Hydrogen, long seen as a promising but distant solution for a cleaner future, is now making its way into the mainstream. As the world pushes toward more sustainable energy sources, hydrogen has emerged as a key player — and traders are taking notice. From zero-emission vehicles to green energy production, hydrogen's potential seems endless. But why are hydrogen stocks getting so much buzz right now, and how can traders tap into this growing sector?

What Are Hydrogen Stocks and Why Are They Gaining Popularity?

Hydrogen stocks represent shares in companies that are involved in the production, development, or distribution of hydrogen fuel and technology. Hydrogen is considered one of the cleanest energy sources, with water being its only byproduct when used in fuel cells. This makes it an attractive alternative to traditional fossil fuels, especially as governments and businesses around the world push for decarbonisation.

The rising popularity of hydrogen stocks can be attributed to several key factors. First, hydrogen is seen as a viable solution to help reduce global carbon emissions. Second, it offers a unique energy source for industries like transportation, heavy industry, and power generation. Finally, governments are increasingly supporting hydrogen development through incentives and investments aimed at reaching net-zero emissions targets.

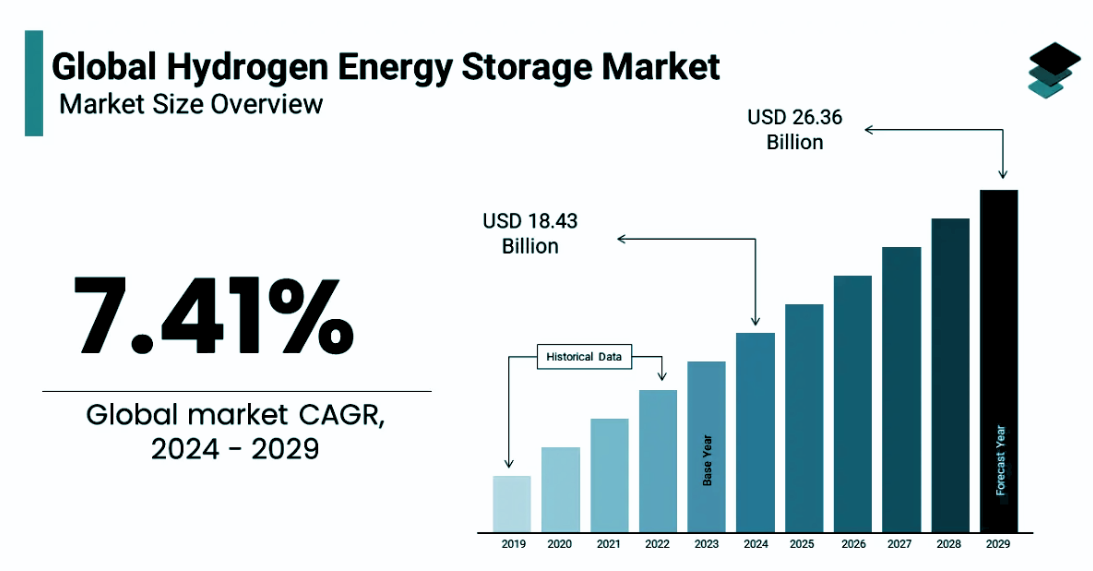

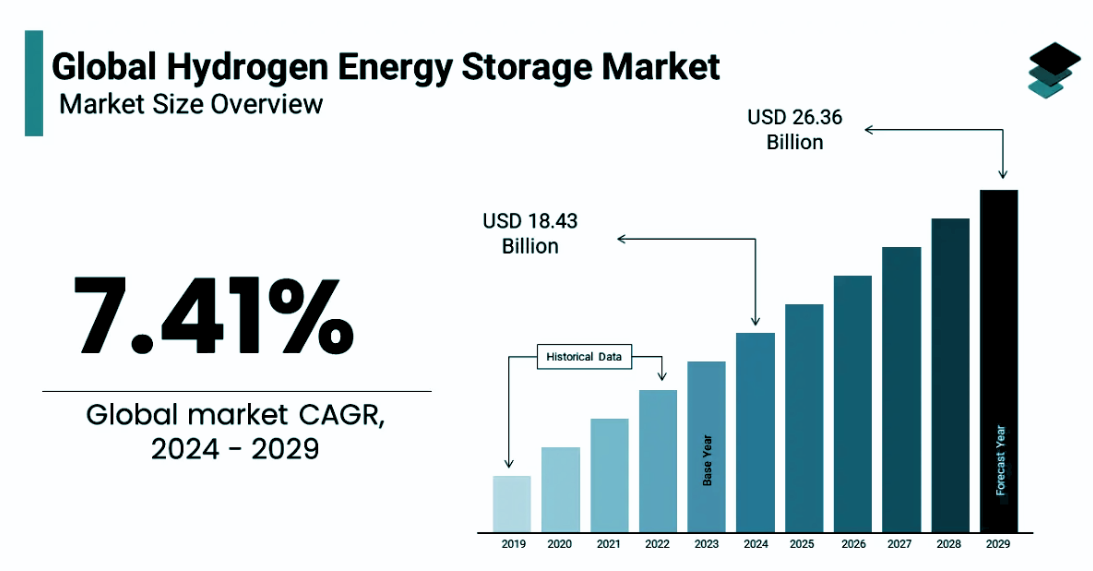

Hydrogen's versatility is another major reason for its growing appeal. It can be stored, transported, and used in multiple ways, making it a valuable asset in a world transitioning to cleaner energy. As countries like the UK, the US, and parts of Europe ramp up their hydrogen strategies, it's clear that this sector is poised for substantial growth in the coming years.

Top Hydrogen Companies to Watch in 2025

Now that we know what hydrogen stocks are, let's take a look at some of the key players in the industry. These companies are leading the charge, investing heavily in hydrogen technology and positioning themselves for future growth.

1. Plug Power

Plug Power has become a household name in the hydrogen space, and for good reason. The company focuses on producing hydrogen fuel cells for a range of applications, from powering vehicles to industrial machinery. Plug Power has made impressive strides in creating green hydrogen, which is produced through renewable energy sources, making it a frontrunner in the race to reduce emissions.

With partnerships with giants like Amazon and Walmart, Plug Power is on track to expand its market share significantly. As the company continues to scale its production of hydrogen fuel cells, it is well-positioned for growth in the years ahead. Traders are keeping a close eye on Plug Power, with many seeing it as a major player in the shift to clean energy.

2. Ballard Power Systems

Ballard Power Systems is another key name in the hydrogen sector. Known for its fuel cell technology, Ballard is focusing on developing hydrogen solutions for transportation, including buses, trucks, and trains. The company's hydrogen fuel cells offer a cleaner, more efficient alternative to traditional batteries, making them a key component in the transition to zero-emission transportation.

Ballard has made significant strides in Europe, where governments are heavily investing in hydrogen infrastructure. As more countries move towards hydrogen-powered transportation, Ballard's technology is likely to be in high demand, positioning the company as a major player in the clean energy transition.

3. Nel ASA

Based in Norway, Nel ASA is a leader in the production of hydrogen through electrolysis, a process that uses electricity to split water into hydrogen and oxygen. Nel's expertise lies in providing green hydrogen solutions, which are crucial for industries looking to decarbonise their operations.

The company has signed a number of strategic partnerships with energy giants like Shell and Equinor, positioning itself at the forefront of the global hydrogen economy. As the demand for green hydrogen increases, Nel ASA is well-positioned to play a key role in meeting that demand, making it a company to watch closely in 2025.

The Trends Shaping Hydrogen Stocks and Their Growth Potential

Hydrogen stocks are experiencing a surge in interest, and there are several trends that suggest this momentum will continue into 2025 and beyond. These trends not only highlight the potential for growth but also the opportunities for traders to capitalise on the green energy revolution.

1. Government Support and Policy Initiatives

One of the strongest drivers behind the growth of hydrogen stocks is government support. From the European Union's Green Deal to the US's Infrastructure Bill, governments around the world are investing billions in hydrogen infrastructure. This includes funding for research, development, and the building of hydrogen refuelling stations.

For instance, the EU has set ambitious targets for hydrogen production, aiming to produce 10 million tonnes of renewable hydrogen annually by 2030. Such initiatives are creating a favourable environment for hydrogen companies, with many offering grants and incentives to speed up the transition to clean energy.

2. Expanding Hydrogen Infrastructure

As the demand for hydrogen increases, the infrastructure needed to support it is also expanding. Companies are investing heavily in hydrogen refuelling stations, storage systems, and transportation networks to ensure that hydrogen can be produced and distributed efficiently. For example, the growth of hydrogen-powered vehicles depends on the availability of refuelling stations, which is a key area of focus for governments and private companies alike.

The expansion of hydrogen infrastructure is critical for the widespread adoption of hydrogen fuel. As more infrastructure comes online, hydrogen stocks are likely to see substantial growth, especially for companies that are involved in building and maintaining this infrastructure.

3. Technological Advancements and Cost Reductions

The cost of producing hydrogen, especially green hydrogen, has historically been a barrier to widespread adoption. However, recent technological advancements have led to significant cost reductions in hydrogen production. Electrolysis technology, in particular, has seen major improvements, making green hydrogen more affordable and competitive with traditional fossil fuels.

As these technologies continue to improve, hydrogen will become a more viable energy source for industries and consumers alike. Companies that are at the cutting edge of these advancements, like Nel ASA and Plug Power, are likely to benefit the most, as they stand to see their production costs fall while demand for their products rises.

Why 2025 Could Be the Year for Hydrogen Stocks

Looking ahead to 2025. the hydrogen sector appears poised for explosive growth. The combination of government support, expanding infrastructure, and technological advancements makes this an exciting time for traders. Companies like Plug Power, Ballard Power Systems, and Nel ASA are well positioned to capitalise on these trends, offering promising opportunities for those looking to invest in the clean energy future.

With global markets increasingly focused on decarbonisation, hydrogen is set to play a crucial role in meeting net-zero emissions targets. As a result, hydrogen stocks are likely to continue to attract trader interest, providing potential for long-term growth. Whether you're new to investing or looking to diversify your portfolio, the hydrogen sector offers a compelling opportunity to be part of the energy revolution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.