Futures trading has become increasingly popular among traders and investors seeking opportunities to profit from market movements in commodities, currencies, indexes, and more. If you're a beginner, learning the basics and developing a strategy are crucial before jumping in.

This step-by-step guide explains what futures contracts are, how they work, how to get started, and the essential strategies and risks to consider as a beginner.

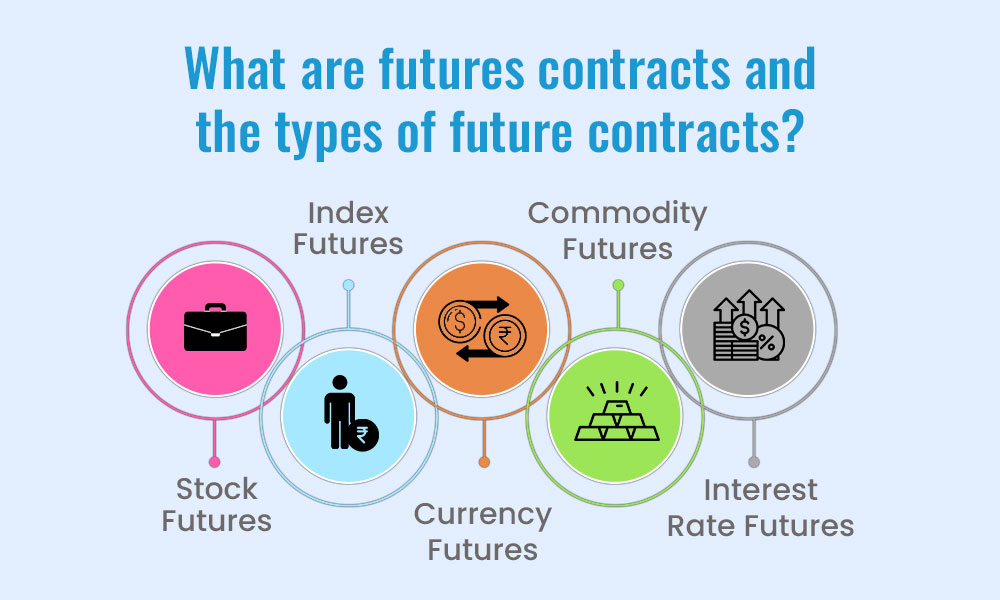

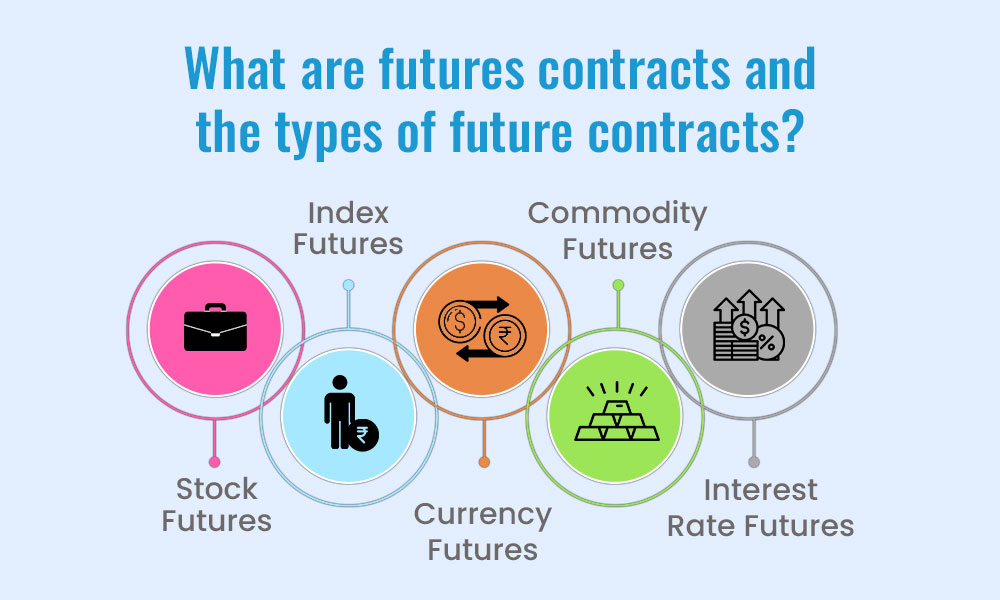

What Are Futures Contracts?

A futures contract is a legally binding agreement to buy or sell an asset at a predetermined price at a specific future date. Futures are standardised and traded on organised exchanges such as the CME (Chicago Mercantile Exchange) or ICE (Intercontinental Exchange).

These contracts are used by speculators aiming to profit from price movements and by producers and consumers to hedge risk against price volatility. Futures can be based on a wide range of underlying assets, including:

Commodities (e.g., crude oil, gold, natural gas)

Indexes (e.g., S&P 500 futures)

Currencies (e.g., euro, yen)

Interest rates (e.g., Treasury bond futures)

How Does it Work

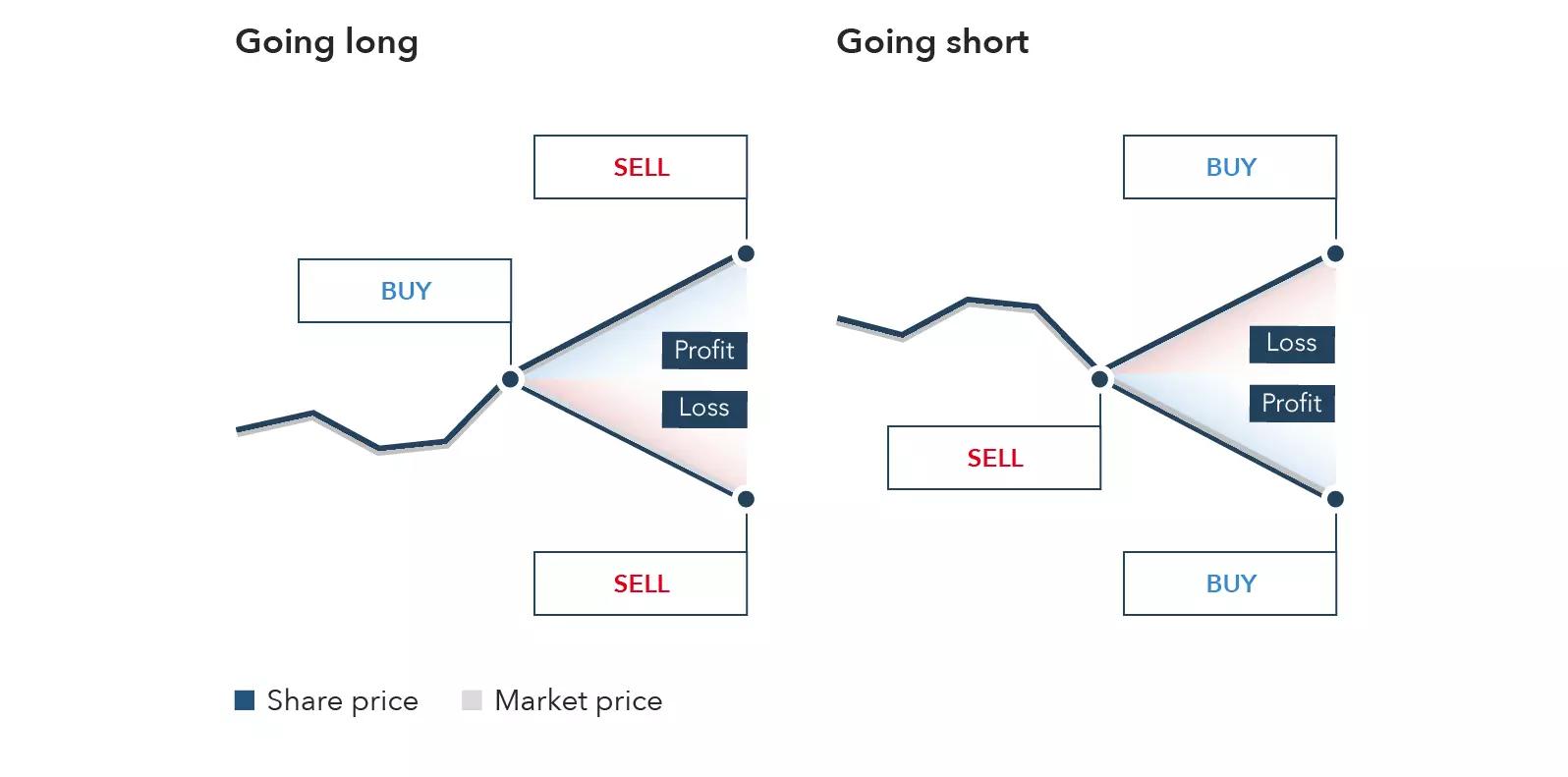

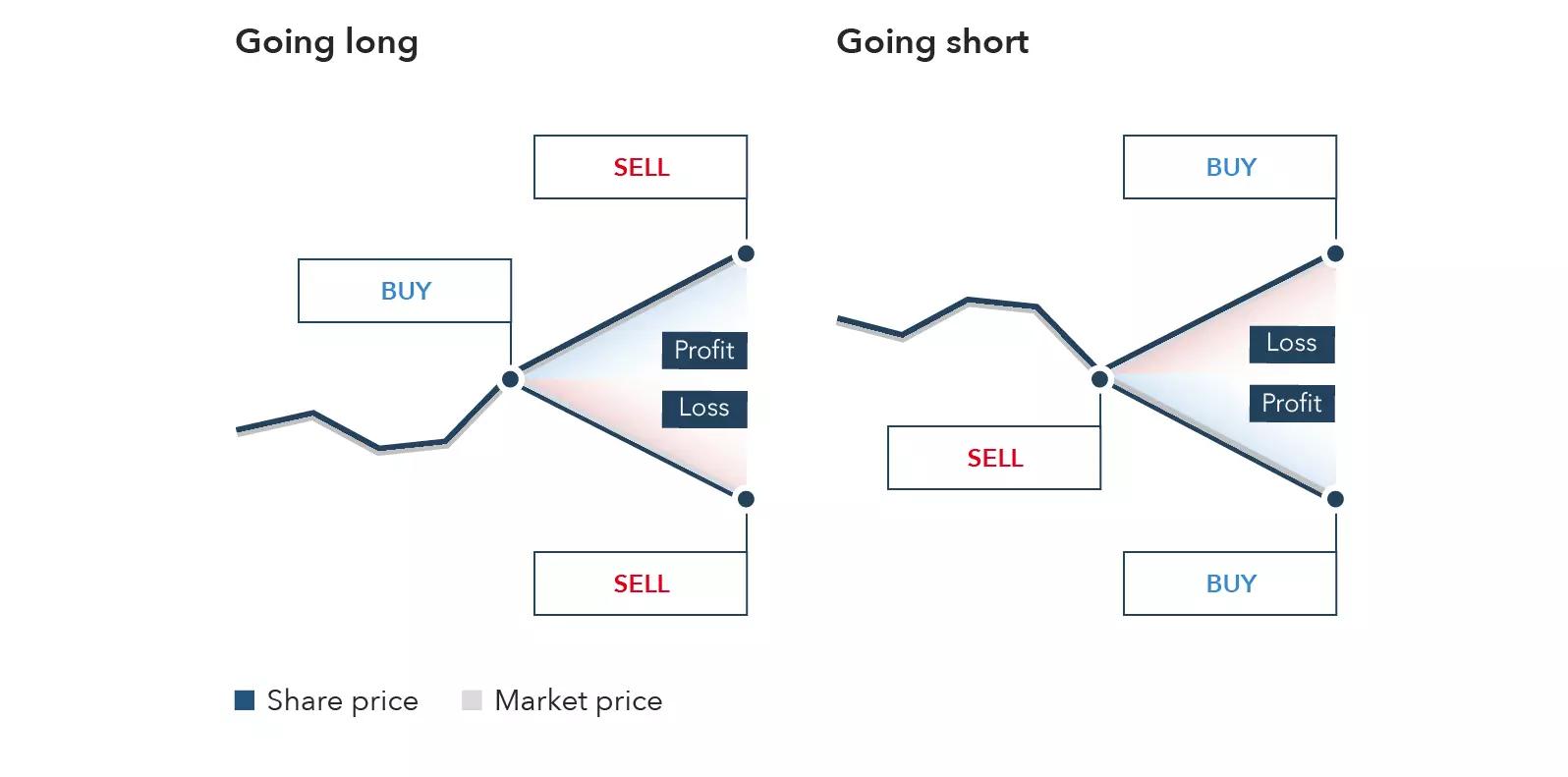

Futures contracts specify the quantity and quality of the underlying asset and the delivery date. However, most traders never take delivery of the asset. Instead, they close their positions to realise a profit or limit a loss before expiration.

Let's look at a simplified example:

Suppose you believe crude oil prices will rise. You buy one Crude Oil Futures contract at $70 per barrel. If the price increases to $75, you can sell the contract and make a profit. If it falls to $65, you incur a loss.

Each futures contract has a tick size (the minimum price increment) and a tick value, which determines how much you gain or lose per tick movement.

Pros and Cons

However, like any financial instrument, futures come with their own set of advantages and disadvantages.

Pros:

High liquidity in major contracts

Leverage allows control of large positions with less capital

Diversification through access to global markets

Transparency due to regulated exchanges

Hedging opportunities for businesses and investors

Cons:

High risk due to leverage

Steep learning curve

Emotional pressure in fast-moving market

Margin calls if the account value drops too low

Weigh these pros and cons based on your trading goals and financial situation.

Step-by-Step Guide on How to Trade Futures

Step 1: Understand the Risks and Rewards of Futures Trading

Futures trading can be highly profitable, but carries significant risk due to leverage. Leverage allows you to control large amounts of the underlying asset with relatively small capital. While this amplifies gains, it also magnifies losses.

For example, a 1% move in the asset price could result in a much larger change in your account balance. Therefore, proper risk management, stop-loss placement, and position sizing are essential.

Step 2: Learn the Key Terms in Futures Trading

Before you begin trading, you'll need to understand some of the basic terminology used in futures markets:

Margin: The amount required to open and maintain a futures position.

Initial Margin: The upfront capital needed to initiate a trade.

Maintenance Margin: The minimum account balance required to keep the position open.

Contract Size: Specifies how much of the underlying asset is represented in one contract.

Expiration Date: The date when the futures contract expires.

Settlement: Futures can be settled either physically or in cash.

Understanding these terms helps you navigate your trades with confidence and clarity.

Step 3: Choose a Reliable Futures Broker

Then, you'll need to open an account with a registered futures broker. Look for a broker that offers:

Access to major futures exchanges

Competitive commission rates

User-friendly trading platforms

Risk management tools and educational resources

Strong customer support

Some of the most popular futures brokers include:

Step 4: Choose the Market You Want to Trade

As a beginner, we advise starting on one or two markets. Each market has unique characteristics, such as volatility, liquidity, and trading hours. Some popular futures markets include:

Crude Oil Futures (CL): High volume and volatility, attractive to short-term traders.

Gold Futures (GC): A safe haven asset with strong technical patterns.

E-mini S&P 500 Futures (ES): Tracks the S&P 500 index; ideal for index traders.

Euro FX Futures (6E): Reflects the euro value versus the U.S. dollar.

By studying one market in depth, you'll gain a better feel for its price behaviour and risk profile.

Step 5: Use a Demo Account to Practice

Most brokers offer paper trading or demo accounts that simulate real-market conditions without risking real money. It is a critical step for beginners.

A demo account allows you to:

Test different trading strategies

Understand order placement and margin

Practice risk management

Build confidence in your approach

Spend time on a demo account before transitioning to a live account. Track your trades, analyse mistakes, and refine your strategy.

Step 6: Develop a Trading Strategy

Jumping into futures trading without a strategy is a recipe for failure. A good trading strategy includes:

Entry rules: Define when and why you enter a trade.

Exit rules: Set profit targets and stop-loss levels.

Position sizing: Determine how much to risk per trade.

Risk/reward ratio: Target setups that offer more potential reward than risk.

Popular futures trading strategies include:

Trend-following: Buy in uptrends and sell in downtrends.

Breakout trading: Enter trades when prices break key support/resistance levels.

Scalping: Make quick trades to capture small price movements.

Range trading: Buy at support and sell at resistance during sideways markets.

Your strategy should match your risk tolerance, personality, and time availability.

Step 7: Understand Order Types

Futures trading platforms offer several types of orders. Knowing how to use them effectively is critical for trade execution and risk control:

Market Order: Executes immediately at the best available price.

Limit Order: Executes only at a specified price or better.

Stop Order: Triggers a market order when the price reaches a specific level.

Stop-Limit Order: Combines stop and limit; the order is placed as a limit once the stop price is reached.

OCO (One Cancels the Other): Two linked orders; if one executes, the other is cancelled.

Step 8: Manage Your Risk Carefully

Risk management separates professional traders from beginners, as poor risk control can lead to rapid losses no matter how accurate the strategy is.

Some essential risk management tips:

Never risk more than 1–2% of your account on a single trade.

Use stop-loss orders religiously.

Avoid overleveraging your account.

Stick to a risk/reward ratio of at least 1:2.

Diversify positions only when you have consistent profitability.

Protecting your capital should always be your top priority.

Step 9: Monitor Market News and Economic Events

Economic indicators, central bank decisions, geopolitical tensions, and commodity reports heavily influenced the futures contract. Make it a habit to follow:

News can trigger high volatility, creating both opportunity and risk. Always be aware of upcoming events that may impact your trades.

Step 10: Keep a Trading Journal

Successful traders continuously evaluate and refine their performance. A trading journal is an indispensable tool for growth. Your journal should include:

By analysing your journal, you can spot patterns, eliminate bad habits, and strengthen what works. Journaling helps you move from random results to consistent performance.

Common Mistakes to Avoid

Even experienced traders make mistakes, but beginners are particularly vulnerable. Here are some pitfalls to watch out for:

Overtrading: Making too many trades out of boredom or revenge.

Ignoring stops: Letting small losses turn into big ones.

Chasing the market: Entering after a big move out of FOMO.

Poor risk/reward: Taking trades with more downside than upside.

Trading without a plan: Operating on emotion instead of strategy.

Avoiding these mistakes will dramatically increase your chances of long-term success.

Conclusion

In conclusion, futures trading offers a powerful way to engage with global markets, speculate on price movements, and hedge against risks. But success doesn't come overnight. As a beginner, your primary focus should be education, practice, discipline, and patience.

Start small, trade a demo account, and gradually build confidence. Learn from your mistakes, stick to your plan, and continue developing your skills. With time and dedication, futures trading can become a profitable and rewarding part of your financial toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.