The return on fund holdings refers to the return on holding funds, while the

profit and loss on stock holdings refers to the profit and loss of all stocks

held in the stock account. The profit and loss situation does not need to be

manually calculated by investors but will be displayed in the investor's

holdings. If the profit and loss display is positive, it indicates that the

investor is profitable, and if the profit and loss display is negative, it

indicates that the investor is at a loss.

Fund return = (current net value minus net value at the time of purchase) *

fund units minus handling fees; stock profit and loss = (stock current price

minus stock purchase price) * stock quantity minus handling fee.

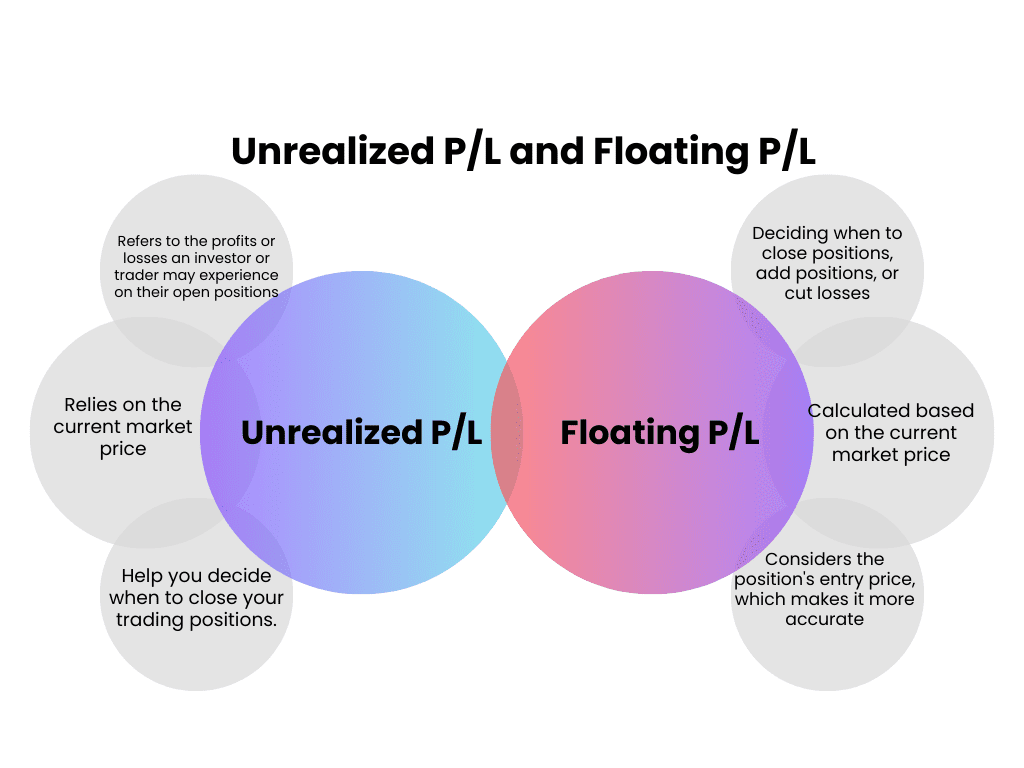

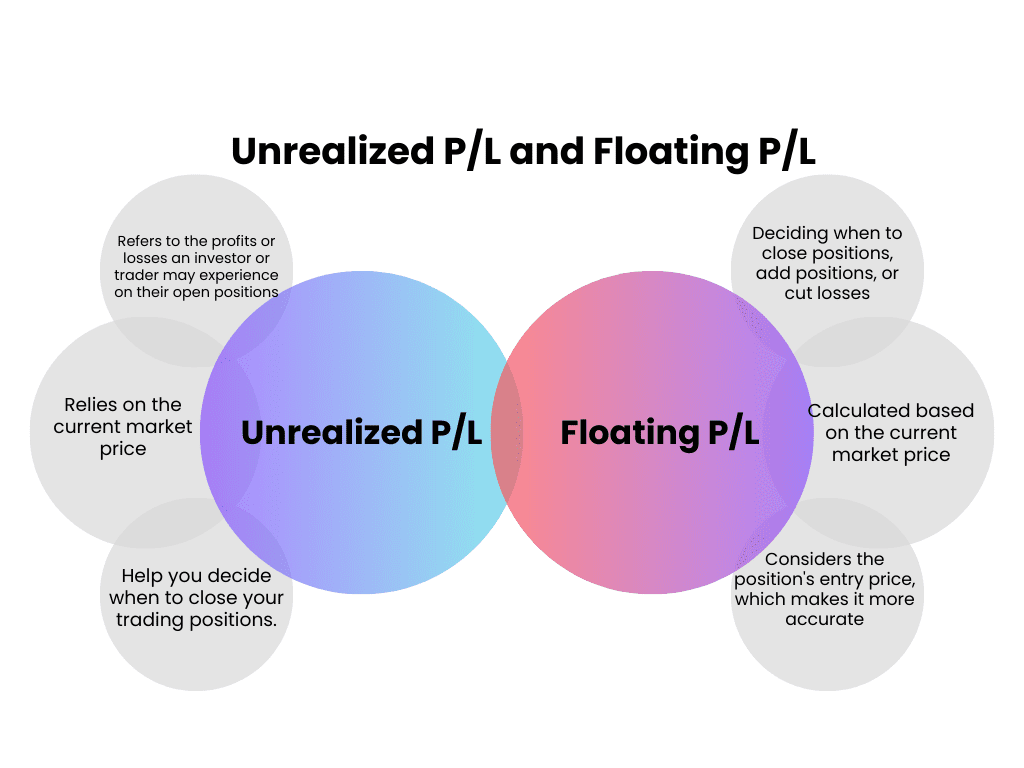

So, is the holding profit and loss a floating profit and loss?

Yes, floating profit and loss and position profit and loss refer to the same

concept, that is, unrealized gains or losses under the current market price. In

the stock, futures, and other trading markets, when an investor holds a security

or contract, its market value will change with the fluctuation of the market

price, resulting changes in position gains and losses or floating gains and

losses. Therefore, holding gains and losses and floating gains and losses can

usually be used interchangeably.

Is there a difference between holding profit and loss and floating profit and

loss?

Although floating profit and loss and position profit and loss can be used to

express the same concept, that is, unrealized gains or losses under the current

market price, there are still some subtle differences between them:

1. The position profit or loss usually refers to the unrealized gains or

losses of the Securities or assets held at a specific time point, while the

floating profit or loss can change at any time because it reflects the market

value under the current market price.

2. The position profit and loss may include the influence of other factors,

such as dividends, while the floating profit and loss only considers the

influence of the current market price on the market value.

3. In futures trading, position gains and losses may also include other

factors such as changes in margin, while floating gains and losses usually only

focus on changes in the contract market value.

In summary, although floating gains and losses and holding gains and losses

can be interchanged, there are still some slight differences between them.