In Forex trading, the ability to adapt quickly to market changes can mean the difference between profit and loss. Forex options provide traders with the flexibility to capitalise on these fluctuations without the obligation to execute a trade.

Unlike traditional currency contracts, where you're locked into a buy or sell position, Forex options offer the right, not the requirement to buy or sell at a set price within a defined timeframe.

These options serve two main purposes: hedging against risks or speculating on price movements. For example, a trader expecting the euro to strengthen against the US dollar could buy a call option, giving them the right to purchase euros at a set price, profiting if the market moves in their favour.

Alternatively, a company exposed to currency risks from international operations might use options to protect their bottom line without committing to an immediate trade.

For example, if you're a business owner importing goods from Europe, and you're concerned about the fluctuating EUR/USD exchange rate. To hedge against potential losses caused by a weakening euro, you might purchase a put option in EUR/USD. If the euro drops in value, your option will increase in value, helping to offset the currency loss on your trades. In this case, the option gives you the flexibility to protect your profits without being obligated to execute the trade.

The flexibility of Forex options—combined with key terms like strike price, premium, and leverage—makes them a powerful tool in any trader's strategy, offering a way to navigate the unpredictable nature of global currency markets.

Vanilla vs. Exotic Options: Which One Fits Your Strategy?

When it comes to Forex options, you'll hear a lot about vanilla options and exotic options. But which one should you choose? Well, that depends on your style and your strategy as a trader.

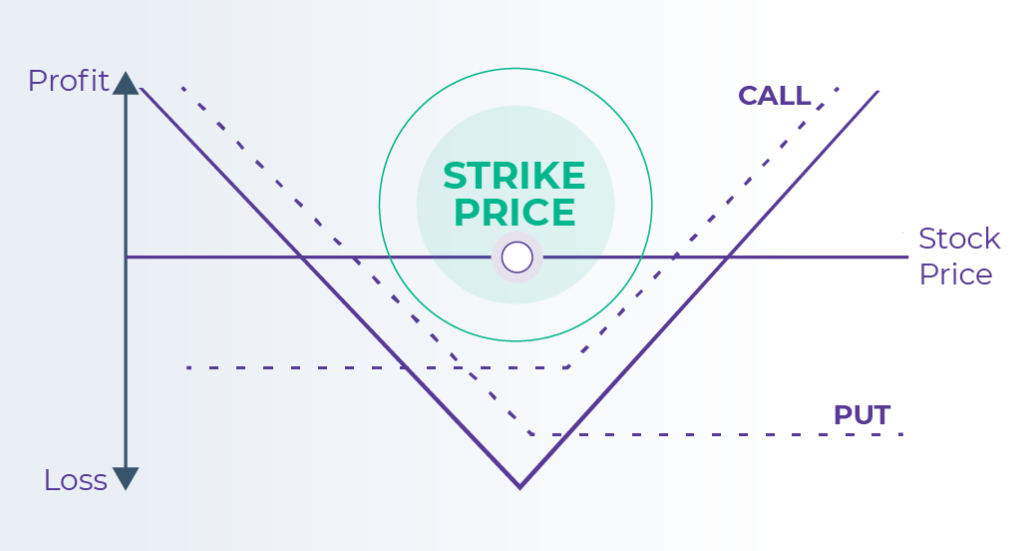

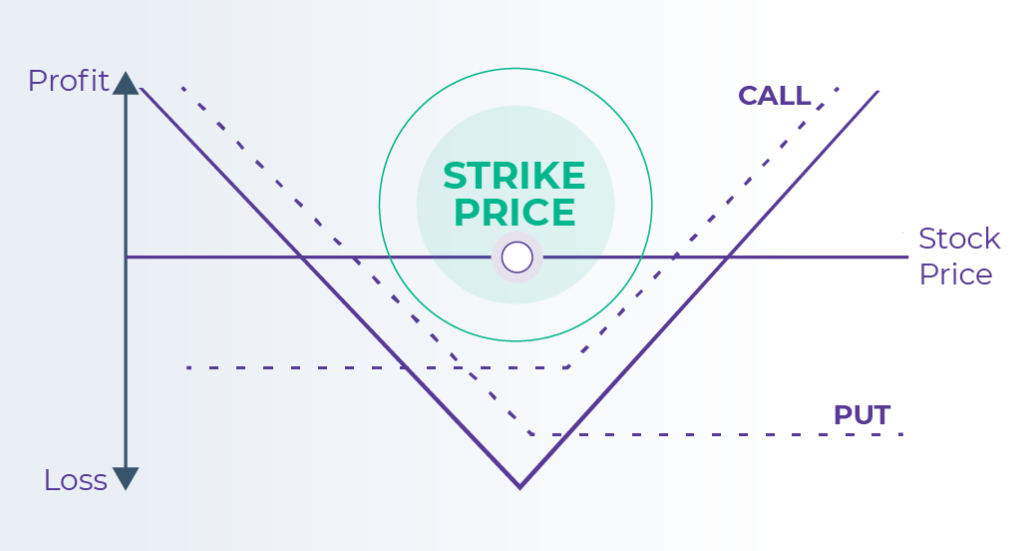

Vanilla options are the go-to for most traders because they're straightforward. You either buy a call option (betting the price of a currency will rise) or a put option (betting the price will fall). The mechanics are simple: you know exactly what you're getting, and you can predict the outcomes. It's like ordering a burger at a fast-food joint—you know exactly what’s coming, and it does the job.

For example, if you're eyeing the EUR/USD pair and you think the euro is going to appreciate against the US dollar in the next week, you could buy a call option with a strike price of 1.2000. If the market moves in your favour, you can exercise your option and lock in the profit. No surprises. The downside? If the market doesn't move in your favour, all you lose is the premium you paid for the option.

Now, exotic options—they're a whole different beast. They're for traders who want more flexibility or are dealing with more complex market scenarios. These options come with a lot of variety, with structures like knock-in options (where the option only becomes active if the price hits a certain barrier), barrier options (which get triggered when the price reaches a specific level), and more. They're like customizing your burger with a ton of toppings: complex, maybe a little messy, but they can pack a punch.

Here's how they work: if you expect a certain currency to hit a specific price at an unpredictable time, with an exotic option, you could structure your trade around that very movement. Therefore, if you're predicting that EUR/USD will hit 1.2200 but you don't want to pay for the entire option upfront, you could look at a knock-in option. It only activates once that price level is reached, so you pay less for the option, but you're waiting for the right trigger. For a more advanced trader, this can give you a lot more control and precision, but it also comes with higher risks.

The key takeaway is this: if you seek straightforwardness and ease of understanding, vanilla options are the ideal choice. Their simplicity makes them well-suited for those new to options trading. However, for those looking to implement more complex strategies with higher potential returns, exotic options may be worth exploring. While they offer greater flexibility and control, they also introduce a higher level of complexity and require more sophisticated risk management to mitigate the associated risks.

So, which one fits your strategy? It all depends on how comfortable you are with risk, how complex you want your trades to be, and how much time you're willing to invest in understanding the ins and outs of different options.

Vanilla Options vs Exotic Options

|

Aspect

|

Vanilla Options |

Exotic Options |

| Definition |

Standardised and simple. |

Customised and complex. |

| Suitability |

Ideal for beginners. |

For advanced traders. |

| Flexibility |

Limited customisation. |

Highly adaptable. |

| Complexity |

Straightforward to trade. |

Requires advanced knowledge. |

| Risk Level |

Lower and predictable. |

Higher with added complexity. |

| Potential Return |

Moderate gains. |

Potentially high rewards. |

| Examples |

Call and put options. |

Barrier, binary, and Asian options. |

Key Terms Every Forex Options Trader Must Know

To effectively trade Forex options, understanding a few key terms is essential. You don't need to be an expert in all of them right away, but understanding these concepts will give you a solid foundation for making smarter, more informed decisions.

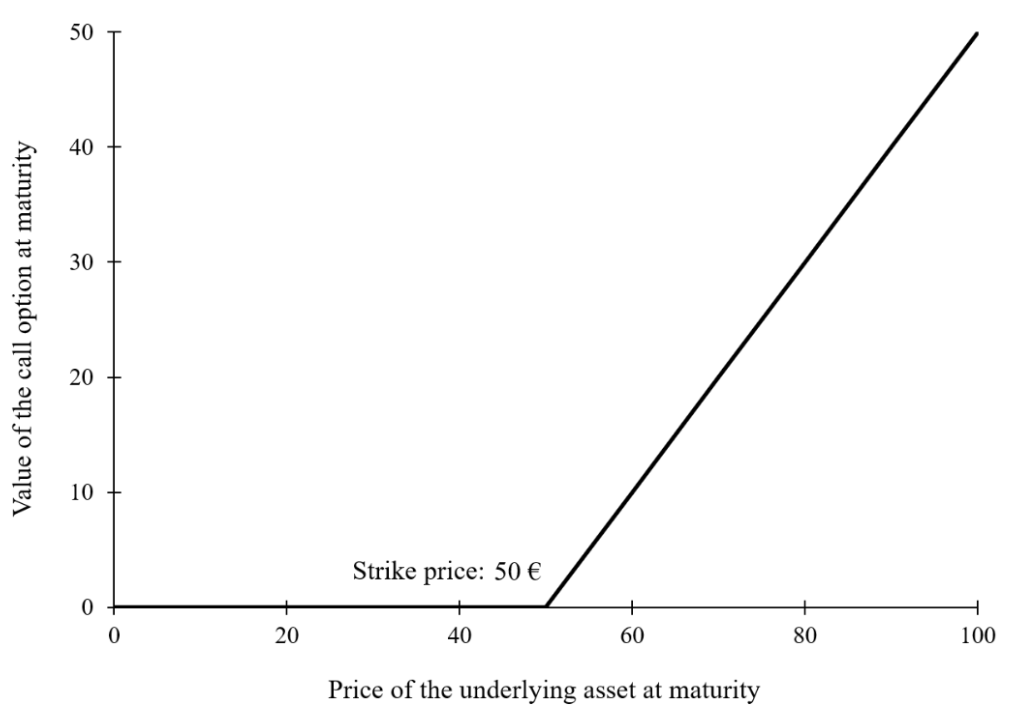

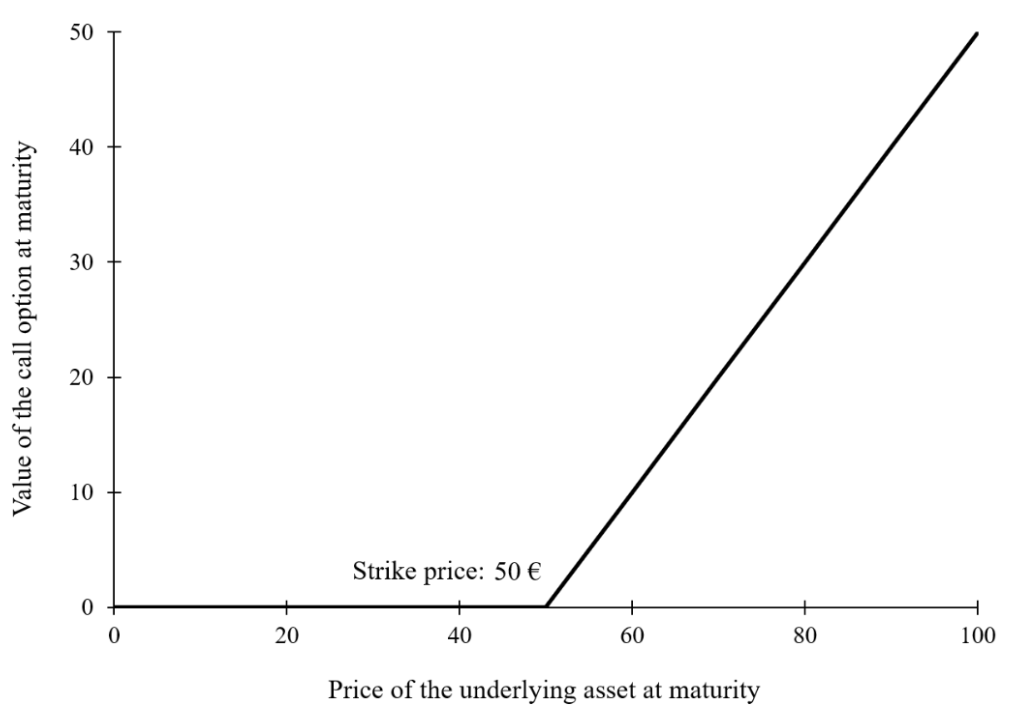

Strike Price:

This is the price at which you have the right to buy or sell the currency. Simply put, it's the "goalpost" for your trade.

For example, if you buy a call option on EUR/USD with a strike price of 1.2000. you're betting that the EUR/USD will hit or exceed that price before the option expires. If the market hits that strike price, you can exercise your option and make a profit. If not, well, you lose the premium you paid for it. It's like setting a target and hoping the market hits it.

Premium:

The premium is what you pay upfront for the option. Think of it like the price tag on the option—it's what you pay to have the right (but not the obligation) to buy or sell at the strike price.

The premium is influenced by various factors like how far the strike price is from the current market price, how much time is left until expiration, and how volatile the currency pair is. The closer the strike price is to the current market price, the higher the premium tends to be. In other words, if you're making a bold bet, be prepared to pay a higher price for that option.

Leverage:

Forex options trading often involves the use of leverage, allowing traders to control larger positions with a smaller investment. Leverage can magnify both profits and losses.

For example, suppose you're trading with 10:1 leverage. If the option's value increases by 10%, you could see a return of 100% on your initial investment. However, this means that if the market moves against you, your losses are equally amplified.

Leverage must be used carefully, as it can lead to significant losses if not managed properly. Always keep an eye on your leverage and be mindful of the risks involved.

By now, you've got a solid understanding of how Forex options work, the different types available, and the key terms that can make or break your trades. But you might still be wondering—is Forex options trading the right move for you?

The answer depends on your trading style and what you're looking to achieve. If you're after flexibility and want to hedge against potential risks, or if you're looking to speculate without the obligation of a traditional trade, then Forex options can be a game-changer. They allow you to take advantage of market movements while limiting the risk to the premium you pay.

To sum up, Forex options offer the flexibility and strategic control that can help you capitalise on the ever-changing world of currency trading. Whether you're hedging, speculating, or just looking for a new way to approach the Forex market, they can be a powerful addition to your trading toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.