The dollar rallied and a gauge of global equities slid on Thursday after data

once again highlighted persistent U.S. labour market strength, suggesting the

Fed will keep interest rates higher for longer to curb inflation.

Gold prices slipped from a two-month high as the dollar and bond yields

ticked higher. Oil prices edged higher on lower U.S. crude inventories and

strong crude imports by China, but a weaker demand outlook kept investors

cautious.

Commodities

Strong economic data, low employment and cooler inflation over a year since

the Fed began one of its most aggressive rate hiking campaigns in history has

supported U.S. oil demand this year.

China's imports of Crude Oil from Russia hit an all-time high in June,

Chinese government data showed on Thursday, even as discounts against

international benchmarks narrowed.

The OPEC and the EIA have said China's demand is expected to continue to rise

in the second half of this year and remain the main driver of global growth.

Crude prices may struggle to find a clear direction given a mixed global

demand outlook in the next few weeks, Citi analysts said in a note.

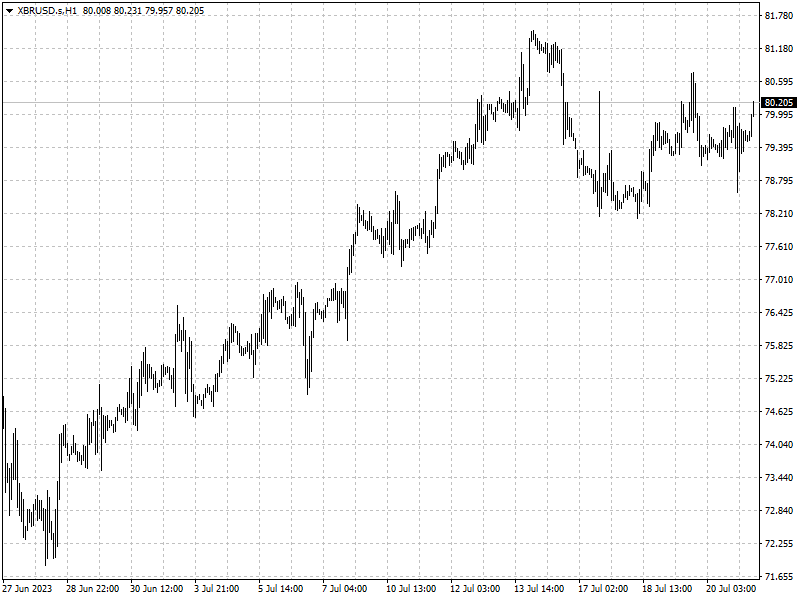

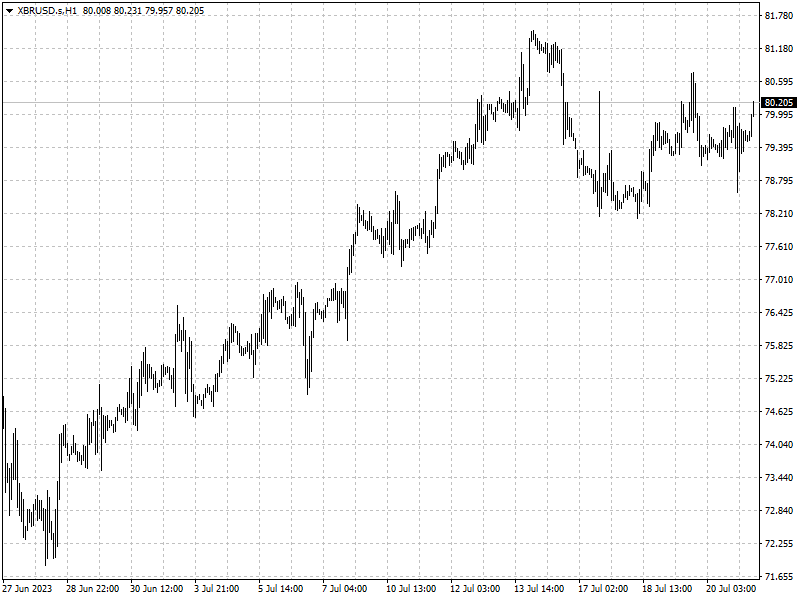

Brent Crude prices have broken through to a higher range this month, after

being stuck at $72-$78 in May and June, they added, after Saudi output cuts and

geopolitical risks supported demand.

Forex

Fewer-than-expected Americans filed new claims for unemployment benefits last

week, the Labor Department said, though the decline was likely exaggerated by

difficulties adjusting the data for seasonal patterns.

Other data on Thursday showed that U.S. existing home sales dropped to a five

month-low in June, depressed by a chronic shortage of houses on the market that

slowed the pace of decline in annual house prices.

Japan's government forecast inflation sharply exceeding the central bank's 2%

target this year, acknowledging broadening price rises that may keep alive

market expectations of an end to ultra-low interest rates.