MSCI's global equity index ended Friday's session virtually unchanged while

the dollar was lower as government data showed that U.S. jobs growth slowed more

than expected in June, easing worries about the outlook for Fed rate hikes.

But while investors appeared to hold out hope for a less hawkish Fed, they

were also looking cautiously to the week ahead, with key U.S. inflation readings

due along with the start of the second-quarter earnings season.

Spot gold added 0.7% to $1,924.13 an ounce. Oil prices climbed nearly 3% to a

nine-week high as supply concerns and technical buying outweighed fears that

further interest rate hikes could slow economic growth and reduce demand.

Commodities

Benchmark 10-year U.S. Treasury yields retreated from a more than four-month

peak to a more than two-week low after the data, making gold attractive for

other currency holders. Short-dated Treasury yields to their highest since

2007.

Traders stuck to bets the Fed would raise interest rates this month, but were

becoming more sceptical of the chance for hikes beyond that after the job

report.

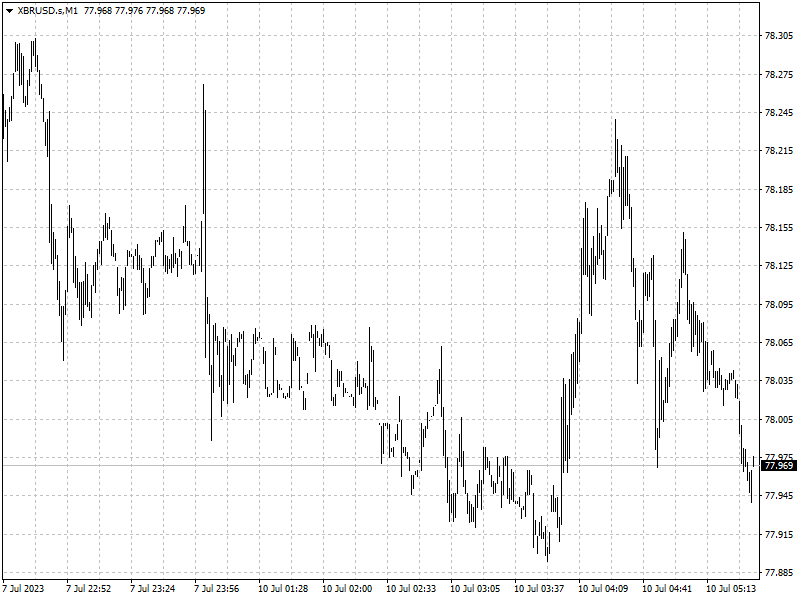

After two months of price consolidation between roughly $73-77, Brent moved

into technically overbought territory for the first time since mid-April.

‘OPEC+ production cuts are expected to tighten the market, driving supply

deficits in the second half of 2023, supporting higher oil prices,’ analysts at

U.S. financial services company Morningstar said in a note.

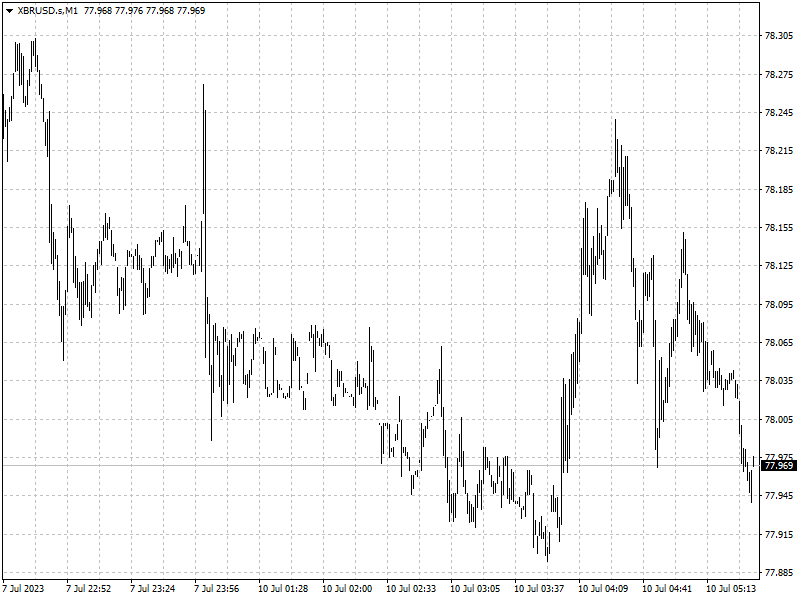

Forex

Weekly data from the U.S. regulator shows speculators hold a short position

in the yen worth $9.793 billion, the largest since May 2022, having almost

doubled in size in the last three months alone.

The yen has held just below the 145 level - which prompted the BOJ's first

intervention in decades last autumn - for about two weeks and authorities have

made clear they are concerned about the weakness in the currency.

Earlier, the Japanese labour ministry reported regular wages posted their

largest annual increase in May since early 1995, reinforcing the view that the

BOJ will have to modify its ultra-loose monetary policy sooner rather than

later.