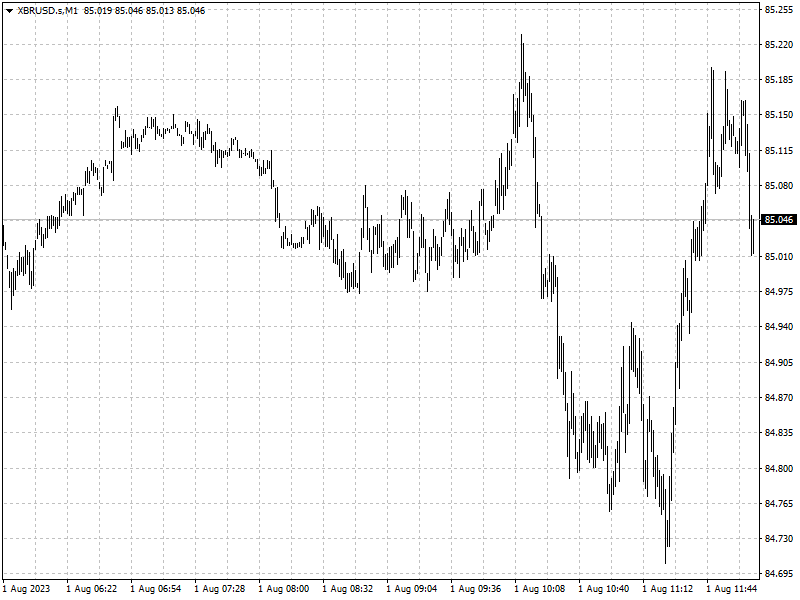

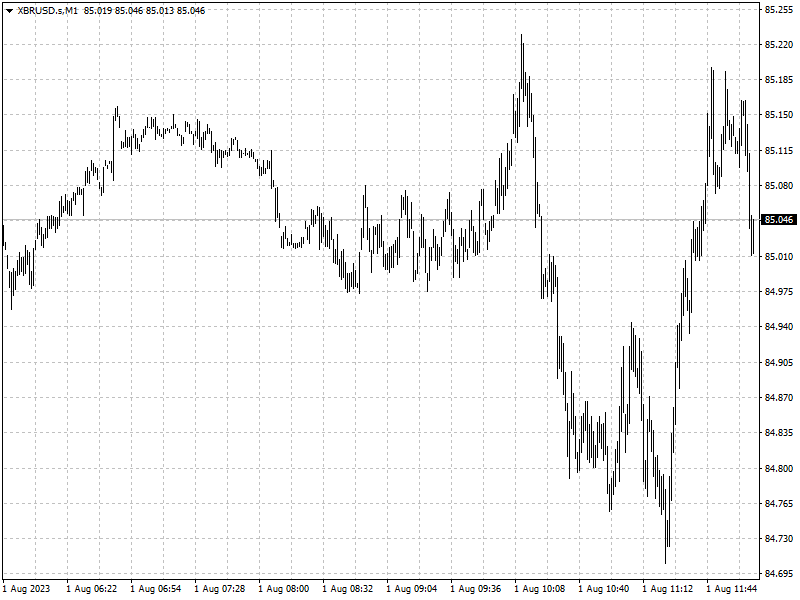

Oil is overbought

Oil prices barely change on Tuesday around a three-month high on signs of

tightening global supply after OPEC+ production cuts and improved demand

outlook.

Still, crude’s climb meant that its 14-day relative-strength index has risen

near 70, a level that suggests the market may be overbought in the near term and

could face a downward correction.

Meanwhile, oil exchange-traded funds have posted their largest week of

outflows for more than a year. Investors are cashing in on long-only oil ETFs

after crude prices surged above $80 a barrel for the first time since April.

‘Prices continue to take the lead from improving supply conditions,’ said

Yeap Jun Rong, market strategist at IG Asia Pte in Singapore, referring to

recent output reductions.

‘All eyes will be on its year-to-date high next, which could determine if

prices can break out of its medium-term range.’

Brent crude reached $88.19 a barrel on 23 January on optimism about a

possible recovery in demand of top oil importer China as the economy recovers

this year from pandemic lockdowns.

Fundamentals turn bullish

The OPEC+ Joint Ministerial Monitoring Committee is due to hold an online

review of the market on Friday to gauge the impact of the reductions that have

been led by Saudi Arabia and ally Russia.

In June, the OPEC+ agreed on a broad deal to limit oil supply into 2024, and

Saudi Arabia pledged an additional voluntary cut for July. On July 3, Saudi

Arabia said the cut would include August, adding that it could be extended

further.

China’s factory activity contracted for a fourth consecutive month in July.

However, Chinese stimulus measures and a pick-up in air travel could buoy prices

later this year, analysts said.

Global oil demand was expected to increase by about 1-2.1 million bpd in

2023, led by China. The government is expected to announce more policies to fuel

post-pandemic recovery if economic data deteriorate further.

‘China's economic outlook may continue to disappoint but upside in oil demand

is still possible with jet demand recovery from international flights later this

year,’ said Ajay Parmar, associate director of global oil markets research at

HSBC.

The EIA said that U.S. fuel demand rose to 20.78 million bpd in May, the

highest since August 2019. It also showed gasoline demand, expressed as product

supplied to the market, surged to 9.11 million bpd, the highest since June

2022.

Expectations the Fed is near the end of its tightening cycle have also

bolstered crude prices amid greater optimism the economy may achieve a ‘soft

landing’ that sees inflation come down while a recession is avoided.

Confidence grows

A survey of 37 economists and analysts forecast Brent crude would average

$81.95 a barrel in 2023, down from June's $83.03 consensus and current levels of

around $85. Brent was forecast to average $83.67 next year.

U.S. crude was seen averaging $77.20 a barrel in 2023, down from the previous

month's $78.38 forecast, and $78.25 in 2024.

‘Oil prices are on track to hit 2023 price highs in our view. The OPEC

meeting this Friday is a potential catalyst for the outlook where we expect

Saudi Arabia's voluntary supply cuts to be extended another month," said

National Australia Bank analysts in a Tuesday note.

‘The market has abandoned its growth pessimism,’ Goldman Sachs senior energy

economist Daan Struyven and his team wrote in a note to clients.

‘Oil prices have rallied by 18% since mid-June on the return to deficits and

on the oil market abandoning its negative growth views, which we saw as too

pessimistic.’

The bank notes the global oil market fell into a supply deficit in July after

having been, on average, in a surplus of about 600,000 barrels per day over the

prior year.