The spot market is an international financial market and has become a hedging

Trading Product. The trading volume is relatively large and will not be

manipulated by the market makers, so it is also a fair and just market. Of

course, novice investors need to learn and understand basic trading knowledge to

enter the spot market, and they must do a good job in spot trading before they

can do a good job in spot trading in order to obtain the benefits of spot

trading.

Spot trading refers to the trading method of directly buying and selling

physical commodities or financial products on the exchange or over-the-counter

market. Unlike futures trading and option trading, spot trading is a real-time

delivery trading method where both buyers and sellers deliver goods and pay for

goods immediately after the transaction is completed.

Spot trading can involve various commodities, such as agricultural products

such as gold, Crude Oil, soybeans, and cotton, as well as financial products

such as foreign exchange and stocks. Investors can directly participate in the

market through spot trading, enjoy real-time price fluctuations, and make

investments based on this to obtain profits.

When conducting spot trading, investors need to understand the following

basic knowledge:

1. Trading Partner

The objects of spot trading can be various physical commodities, such as

crude oil, gold, silver, soybeans, cotton, etc., as well as financial products,

such as stocks, bonds, foreign exchange, etc. Different trading partners have

different characteristics and risks.

2. Trading method

Spot trading can be conducted on exchanges or in the over-the-counter market.

An exchange is a centralized trading venue where both parties engage in trading

through the exchange's trading system. The over-the-counter market refers to

direct trading between both parties without the participation of

intermediaries.

3. Transaction time

The time of spot trading is generally during the opening time of the

exchange, which varies depending on the different exchanges and trading

partners. The trading time in the over-the-counter market is generally more

flexible and can be determined through negotiation between the trading

parties.

4. Transaction Price

The price of spot trading is determined by the market supply and demand

relationship, and both buyers and sellers determine the trading price based on

market conditions. The fluctuation of transaction prices is influenced by

various factors, such as supply and demand relations, the macroeconomic

environment, policy changes, etc.

5. Transaction costs

The cost of spot trading includes transaction fees and transaction taxes.

Transaction fees are transaction fees collected by exchanges or brokers, and

transaction taxes are transaction taxes in accordance with national laws and

regulations.

6. risk management

Spot trading carries certain risks, and investors need to conduct risk

management. Risk management includes reasonable position control, stop-loss

strategies, and diversified investments. Investors can also use derivative tools

for hedging operations to reduce risk.

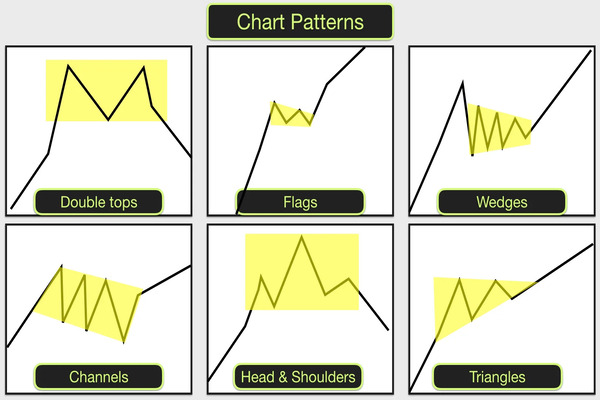

7. Trading Strategy

Spot trading requires the development of reasonable trading strategies.

Trading strategies include two methods: technical analysis and fundamental

analysis. Technical analysis predicts market trends by studying technical

indicators such as price trends and trading volume, while fundamental analysis

predicts market trends by studying fundamental factors such as supply and demand

relationships and economic data.

Of course, in the introduction to spot trading, one should also have an

understanding of various aspects, such as the trend judgment of spot trading.

Only in this way can one invest and trade in the spot market. After

understanding and learning the basics, investors also need to do a good job of

simulating trading. After that, they can exercise their trading skills and

combine knowledge and practical operations to do a good job in spot trading.

Disclaimer: Investment involves risk. The content of this article is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.