The Schaff Trend Cycle (STC) is a popular indicator used by traders to identify trends and market reversals. While it has proven its worth in various markets, there are still several misconceptions surrounding its use.

In this article, we will debunk common myths about the Schaff Trend Cycle, helping you understand how it works and why it can be an essential tool in your trading arsenal.

7 Myths About the Schaff Trend Cycle

Myth 1: The Schaff Trend Cycle Works Like Any Other Oscillator

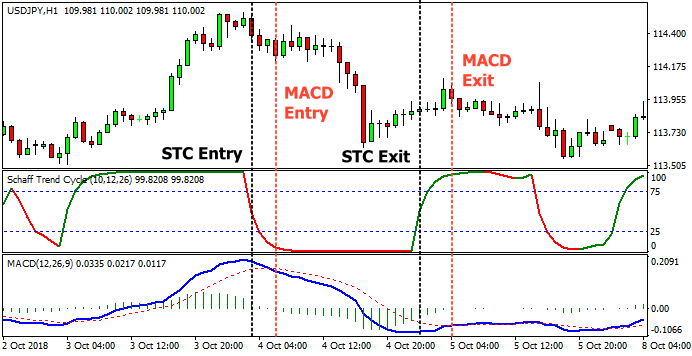

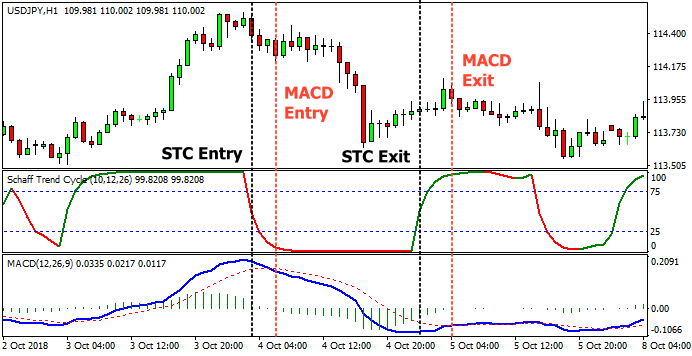

One of the most common myths about the Schaff Trend Cycle is that it functions in the same way as other oscillators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). While STC shares some similarities with these indicators, it operates differently.

The Schaff Trend Cycle was developed by Doug Schaff to combine the best features of the MACD and the cycle theory. Unlike traditional oscillators, the STC is designed to provide faster signals, making it more responsive to market movements. This speed allows traders to spot trends earlier and more accurately than with slower oscillators. While other indicators may lag behind, the Schaff Trend Cycle is built for faster reaction times, making it a powerful tool for timing trades.

Myth 2: The Schaff Trend Cycle Is Only Useful in Trending Markets

Another common misconception is that the Schaff Trend Cycle is only effective in strongly trending markets. Some traders believe that it fails to deliver reliable signals in sideways or choppy markets. However, this is not the case.

The STC's unique design allows it to identify both trending and range-bound conditions. In trending markets, it helps confirm the strength and direction of the trend, providing clear buy or sell signals. In sideways markets, it can detect reversals or periods of indecision, allowing traders to adjust their strategy accordingly. The Schaff Trend Cycle adapts to different market conditions, making it versatile and useful across various trading environments.

Myth 3: The Schaff Trend Cycle Is a Perfect Indicator for Predicting Market Movements

No trading indicator is perfect, and the Schaff Trend Cycle is no exception. While it provides reliable signals, it is not foolproof. Some traders expect the STC to predict market movements with 100% accuracy, which can lead to frustration when things don't go as planned.

The STC is a tool designed to assist traders in making informed decisions, not to guarantee success. Like any other technical indicator, it is best used in conjunction with other tools and analysis techniques. Relying solely on the Schaff Trend Cycle without considering other factors, such as market fundamentals or risk management strategies, can lead to poor results. It's essential to use the STC as part of a broader trading strategy, not as a standalone solution.

Myth 4: The Schaff Trend Cycle Is Only for Advanced Traders

Some believe that the Schaff Trend Cycle is too complex for beginners and should only be used by advanced traders. However, this myth could not be further from the truth.

The STC is relatively easy to understand and implement, even for those new to technical analysis. Its signals are straightforward, with clear buy and sell indications based on the crossing of the cycle line. While it may take time to master its full potential, beginners can quickly start using the Schaff Trend Cycle as part of their trading routine. There are many resources available to help traders of all levels understand how to use the STC effectively.

Myth 5: The Schaff Trend Cycle Is Only Effective in Forex and Stocks

Another misconception is that the Schaff Trend Cycle is only useful in specific markets, such as Forex or stocks. In reality, the STC can be applied to virtually any market, including commodities, indices, and cryptocurrencies.

The versatility of the STC comes from its ability to identify trends and reversals across different timeframes and asset classes. Whether you're trading oil futures, Bitcoin, or stocks, the Schaff Trend Cycle can provide valuable insights into market behaviour. Its flexibility makes it an excellent tool for traders who want to apply consistent technical analysis across various markets.

Myth 6: The Schaff Trend Cycle Is Too Sensitive and Generates Too Many False Signals

Some traders believe that the Schaff Trend Cycle is too sensitive, resulting in excessive noise and false signals. While it is true that the STC reacts quickly to market changes, it is important to understand how to filter out the noise.

The key to using the Schaff Trend Cycle effectively is to adjust the settings to match your trading style and timeframe. For short-term traders, the STC can provide rapid signals, but for longer-term traders, a more conservative approach may be needed. By fine-tuning the settings and combining the STC with other technical indicators, traders can reduce the risk of false signals and increase the accuracy of their trades.

Myth 7: The Schaff Trend Cycle Works Better in Certain Timeframes

Some traders assume that the Schaff Trend Cycle works better on specific timeframes, such as daily or hourly charts. While the STC can be effective on multiple timeframes, it is important to understand that its success depends on how well it is used in conjunction with the trader's strategy.

The STC can provide valuable signals in both short-term and long-term charts, but the key to success is how you apply it. Whether you are day trading or swing trading, adjusting the settings and interpreting the STC signals relative to your timeframe will help you make better trading decisions.

Conclusion

The Schaff Trend Cycle is an incredibly valuable tool for traders, but it is often misunderstood. By debunking these common myths, we've highlighted its versatility, speed, and potential for all levels of traders.

The STC is not a perfect solution, but when used correctly and in combination with other analysis tools, it can be a powerful indicator for identifying trends and reversals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.