Due to the fact that bond yields are not as high as stocks and their

stability is not as good as time deposits, bonds are not a popular investment

option for everyone. However, bonds can be considered an investment method

between stocks and term deposits, with relatively low risk and relatively high

interest rates. For those who pursue stable investment, it is a good choice.

Today we will discuss how to understand bond investment and how to invest in

bonds.

How to Understand Bond Investment

The essence of a bond is a borrowing voucher. When the government or listed

companies need to raise funds, they usually choose to issue stocks or bonds.

From the perspective of investors, purchasing bonds is like lending a sum of

money to a company or government. A bond is a promise to return the principal

after a certain period of time and pay interest once or multiple times a year.

Investors need to consider some risk indicators to determine whether investing

this money is wise, and there are two main ways. One is to hold bonds until

maturity, earning interest and principal. Another way is to earn income through

the trading spread of bonds. If the purchased bonds have market liquidity, they

can be sold in the future and can also generate significant returns.

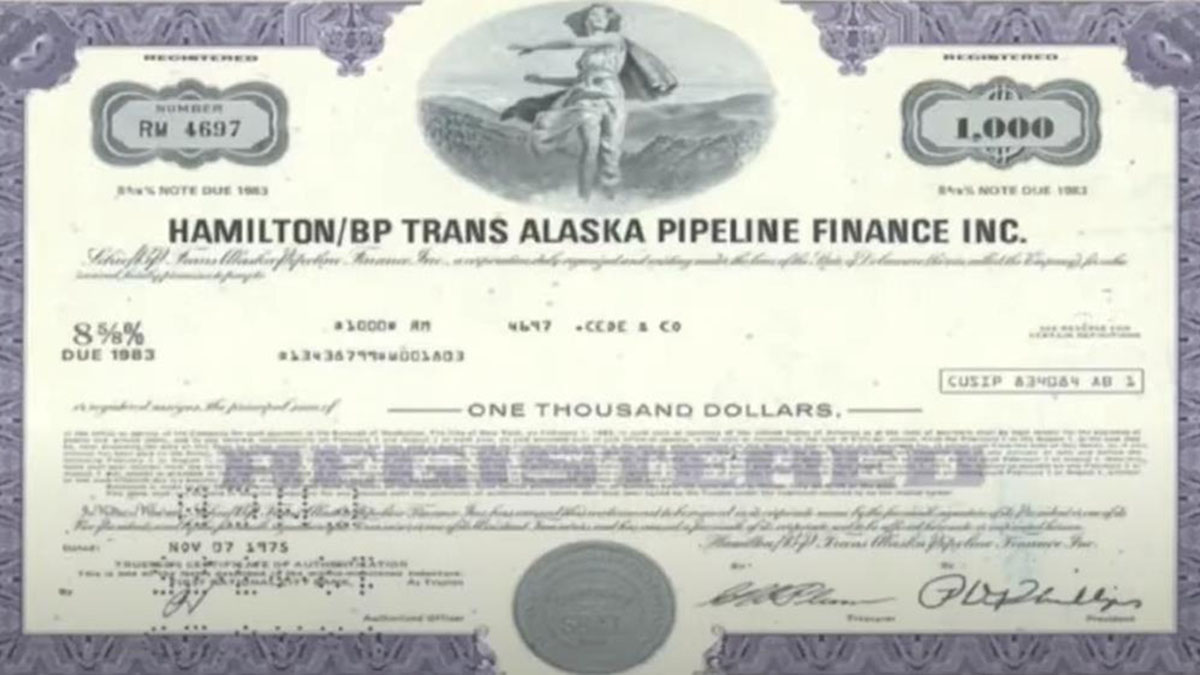

From the above picture, to understand the appearance of bonds, usually

physical vouchers are no longer provided for bond purchases. This image shows a

78-year bond issued on November 7, 1975, with a face value of $1000 and a yield

of 8.5%, or 8.625%. These are all the things you need to know when purchasing

bonds. Investors need to know the issuance date and term of the bond, and if

they plan to hold the maturity date, they need to consider how long the funds

will be locked in. The nominal price represents how much principal will be

returned upon maturity, and the yield tells investors how much interest can be

earned annually during the bond holding period. This is the most direct and

stable source of income for purchasing bonds.

Another important factor is the purchase price, which is determined based on

factors such as the bond's interest rate and market interest rate and may not

necessarily equal its face value. This means that you may only need to pay $90

to purchase a $100 bond.

It is also necessary to consider the company's risk rating, which is usually

divided into four levels: A, B, C, and D. A grade indicates the highest

evaluation of the security of bonds, while B grade bonds carry certain risks and

may be affected by economic instability factors. The C and D levels of risk are

higher, usually speculative and gambling bonds. Of course, the lower the risk of

bonds, the lower the yield. It is also necessary to consider whether there is a

guarantee, i.e., whether there are institutions willing to bear the repayment

responsibility in the event of company bankruptcy. When choosing bonds,

guaranteed bonds are usually more secure.

One of the biggest risks of bonds is the company's poor management, resulting

in the company being unable to repay its principal. In China, the issuance of

bonds is subject to strict approval process supervision, but in the event of

default, it will have a serious negative impact on society and affect the

development of the bond market. Therefore, some state-owned enterprises, such as

railways and petrochemical companies, have relatively low bond risks, and

factors such as enterprise ratings and financial statements should also be

considered.

Another factor to consider is that bonds typically have longer maturities.

When purchasing bonds, investors need to consider the worst-case scenario, which

is the inability to use the funds before the bond matures. Although bonds can be

sold midway, the liquidity of bonds is also a factor to consider, as prices

change daily and it may be difficult to find buyers if funds are urgently needed

or a portion of funds may be lost.

From the relevant content on how to understand bond investment, it is known

that the risk of bonds is relatively low, but investors still need to consider

factors such as ratings, guarantees, and the company's financial condition and

development trends when purchasing. After all, although stocks are more popular,

bonds are also a worthwhile investment method to consider.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.