Euro hits biggest drop since September 2022

2024-04-15

Summary:

Summary:

Monday saw the dollar stabilize, marking its largest weekly surge since 2022, buoyed by rising Middle East tensions and looming high interest rates.

EBC Forex Snapshot, 15 Apr 2024

The dollar steadied on Monday, holding its biggest weekly gain since 2022, as

escalating conflict in the Middle East and the prospect of high interest rates

lent support.

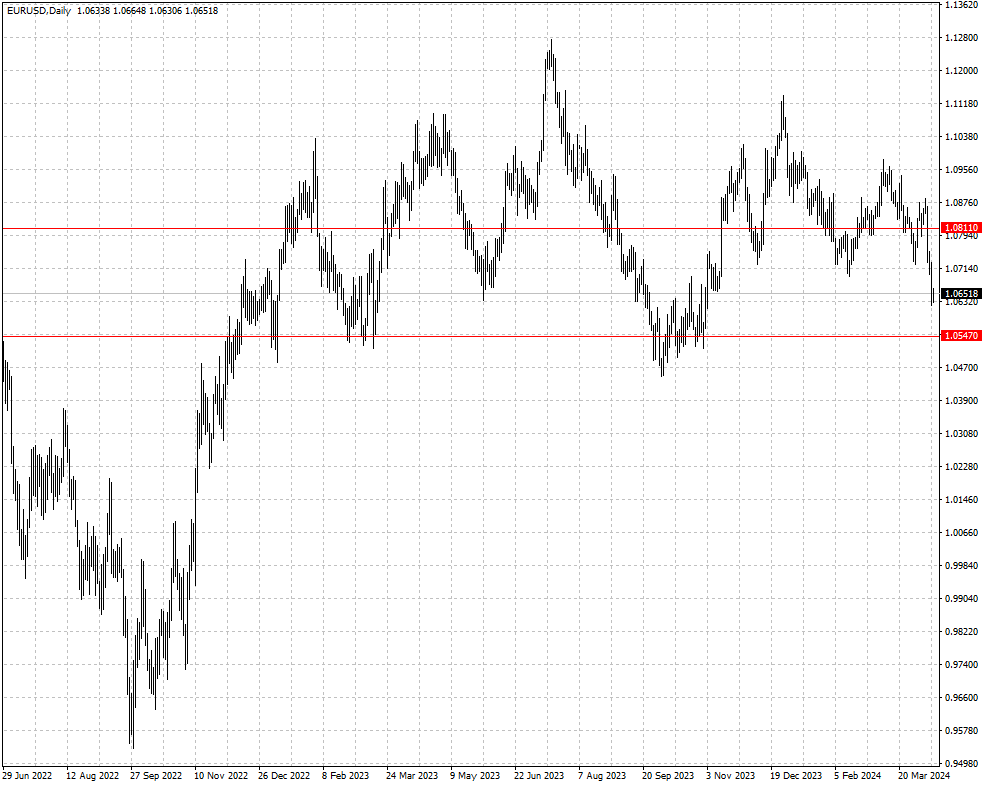

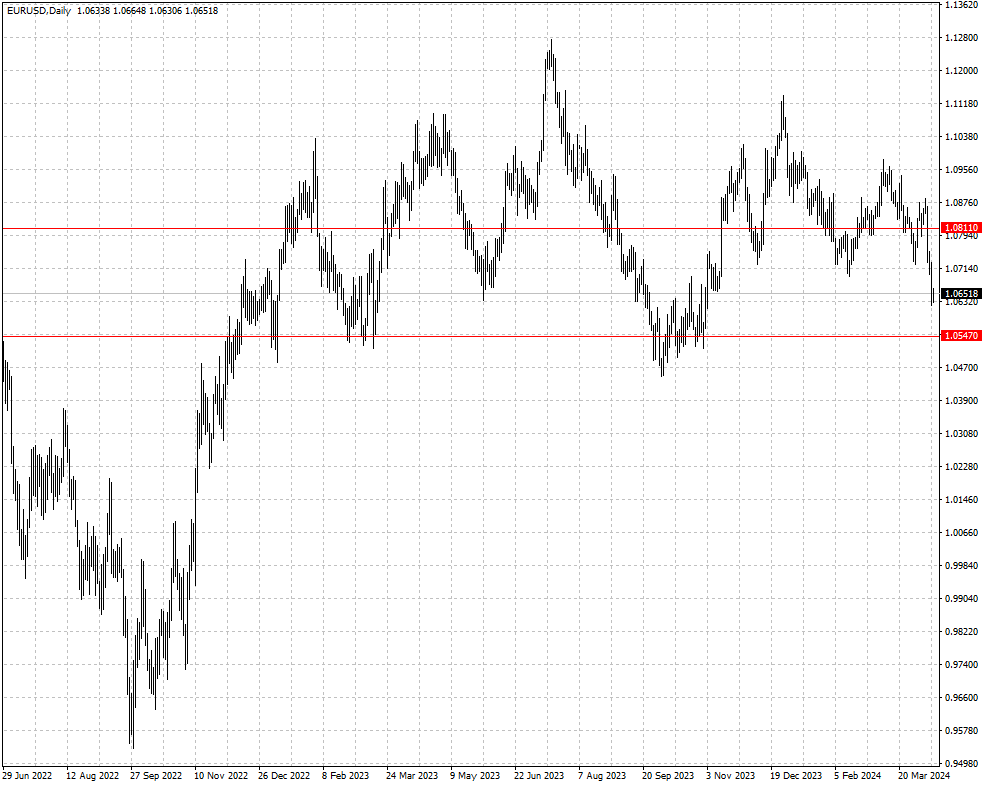

The euro recorded its biggest weekly percentage drop since late Sep 2022 last

week while sterling had its largest weekly percentage drop since mid-July. The

Swiss franc rallied though due to its safe-haven status.

The findings from the ECB Survey of Professional Forecasters showed on Friday

that all inflation forecasts across the time horizons are left unchanged.

Inflation is seen at 2.4% in the eurozonethis year.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 25 Mar) |

HSBC (as of 15 Apr) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0695 |

1.1017 |

1.0547 |

1.0811 |

| GBP/USD |

1.2503 |

1.2896 |

1.2346 |

1.2632 |

| USD/CHF |

0.8741 |

0.9112 |

0.9035 |

0.9196 |

| AUD/USD |

0.6443 |

0.6691 |

0.6397 |

0.6587 |

| USD/CAD |

1.3359 |

1.3607 |

1.3569 |

1.3881 |

| USD/JPY |

146.66 |

151.91 |

151.49 |

154.37 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.