The dollar rebounded off a 15-month low and global stock markets rose on

Tuesday as upbeat earnings on Wall Street and retail sales pointing to a

resilient U.S. economy sealed expectations that the Federal Reserve will hike

interest rates next week.

Retail sales increased 0.2% last month but core retail sales increased 0.6%,

excluding automobiles, gasoline, building materials and food services. Headline

data for May also was revised higher to show sales gaining 0.5% instead of 0.3%

as previously reported.

Gold rose to a more than one-month high, bolstered by a softer dollar and

lower Treasury yields. Oil prices climbed more than 1% after China said it will

act to support economic growth.

Commodities

Brent's premium over WTI narrowed to its lowest since late May. The smaller

premium makes it less likely energy firms will spend money to send ships to the

U.S. to pick up crude cargoes for export.

Energy traders expect ‘the oil market will remain tight as Russian shipments

drop and as China prepares to provide more support to households,’ said Edward

Moya, senior market analyst at data and analytics firm OANDA.

On the supply side, U.S. shale oil production will likely decline in August

for the first time since December, projections from the EIA showed.

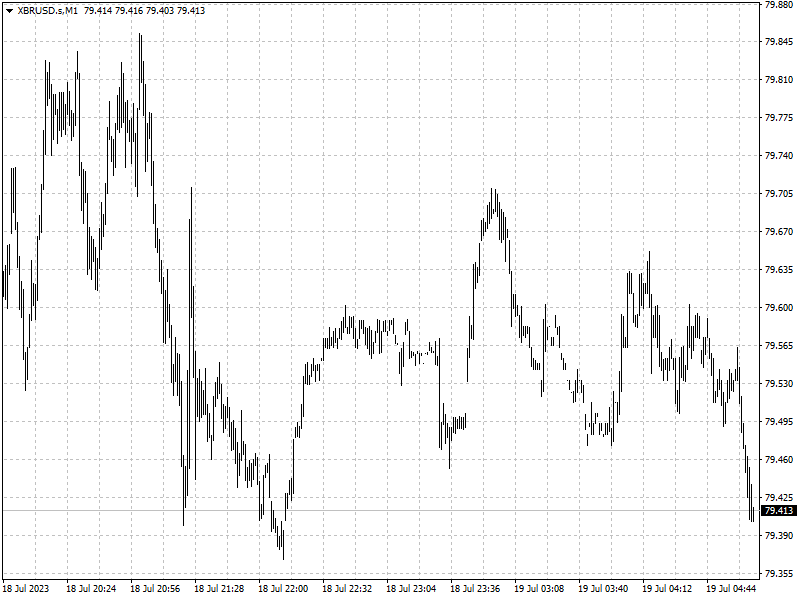

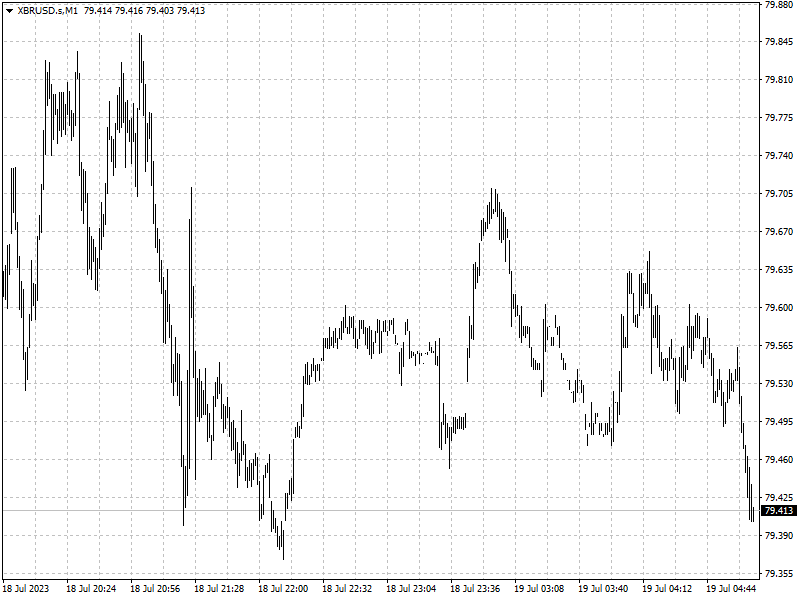

Forex

Fed funds futures traders are pricing in an additional 33 basis points of

tightening this year, with the benchmark rate expected to peak at 5.40% in

November.

Other data showed production at U.S. factories unexpectedly fell in June, but

rebounded in the second quarter as motor vehicle output accelerated after two

straight quarterly declines.

Bank of America analysts noted in a report that recent weakness in the

greenback has exceeded the drivers of the move, which ‘can typically be

attributed to stretched positioning and sentiment, as well as technical

breaks.’

In particular the analysts note that gains in the Norwegian krone and

Japanese yen have exceeded their expected moves, and that they expect yen

underperformance to resume "once the dust settles."