Oil prices fell on Thursday, extending losses from the previous day,

pressured by large builds in US fuel inventories last week, though concerns over

tighter supplies from OPEC+ capped the decline.

Gasoline stocks rose by 6.3 million barrels last week, the EIA said, well

above analyst forecast of a 1.5 million-barrel gain. Crude inventories fell by

959,000 barrels, compared with expectations for a 184,000-barrel drop.

OPEC's crude output fell in December after two months of increase, a Reuters

survey showed. Field maintenance in the United Arab Emirates offset a Nigerian

output hike and gains elsewhere in the group.

Oil has had a strong start to 2025 following a disappointing year, but many

analysts continue to warn of a glut this year with stalling Chinese demand and

non-OPEC+ output increase.

WTI's prompt spread retreated from a 3-month high, indicating optimism was

fading. Hoverer, Saudi Arabia hiked oil prices to Asian customers earlier this

week, a vote of confidence for crude demand.

Trump on Monday denied a Washington Post report that said his aides were

exploring tariff plans that would only cover critical imports, deepening

uncertainty among business leaders about future economic policies.

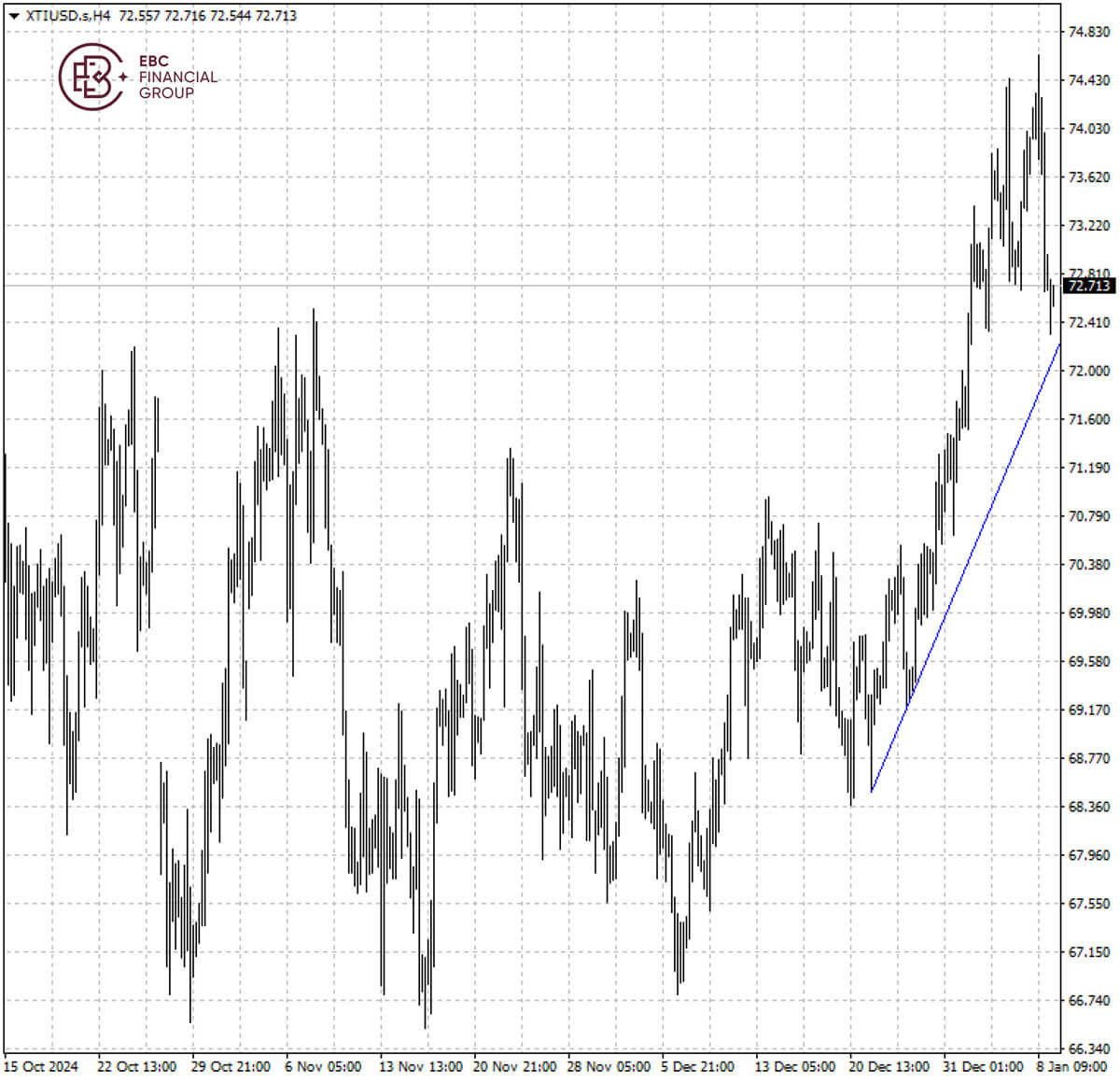

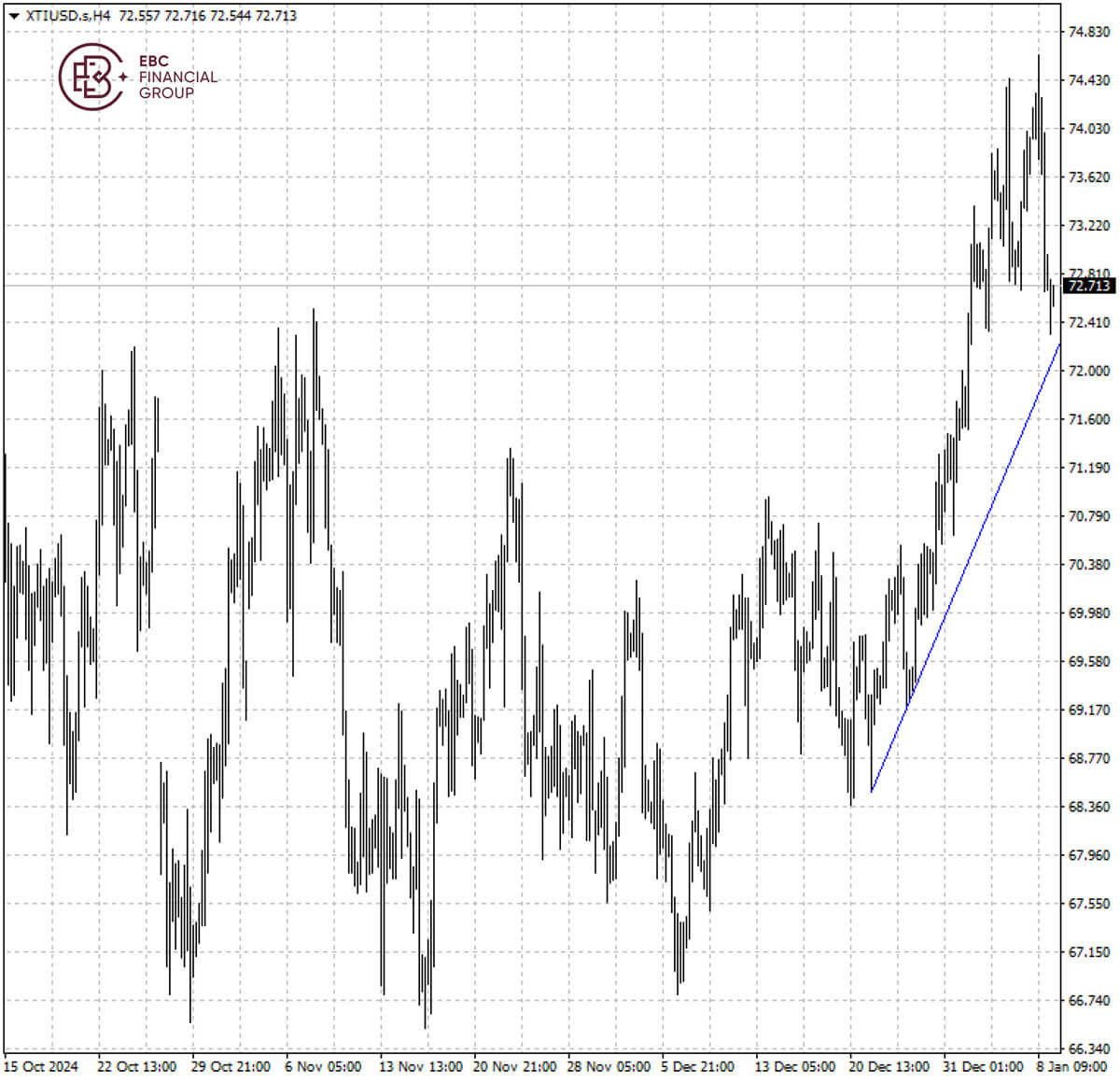

WTI crude broke out of its three-month range, but it lost momentum near 200

SMA. It is critical to hold above the ascending trendline, otherwise we could

see another leg lower.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.