The gold price has recently been on a turbulent ride, with market sentiment swinging between caution and optimism. On Monday (11 August), spot gold saw a marked decline, as investor focus shifted to the upcoming talks between the United States and Russia over the Ukraine conflict, as well as the imminent release of the US Consumer Price Index (CPI) data. Both developments carry significant implications—not only for the geopolitical landscape but also for the US Federal Reserve's interest rate policy, which in turn could influence the future trajectory of gold.

Geopolitical Easing Pulls Gold Price Lower

Spot gold weakened on Monday, touching a three-month low of $3.363.99 per ounce by 14:34—down nearly 1%. This comes despite prices having reached a high since 23 July just last Friday. The decline was largely attributed to a cooling in geopolitical risk, which has reduced safe-haven demand for the precious metal. US gold futures fell even more sharply, dropping almost 2% to $3.422.20 per ounce.

Matt Simpson, Senior Analyst at City Index, noted that the easing of geopolitical tensions was a major driver behind the fall in the gold price.

Last Friday, US President Donald Trump announced plans to meet Russian President Vladimir Putin in Alaska on 15 August to discuss ending the Russia–Ukraine conflict. Since the war's outbreak, the crisis has been a key factor pushing gold higher due to its safe-haven appeal. The prospect of constructive talks injected optimism into markets, prompting some investors to reduce their gold holdings and adopt a wait-and-see stance.

US Inflation Data in Focus

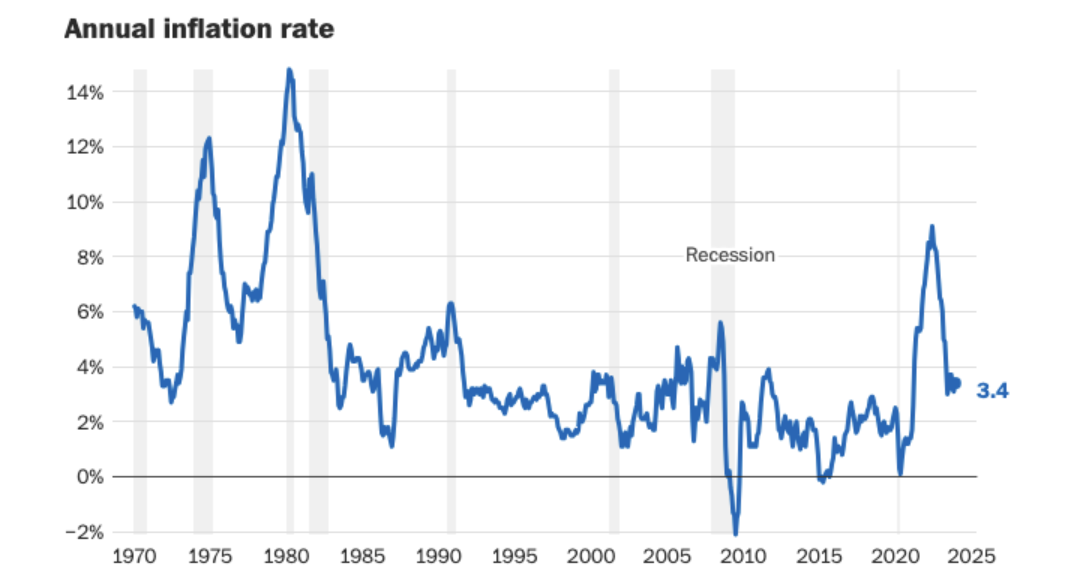

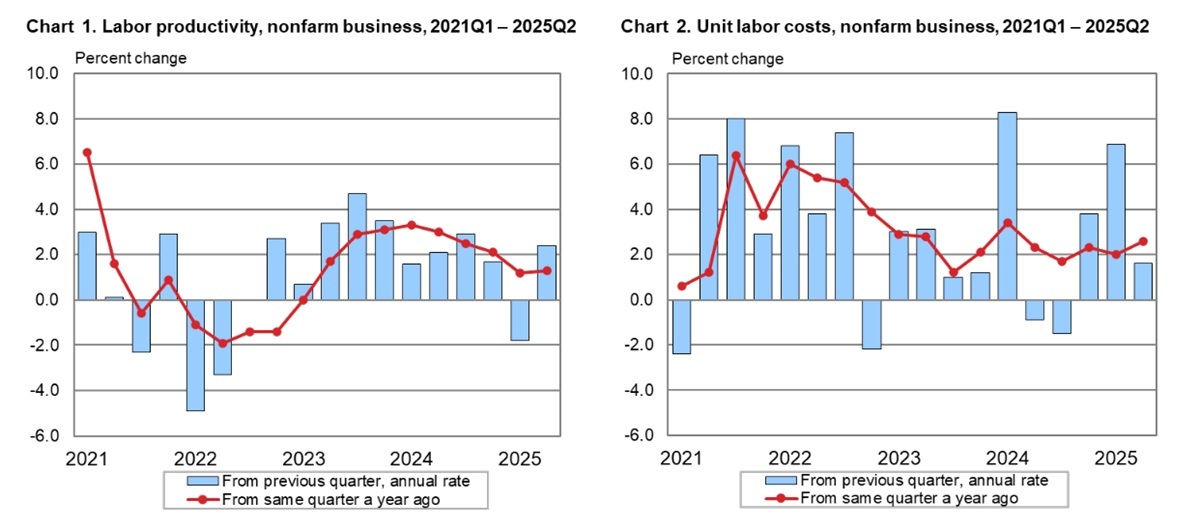

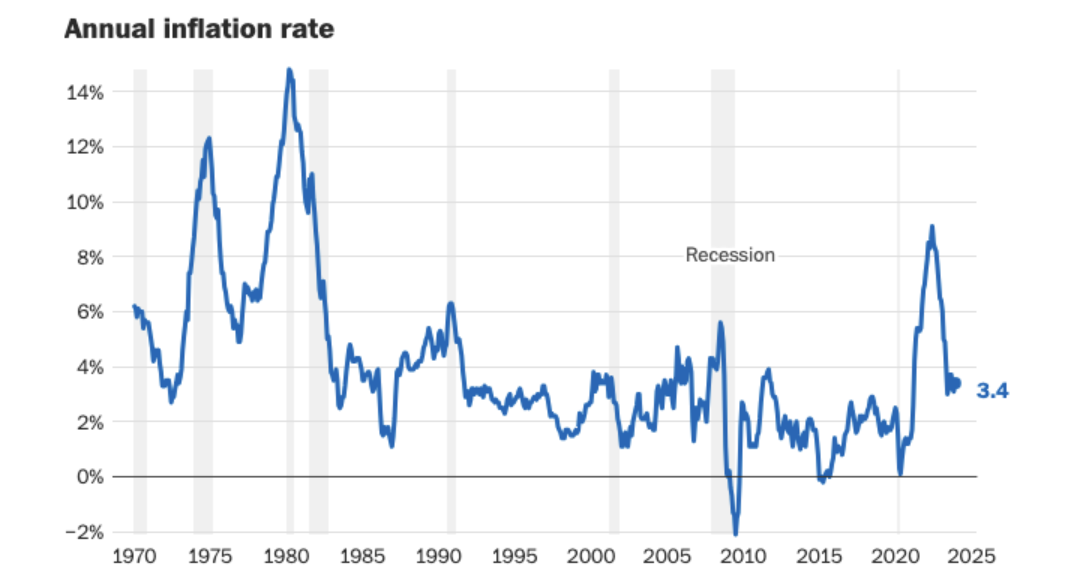

In addition to geopolitics, all eyes are now on the US CPI data for July, due to be released soon. Analysts expect core CPI to rise by 0.3% from the previous month and 3.0% year-on-year, partly due to tariff policy impacts. While this remains above the Federal Reserve’s 2% inflation target, it could provide important guidance for future monetary policy.

According to Simpson, a stronger-than-expected CPI reading could strengthen the US dollar, exerting additional downward pressure on the gold price.

Recent US jobs data has fallen short of expectations, fuelling market bets on a September interest rate cut by the Fed. Market pricing now suggests a 90% probability of monetary easing next month, with at least one more cut anticipated by the end of 2025. Rate cuts generally support gold, as they reduce the opportunity cost of holding non-yielding assets. However, in the short term, a stronger dollar could still limit upside potential.

Trade Negotiations and Speculative Positioning

Uncertainty is also building around the approaching deadline for US–China trade talks. Trump has set 12 August as the target date for an agreement, keeping investors on edge. An escalation in trade tensions could boost safe-haven demand and support the gold price, whereas a breakthrough deal might undermine gold's appeal.

CFTC data shows that in the week ending 5 August, net long positions in COMEX gold futures increased by 18.965 contracts, bringing the total to 161.811. This indicates that, despite the recent pullback, speculative sentiment towards gold remains positive—driven by expectations of global economic uncertainty and looser monetary policy.

How Should Investors Navigate the Current Market?

The gold market is currently navigating a complex mix of influences. While easing geopolitical tensions may reduce demand for safe-haven assets, upcoming CPI data and Fed policy decisions could bring fresh volatility.

In the short term, investors should closely monitor developments in US–Russia talks and US inflation figures. A strong CPI print could further lift the dollar and pressure the gold price, while weaker data or renewed geopolitical risk could see gold regain its shine.

From a longer-term perspective, expectations of Fed rate cuts and persistent global uncertainty could underpin gold. As Simpson advises, buying on dips remains a viable strategy, but investors should remain vigilant to near-term market swings. A diversified portfolio, close attention to macroeconomic data, and a flexible investment approach will be key to navigating this uncertain environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.