Data boosts the pound on Wednesday

2024-07-17

Summary:

Summary:

On Wednesday, the dollar weakened despite a brief lift from strong retail sales. Traders' attention shifted to potential September rate cuts.

EBC Forex Snapshot, 17 Jul 2024

The dollar was broadly weaker on Wednesday after a modest but short-lived

boost following better-than-expected retail sales data, as traders focused on

the prospect of rate cuts as early as September.

The core reading surged 0.9% last month after rising by an unrevised 0.4% in

May. Economists now estimate that consumer spending grew at a 2.0% annualised

rate in Q2.

The British pound gained a touch after data showed UK headline inflation held

at 2% on an annual basis in June against forecasts for a 1.9% increase and the

closely-watched services inflation came in at 5.7%.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 8 Jul) |

HSBC (as of 17 Jul) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0666 |

1.0916 |

1.0741 |

1.0988 |

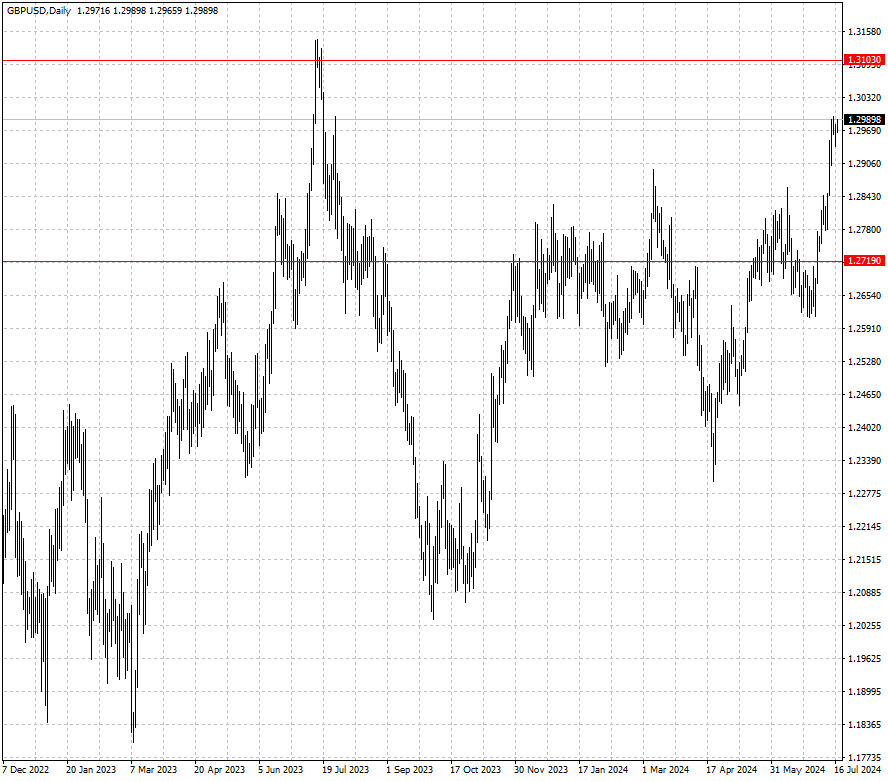

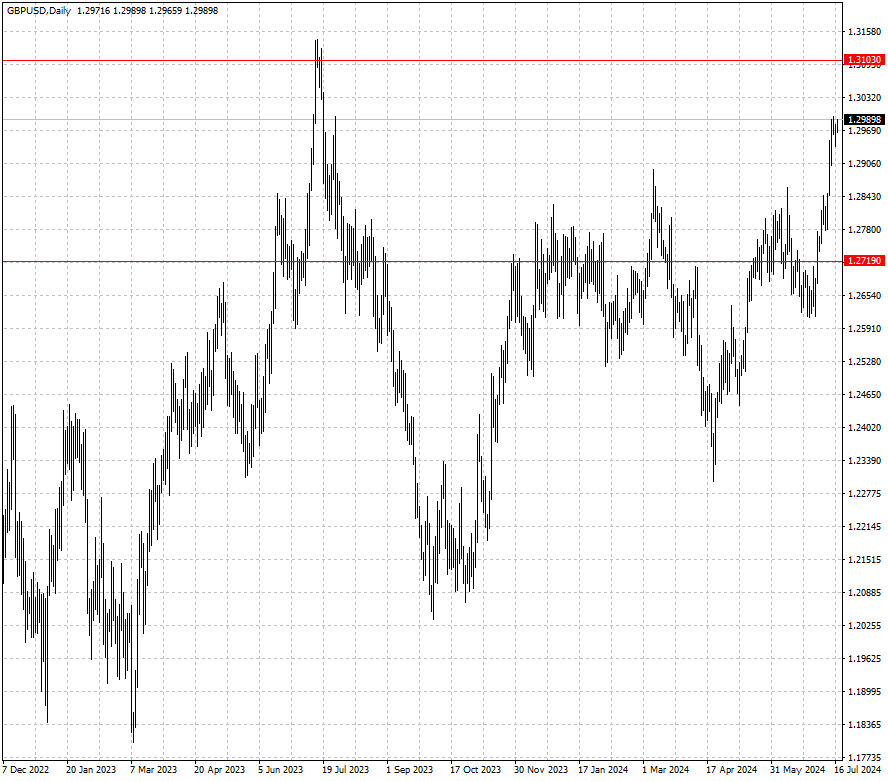

| GBP/USD |

1.2616 |

1.2860 |

1.2719 |

1.3103 |

| USD/CHF |

0.8827 |

0.9158 |

0.8881 |

0.9018 |

| AUD/USD |

0.6595 |

0.6847 |

0.6634 |

0.6815 |

| USD/CAD |

1.3577 |

1.3846 |

1.3586 |

1.3755 |

| USD/JPY |

156.23 |

163.40 |

156.33 |

161.17 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.