Major currencies rose against the dollar on Thursday

2024-06-13

Summary:

Summary:

Major currencies held gains as a weaker dollar followed softer-than-expected US inflation. Markets still expect two 25 bps cuts this year.

EBC Forex Snapshot, 13 Jun 2024

Major currencies held their gains on Thursday against a dollar knocked by

softer-than-expected US inflation. Despite the dot plot update, markets stuck

with pricing in almost two 25 bps cuts this year.

Four Fed policymakers feel the Fed should not cut rates at all this year, the

fresh projections show. The Australian dollar remained week following a positive

jobs report.

Australian employment outpaced expectations last month as firms took on more

full-time workers, while the jobless rate dipped in a sign the labour market

remains resilient even as the economy stalls.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 11 Jun) |

HSBC (as of 13 Jun) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0700 |

1.0981 |

1.0712 |

1.0909 |

| GBP/USD |

1.2300 |

1.2827 |

1.2695 |

1.2879 |

| USD/CHF |

0.8885 |

0.9158 |

0.8827 |

0.9107 |

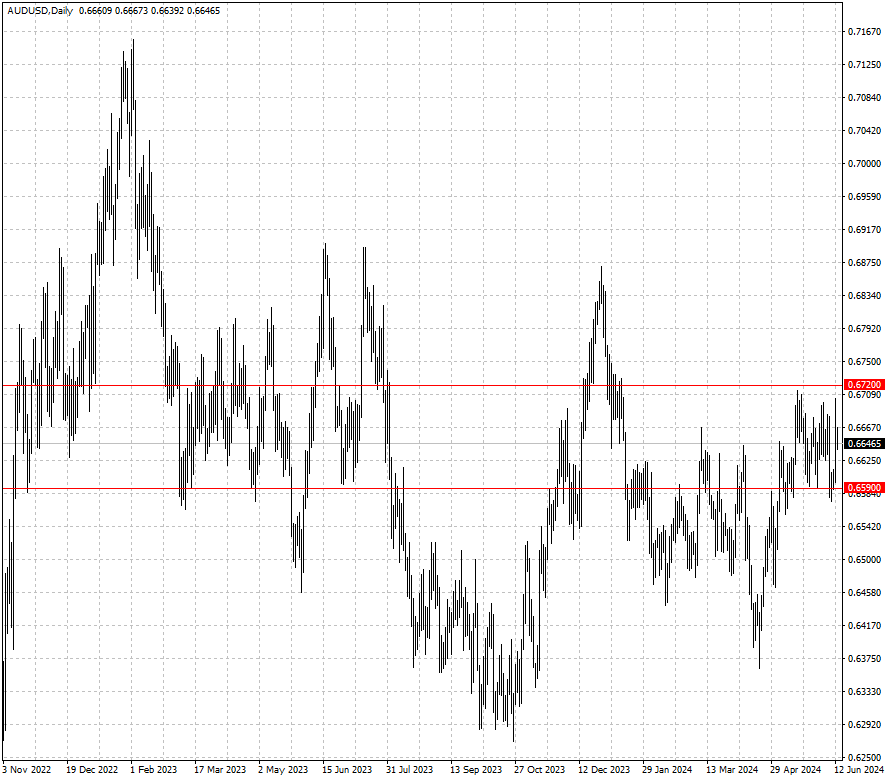

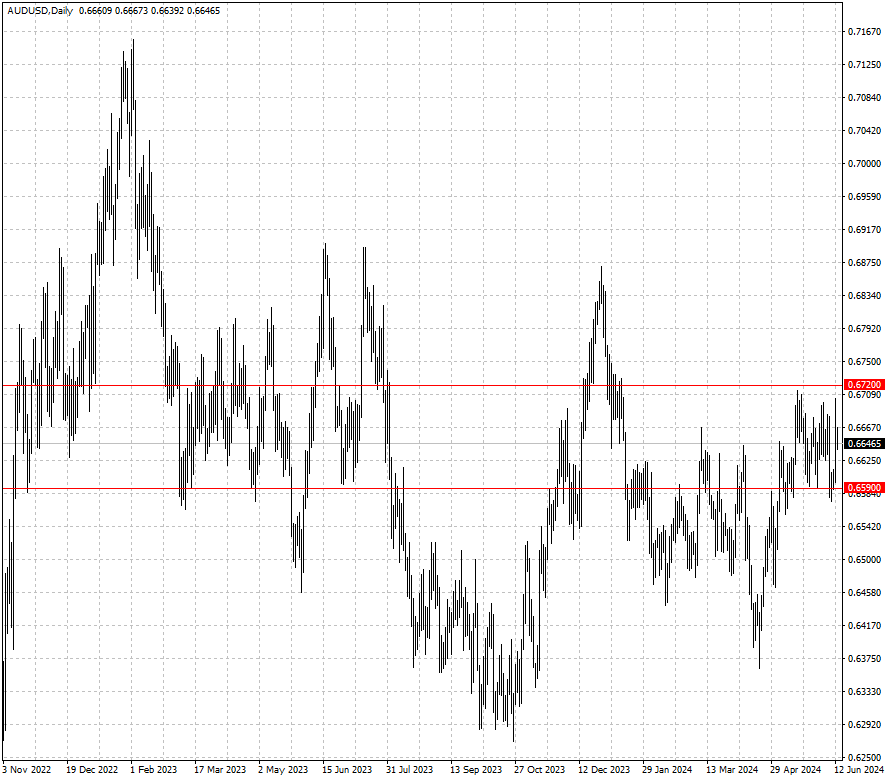

| AUD/USD |

0.6562 |

0.6729 |

0.6590 |

0.6720 |

| USD/CAD |

1.3577 |

1.3846 |

1.3618 |

1.3809 |

| USD/JPY |

151.86 |

157.71 |

154.91 |

158.14 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.