A gauge of global stock markets took a breather on Friday after a run to

14-month highs, while the U.S. dollar headed for its biggest weekly slide since

January following a heavy week of central bank meetings around the world.

Gold prices were choppy as investors juggled a hawkish Federal Reserve

outlook on interest rates, which offset support from the dollar’s overall

retreat this week.

Oil posted a weekly gain, as higher Chinese demand and OPEC+ supply cuts

lifted prices, despite expected weakness in the global economy and the prospect

for further interest rate hikes.

Commodities

Weighing on appeal for zero-yield bullion, traders now saw a 74% chance of a

rate hike in July, according to the CME’s FedWatch tool.

‘This is tough for gold because you have stocks that are continuing to rise

and more hawkish Fed speak,’ said Edward Moya, senior market analyst at

OANDA.

In Iran, crude exports and oil output have hit new highs in 2023 despite U.S.

sanctions, according to consultants, shipping data and a source familiar with

the matter.

U.S. oil rigs fell by four to 552 this week, their lowest since April 2022,

while gas rigs fell by five to 130, their lowest since March 2022, energy

services firm Baker Hughes Co said.

Money managers cut their net long U.S. crude futures and options positions by

13,191 contracts to 73,273 in the week to June 13, the U.S. Commodity Futures

Trading Commission (CFTC) said.

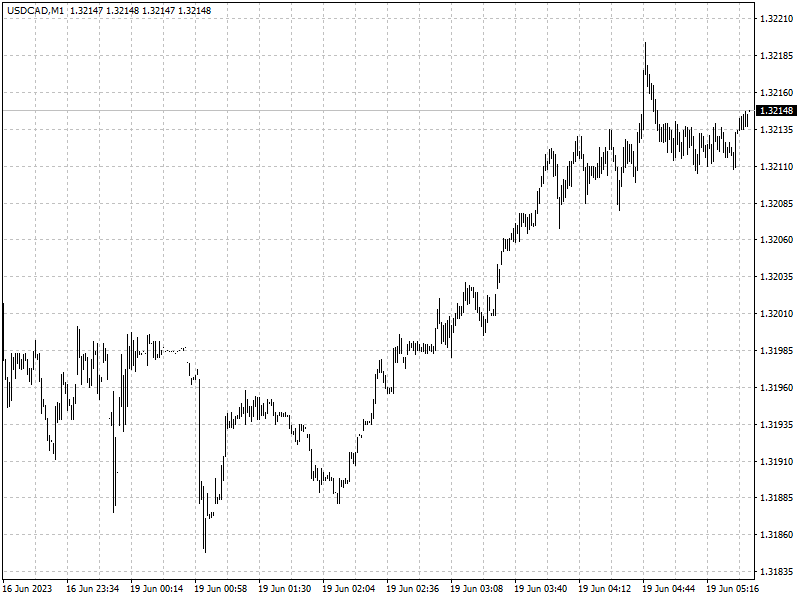

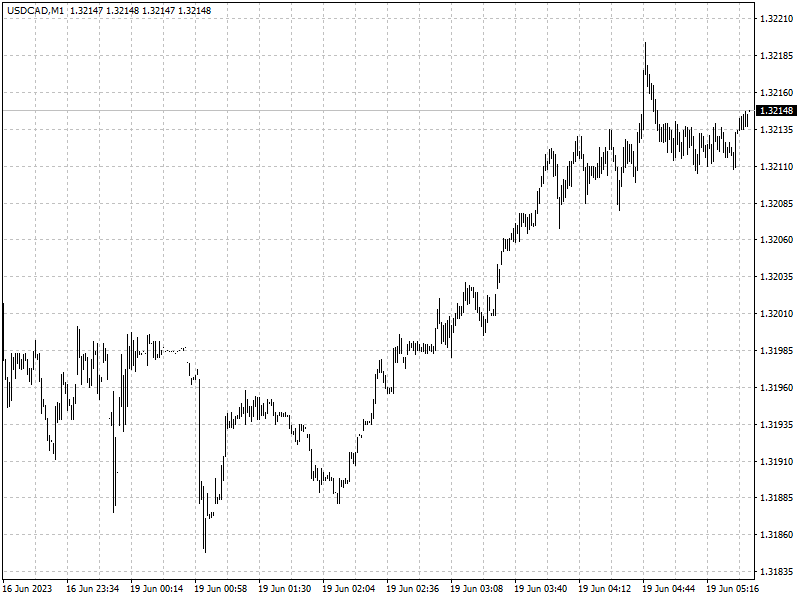

Forex

The Canadian dollar strengthened to a nine-month high against its U.S.

counterpart as oil prices rose and investors recalibrated bets on the peak level

of interest rates this cycle from the BOC and the Fed.

‘I think if we can get a weekly close below 1.32 that's quite meaningful and

that potentially sets us up for a run towards the 1.30 area over the coming

weeks,’ Bipan Rai, global head of FX strategy at CIBC Capital Markets, said.

The yen plunged to a 15-year low against the euro on EBC-BOJ policy

divergence. BOJ Governor Kazuo Ueda said he expects inflation to moderate, but

the ‘pace of decline is somewhat slow.’

ECB President Christine Lagarde told a news conference another rate hike in

July was highly likely and the central bank still has "ground to cover" to stave

off high inflation.