Forex trading offers one of the most exciting opportunities to earn profits in the financial world. The chance to buy and sell currencies based on their ever-changing values presents endless possibilities, making it a playground for savvy traders. However, the key question remains: Is it truly profitable? The answer isn't as simple as a yes or no.

While the Forex market can yield incredible returns, it can just as easily lead to losses. Whether you profit or not depends on how well you navigate the market's twists and turns, how effectively you manage risk, and the strategies you choose to implement.

The truth is the path to profitability in Forex trading isn't paved with shortcuts. It requires skill, discipline, and a clear plan. By understanding the market, using the right tools, and having a strategy tailored to your style, you can greatly improve your chances of success. But remember, the most profitable Forex traders are those who continually learn and adapt, staying ahead of market trends and ever-changing conditions.

Navigating Forex Volatility and Leverage: Risks and Rewards

The high volatility of the Forex market is often seen as one of its main attractions. Currency values fluctuate continuously, providing ample opportunities for traders to make profitable trades. For many professional Forex traders, these fluctuations are the key to success, enabling them to make swift and informed decisions that yield significant profits.

However, volatility comes with its own risks. While it creates opportunities, it also increases the potential for loss. Market shifts can happen rapidly, and if traders are unprepared or fail to act quickly, the results can be damaging. This is where leverage plays a crucial role.

Leverage allows traders to control larger positions than their initial capital would otherwise permit. For instance, with a 50:1 leverage ratio, you could trade £50.000 with just £1.000 in your account. This magnification of your trading position can lead to substantial profits if the market moves in your favour. However, it also means that losses are similarly magnified if the market moves against you. Consequently, managing leverage responsibly is essential for maximising profitability and safeguarding against major losses.

How Risk Management Drives Forex Trading Success

Risk management is arguably the most important aspect of successful Forex trading. Even the most seasoned traders experience losing streaks, and without effective risk management, these losses can quickly spiral out of control.

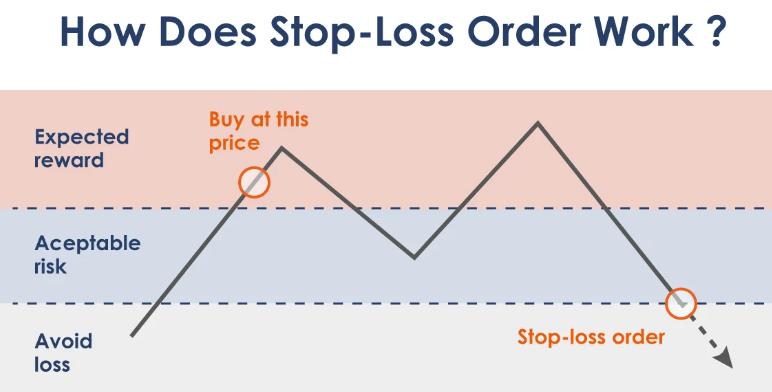

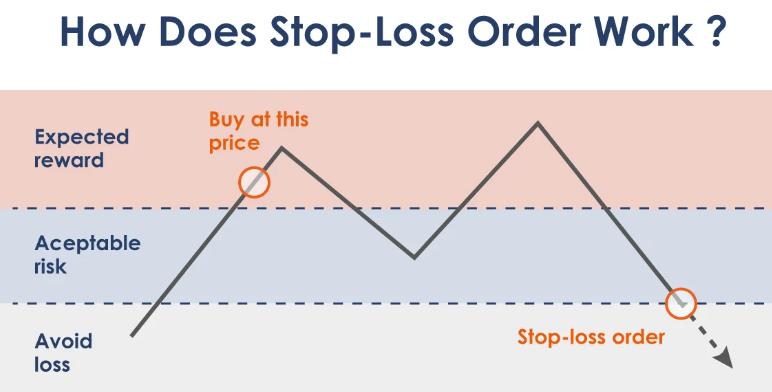

One of the key tools in risk management is the use of stop-loss orders. A stop-loss order automatically closes a position once the market moves against you beyond a set threshold, helping to limit potential losses. This tool ensures that no single trade can wipe out your entire account, providing a safety net for your capital.

Another important concept is the risk-to-reward ratio. This helps traders assess whether a trade is worth taking by comparing the potential risk to the potential reward. For example, if you're willing to risk £100 on a trade, you should aim for a reward of at least £300. By maintaining a favourable risk-to-reward ratio, even a lower win rate can still result in long-term profitability.

Diversification is another effective risk management strategy. Spreading your trades across multiple currency pairs reduces the risk of large losses due to sudden market shifts affecting a single pair. Focusing on just one or two pairs can expose you to greater risks if those positions go against you.

Developing a Well-Defined Trading plan

A clear and structured trading plan is essential for success in Forex. Without a defined strategy, it's easy to fall into emotional trading, chasing after quick profits, or making impulsive decisions. Successful traders rely on well thought-out plans that outline when to enter and exit trades, how to manage risks, and what objectives they hope to achieve with each trade.

Top traders also incorporate a systematic approach to evaluating market conditions. For example, many rely on technical analysis to identify trends and patterns in currency prices, helping them predict future movements. By studying charts, indicators, and price action, traders can make more informed and calculated decisions on when to buy or sell.

The fast-paced nature of the Forex market demands a disciplined approach. A clear trading plan not only keeps you focused but also helps you track your performance, allowing for ongoing adjustments and improvements over time. In an environment where every second counts, the ability to stay calm and stick to your plan can make all the difference.

Enhancing Forex Strategies with Advanced Platforms and Indicators

In the modern Forex market, traders have access to a variety of platforms and technical indicators that facilitate better decision-making. Most platforms offer real-time market data, charting capabilities, and a wide range of indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands.

For instance, a trader might use the RSI to determine whether a currency pair is overbought or oversold, which can indicate a potential reversal or entry point. Similarly, moving averages can provide insight into the overall direction of a market trend, helping traders decide whether to buy or sell.

While these tools can significantly enhance a trader’s ability to analyse the market, they are not foolproof. The key to successful Forex trading is combining these technical tools with a solid understanding of market conditions and strong risk management practices. Relying solely on indicators without considering the broader economic context can lead to poor trading decisions.

In conclusion, making Forex trading profitable is not about quick wins or luck; it's about developing a clear strategy, understanding the market, and managing risk effectively. Successful traders rely on a combination of market analysis, leverage management, a solid trading plan, and continuous learning. With the right tools and mindset, Forex trading can offer substantial opportunities, but it requires discipline, patience, and a long-term approach.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.