Bullion gains on cooling US inflation

2025-03-03

Summary:

Summary:

Gold edged up on Monday as US inflation cooled in January. Futures traders slightly increased the odds of a June rate cut, now above 70%.

Gold inched up on Monday as US inflation cooled further as expected in

January. Futures traders slightly raised the odds of a June rate cut, with the

implied probability now just above 70%.

Onshore gold ETF holdings in China increased by 17.7 tons in the first three

weeks of February, close to the monthly record inflow of 20.9 tons set last

October, according to data from the WGC.

The gold market received a boost earlier last month, with the announcement of

a pilot program allowing insurers to buy the metal for the first time. The

investment demand helped offset weaker jewellery consumption.

Meanwhile, strong US demand for gold is pulling bullion out of some countries

as traders try to stockpile it before Trump's tariffs on Canada and Mexico kick

into high gear.

The precious metal is shifted into the Commodities Exchange Centre and other

vaults in New York. Gold reserves in London's vaults fell for the third

consecutive month in January, data from the LBMA showed.

The White House cancelled a joint press conference for Trump and Zelensky

last week following the collapse of talks with President Donald Trump after a

televised explosive clash in the Oval Office.

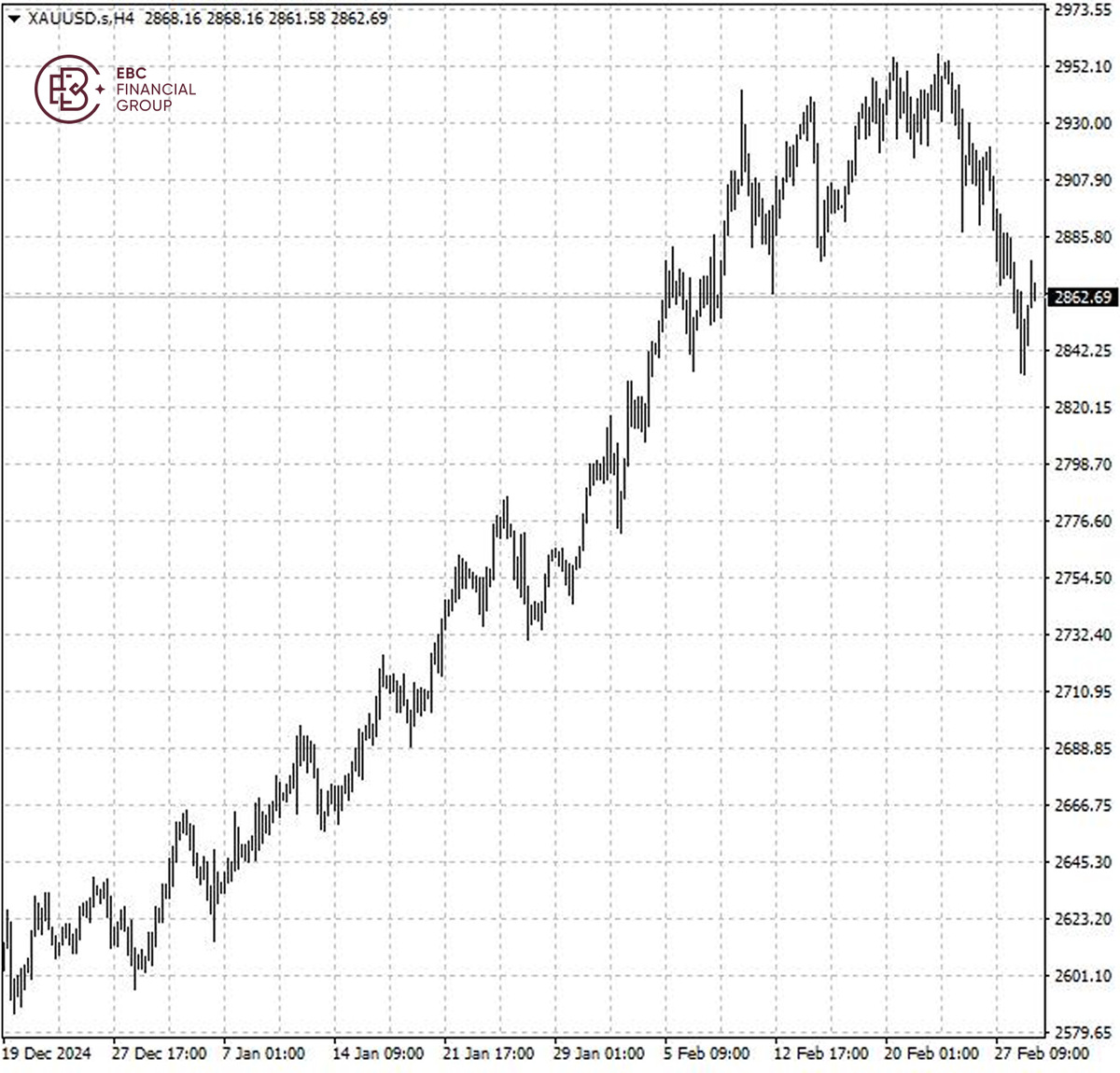

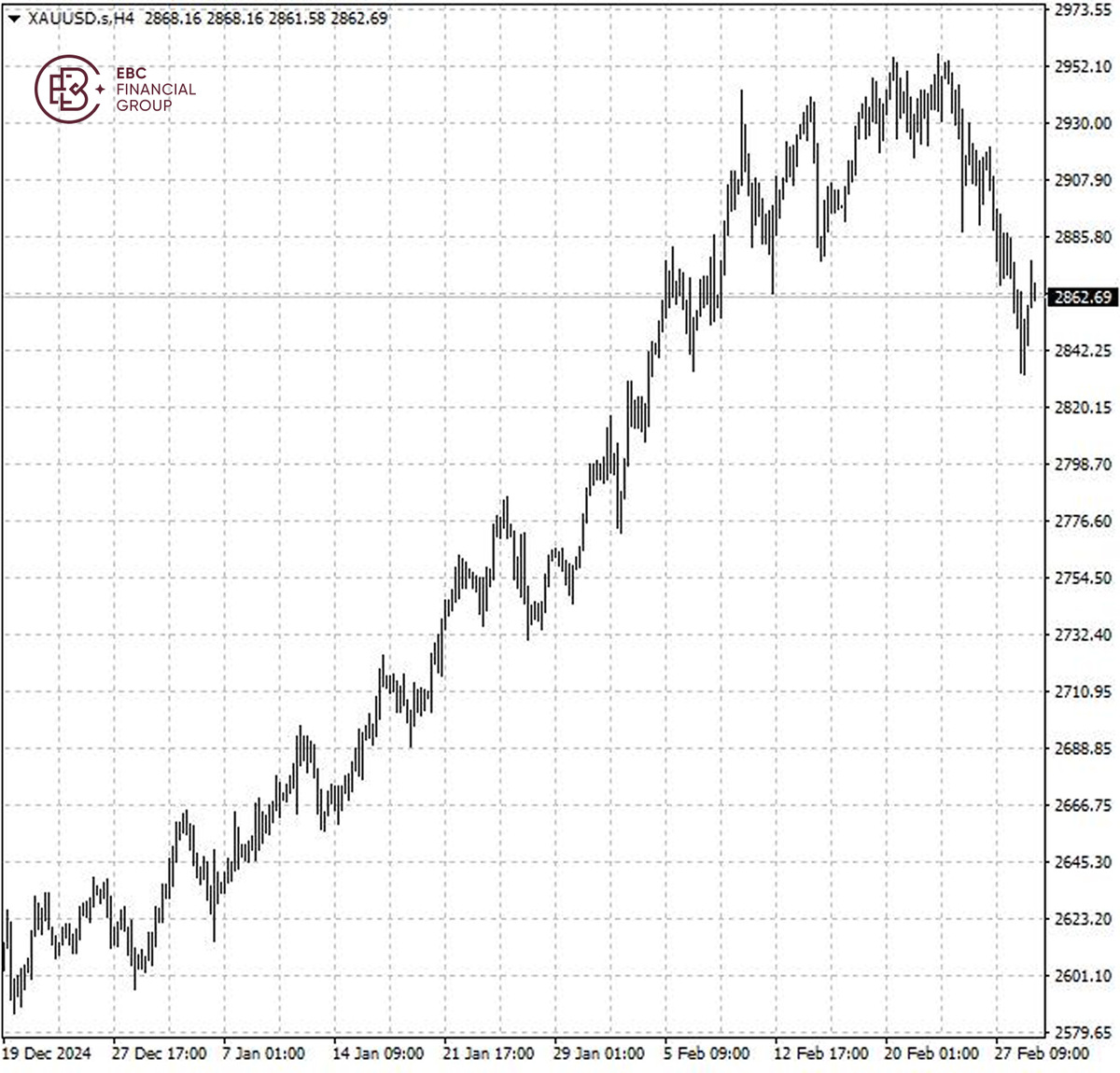

Bullion has rebounded from the low hit on 6 February above $2,830, but the

rally was rejected by where the tumble began. As such we remain bearish on it in

the short term.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.