S&P 500 plummeted by nearly 3%

2. The New York Stock Exchange closed at 2:07 pm on the same day to mourn the President

But the market crash was brief, and after 2 days, the market recovered all losses.

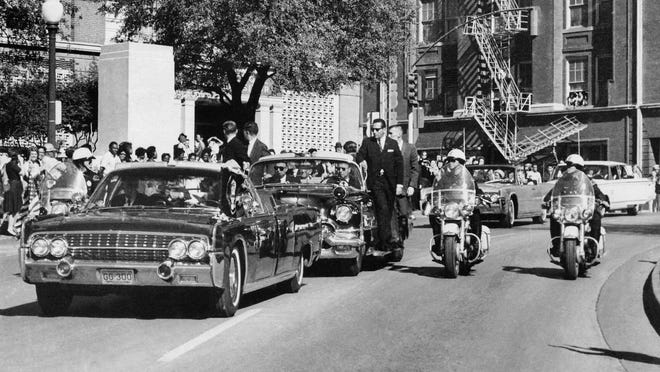

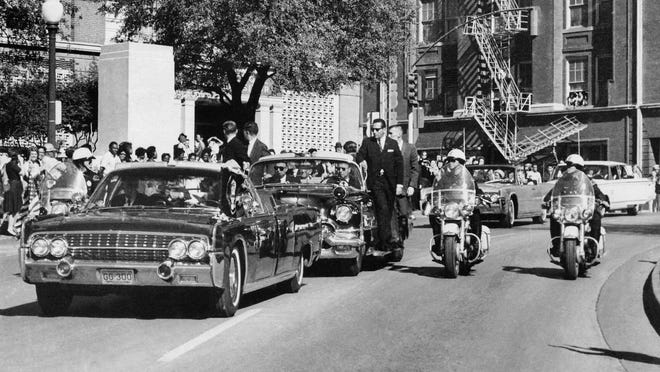

Information - On Friday, November 22, 1963, President Kennedy can be seen through the windshield of the convertible in the foreground. As the convoy drove past the Texas School Library in Dallas, Kennedy's hand reached out to his head a few seconds after being stabbed, while First Lady Jacqueline held onto his forearm.

When the news of the assassination spread on television and radio, shock and sadness prevailed, and stock prices plummeted. Lee Harvey Oswald in DallasOn the day Oswald was shot dead, the S&P 500 index plummeted 2.8%. Shocked Wall Street closed the New York Stock Exchange at 2:07 pm Eastern Time on Friday to mourn the assassination of President Kennedy.

This is a shock for the market, "said Sam Stovall, chief equity strategist at Standard&Poor's Capital IQ. From a political perspective, there is chaos and complete uncertainty.

According to the data of Standard&Poor's Capital IQ that year, the reaction of the stock market to the first day of Kennedy's accidental death was one of the biggest reactions to the accidental impact in the past 70 years.

In fact, the drop of nearly 3% on the day of the assassination of the 35th President of the United States was even greater than the Cuban missile crisis of October 10, 1962, and the day after the Cuban missile panic, the sharp drop was only 2.7%. S& PCapital IQ data shows that after experiencing the significant impact of World War II, a 2.8% decrease was greater than the median decrease of 2.4%.

Stovall said that overall, once investors return to rationality and assume that the economy will not be damaged by this event in the long term, the stock market often rebounds rapidly. Although Kennedy's death was a tragedy, the market quickly realized that it was an emotional event, not an economic one. The United States also has a carefully designed succession plan at the highest level of government, allowing for a transition to a new president - Lyndon JohnsonB. Johnson) is seamless.

Wall Street has long assessed that although this assassination is tragic, it will not change growth in the United States or globally, "Stovall said. This is not to say that the president's death will close the waterway, or lead to the closure of oil wells or a surge in interest rates.

In contrast, the shocks that led to a day of decline greater than the Kennedy assassination incident include the Pearl Harbor attack in 1941, the September 11 terrorist attacks in 2001, and the bankruptcy of Lehman Brothers in the autumn of 2008.

The stock market often has elasticity. Investors jumped back into the market after the impact to take advantage of the price downturn caused by the panic surrounding the impact.

In fact, looking at the 14 market "shocks" since World War II, the average decline (median) of the stock market is around 5.3%, with an average rebound after hitting the bottom six days later. Standard&Poor's (S&PAccording to Capital data, the market will recover all previous declines in just 14 days on average.

The first question that a murder investigator ponders, who benefits?

In the assassination of John F. Kennedy, there was a report by Claremont McKenna College economist William Brown in 1996The famous economic study written by Jr. titled "Friends at the Top: The Wealth Impact of Kennedy's Assassination on LBJ Supporters' Assets".

In this article, William Brown measured the power of special interest groups and the impact of Kennedy's death on the stock prices of large companies related to Vice President Lyndon Johnson.

William Brown studied 63 companies and divided them into four investment portfolios: Texas based companies, aerospace contractors, domestic oil companies, and Brown& Root. These business groups are all major financial supporters of Vice President Johnson and profit from his entry into the White House.

For example, historians point out that Brown& The owners of Root, George and the Hermann brothers, funded Johnson's first congressional campaign in 1937. In return, Johnson used his influence to smooth out a $27 million federal dam project for them.

In the following years, Brown& Root officials invested hundreds of thousands of dollars in Johnson's campaign and became wealthy through federal contracts.

William Brown found that between the assassination day of November 22, 1963 and the first day of the stock market reopening, the value of 63 Johnson related companies increased by an average of 0.85% compared to other markets. Brown& Root related companies rose even more, with an average growth rate of 1.64%.

After the assassination incident, the value of the aerospace contracting company was three-quarters higher than the market. The stock price of General Dynamics, a defense company located in Fort Worth, Texas, climbed from $23.75 on November 22 to $25.13 on November 26, and by February 1964, it had risen by over $30, up about 30% in three months.

Shortly before the assassination, General Dynamics became the Senate Government Operations CommitteeThe key survey subjects of the Committee.

The cause of the incident was the Pentagon's appeal to General Dynamics in 1962Dynamics awarded a controversial contract for the TFX fighter bomber, later known as the F-111. This was the largest aerospace contract at the time, which rescued the company from deep financial difficulties.

The key figure in the investigation is Navy Secretary Fred Korth, who previously served as the Continental National Bank of Fort WorthPresident of Fort Worth, the bank is GeneralThe main holders of Dynamics deposits. Before joining the government, Koch used his political influence in Washington to promote General Dynamics' contracts.

The Senate Investigation Committee held a hearing on the TFX scandal on November 20th, just two days before the assassination incident. The Senate plans to hear Koth's testimony in a week. But after Johnson took office, there were no further hearings.

On November 22nd, in another investigation into government corruption, Senate members heard testimony alleging payment of $100000 to Vice President Johnson in connection with the TFX contract. But after the assassination incident, there was no news of this investigation, and the actions of the Senate were quite suspicious. University of California, BerkeleyPeter Dale, Honorary Professor of California at BerkeleyScott pointed out in his book "Deep Politics and the Death of JFK" published in 1993.

Some conspiracy theory try to deduce from these events that if Kennedy is killed, General Dynamics, Brown& Root or more commonly known as "military industrial consortia", groups with interests in Vice President Lyndon Johnson, may have greater suspicions. But there is no evidence to suggest a direct relationship between them and Kennedy's death.

It is undeniable that interests come first, and 'who benefits' can often become the inference basis for assassination purposes. The above facts indicate that the President's assassination accident has a significant impact on the stock market, upper asset allocation, and political landscape at various levels. For most shareholders, the overall impact is severe and brief.

Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.