RSI, or the Relative Strength Index, is a popular technical analysis tool used by traders to evaluate the strength or weakness of a stock, index, or other financial asset. Although it may sound a bit technical at first, RSI is a valuable indicator that can offer key insights into potential market trends. If you're new to trading or trying to understand how this indicator works, you're in the right place. This guide will explain RSI in simple terms and show how it can help you make informed trading decisions.

What is RSI and Why is it Important for Traders?

At its core, RSI is a momentum oscillator that measures the speed and change of price movements. It was developed by the technical analyst J. Welles Wilder in the late 1970s and has since become one of the most widely used tools for stock traders.

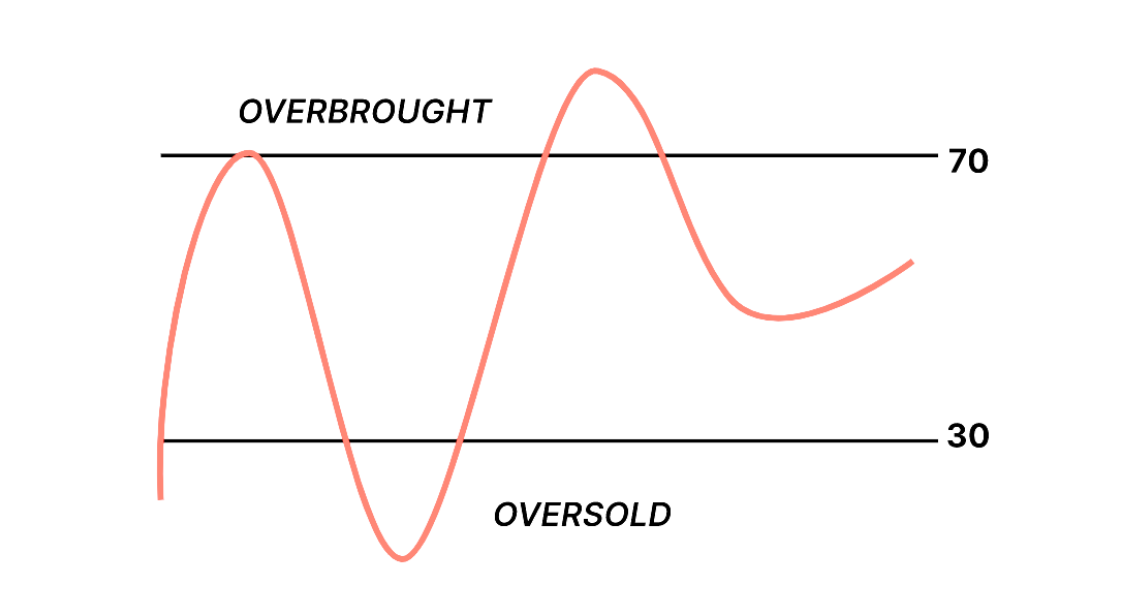

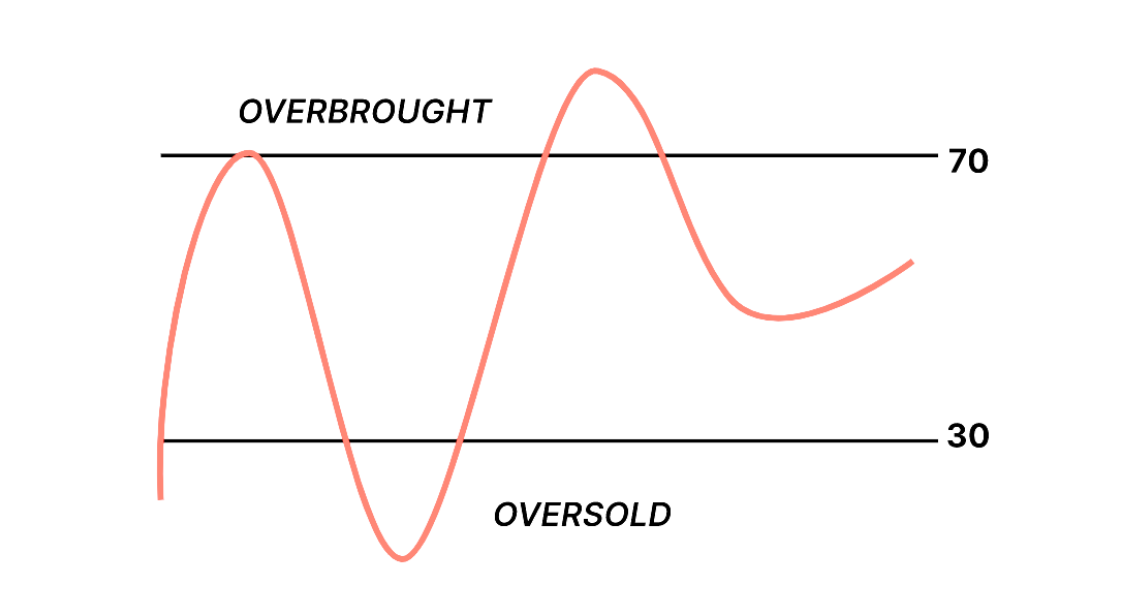

It is calculated on a scale of 0 to 100 and is typically displayed as a line graph that fluctuates between these two values. The general rule of thumb is that when RSI is above 70. the asset is considered "overbought," which might suggest that the price is too high and could soon drop. On the other hand, when RSI is below 30. it's considered "oversold," meaning the asset could be undervalued and might soon rise.

How the RSI Helps Traders Navigate Market Momentum

How the RSI Helps Traders Navigate Market Momentum

Understanding this index is important because it helps traders gauge the potential turning points in a stock's price. For instance, if a stock's RSI shows it's overbought, traders might decide to sell or avoid buying it, anticipating a potential price drop. Conversely, if the RSI is showing that a stock is oversold, traders may see it as an opportunity to buy, hoping the price will rise.

By looking at RSI, traders can better understand market sentiment and act accordingly, whether they're looking for a potential buying opportunity or deciding to sell before prices fall. RSI gives you a sense of the momentum behind a stock, and in a market full of volatility, having a reliable tool to track momentum can make a world of difference.

How to Read RSI: Overbought and Oversold Conditions

Reading RSI is not as complicated as it may seem. It's all about understanding the values and what they represent. Here's a step-by-step breakdown of how to interpret the RSI readings and how you can apply them in your trades:

RSI Values Above 70 (Overbought): When the RSI is above 70. it indicates that the asset may be overbought, meaning that it has risen too quickly and might be due for a pullback. It's a sign that the upward momentum might be losing steam, and the stock could be nearing the end of its rally. As a trader, this is often a signal to either sell the stock or wait for a better entry point if you haven't already entered a position.

RSI Values Below 30 (Oversold): When the RSI falls below 30. it suggests that the asset is oversold, meaning it may be undervalued. The price has likely dropped too far, too fast, and the stock could be due for a rebound. This is often a signal for traders to consider buying, as the stock may be set for a bounce back, especially if the broader market conditions are favourable.

RSI between 40-60: If the RSI is between 40 and 60. it is often considered neutral. This range indicates that the stock is neither overbought nor oversold, meaning there isn't an immediate signal to buy or sell. In this situation, you may want to wait for the RSI to move outside these bounds before making a move, as it could indicate a more decisive trend.

RSI between 40-60: If the RSI is between 40 and 60. it is often considered neutral. This range indicates that the stock is neither overbought nor oversold, meaning there isn't an immediate signal to buy or sell. In this situation, you may want to wait for the RSI to move outside these bounds before making a move, as it could indicate a more decisive trend.

Divergence Between RSI and Price Action: A key thing to look out for when reading RSI is divergence. This happens when the price of the stock moves in one direction, but the RSI moves in the opposite direction. For example, if a stock is making new highs, but the RSI is failing to do the same, this can be a sign of weakening momentum. Divergence can often signal a reversal, so traders may use this as a signal to take profits or enter a position.

Trend Confirmation: RSI can also be used to confirm trends. If the RSI stays above 50 for a prolonged period, it suggests an uptrend, while if the RSI stays below 50. it suggests a downtrend. You can use this information to align your trades with the overall market trend, which is generally a safer and more effective approach.

Practical Uses of RSI in Stock Trading

Now that you have a clear understanding of how to read RSI, let's look at some practical ways it can be used in stock trading:

Identifying Reversal Points: One of the most common uses of RSI is to help identify potential reversal points in the market. When a stock is overbought (RSI above 70) or oversold (RSI below 30), it might be reaching a point where the current trend is losing momentum. Traders use this information to enter or exit positions in anticipation of price reversals.

Timing Market Entries and Exits: RSI is often used to time market entries and exits. For example, traders might wait for the RSI to drop below 30 and then rise above it as a signal to enter a buy position. Similarly, an RSI reading above 70. followed by a decline below 70. could signal it's time to sell and lock in profits. By using RSI to time your trades, you’re making sure that your entries and exits are in line with market momentum.

RSI with Other Indicators: While RSI is a powerful tool, it's often most effective when combined with other technical indicators. For instance, you can pair RSI with moving averages or trend lines to confirm the signals RSI provides. If RSI shows an oversold condition and a moving average crossover is about to happen, it may be a stronger signal to buy.

RSI for Divergence Trading: Divergence trading with RSI is one of the most popular strategies. If the price of an asset is making new highs or new lows, but RSI isn't confirming those highs or lows, it may indicate that the momentum is fading. Traders often use these divergence signals as a way to predict potential price reversals.

RSI and Overbought/Oversold Conditions in Range-bound Markets: RSI is especially useful in range-bound markets, where the price of a stock moves within a defined range. In these cases, RSI can help traders pinpoint overbought and oversold conditions, giving them clear buy and sell signals as the stock fluctuates between support and resistance levels.

In conclusion, RSI is a versatile and relatively simple tool that can help traders gauge momentum and identify potential entry and exit points. By understanding how to read RSI and applying it in combination with other technical indicators, traders can enhance their decision-making process and better navigate market trends. Whether you're looking to capitalise on price reversals or confirm the strength of a current trend, RSI offers valuable insights that can make a difference in your trading strategy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

How the RSI Helps Traders Navigate Market Momentum

How the RSI Helps Traders Navigate Market Momentum RSI between 40-60: If the RSI is between 40 and 60. it is often considered neutral. This range indicates that the stock is neither overbought nor oversold, meaning there isn't an immediate signal to buy or sell. In this situation, you may want to wait for the RSI to move outside these bounds before making a move, as it could indicate a more decisive trend.

RSI between 40-60: If the RSI is between 40 and 60. it is often considered neutral. This range indicates that the stock is neither overbought nor oversold, meaning there isn't an immediate signal to buy or sell. In this situation, you may want to wait for the RSI to move outside these bounds before making a move, as it could indicate a more decisive trend.