The foreign exchange (forex) market is the world's largest and most liquid financial market, where currencies are bought and sold. For traders, choosing the right currencies to trade can significantly impact their success. But with so many currencies available, which ones are considered the best for trading? In this guide, we'll explore some of the most popular and widely traded currencies, highlighting their unique characteristics and why they're favoured by traders, focusing on the commonly traded currency pairs.

What Makes a Currency Good for Trading?

Before diving into the specific currencies, it's important to understand what makes a currency attractive for trading. A good trading currency typically has the following qualities:

High Liquidity: The currency is frequently traded, allowing for easier entry and exit from trades with minimal price slippage.

Volatility: Currencies that experience significant price fluctuations provide opportunities for traders to profit from price movements.

Economic Stability: Countries with strong economies and stable governments usually have currencies that are less prone to extreme market shocks.

Tight Spreads: The difference between the buying and selling price (spread) is narrow, reducing trading costs.

With these factors in mind, let's look at some of the best currencies for trading.

Understanding Currency Pairs

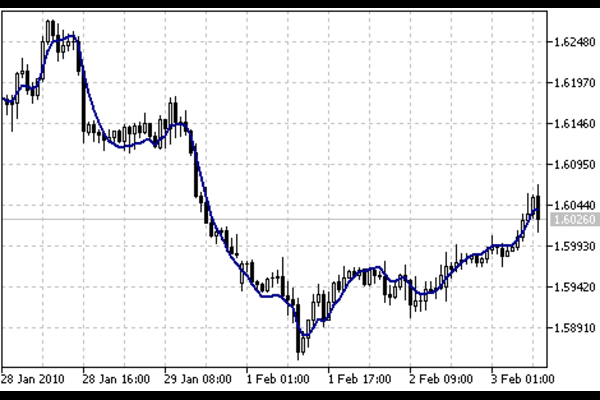

A currency pair is a unit of measurement in the foreign exchange market that measures the value of one currency against another. It is the exchange rate between two different currencies, with all currencies traded in pairs in the forex market. Each currency pair consists of a base currency and a quote currency, with the base currency being the first currency in the pair. For example, in the EUR/USD currency pair, the euro is the base currency, and the US dollar is the quote currency.

1. US Dollar (USD)

The U.S. dollar is by far the most traded currency in the world. It's the global reserve currency and is involved in nearly 90% of all forex trades. The strength of the U.S. economy, its central role in international trade, and its liquidity make the dollar a top choice for traders. Major currency pairs like EUR/USD, USD/JPY, and GBP/USD all involve the U.S. dollar, offering high liquidity and tight spreads.

Why trade USD? Its stability, high liquidity, and its role as a benchmark for global currencies make it ideal for both beginner and experienced traders.

2. Euro (EUR) - Most Traded Currency Pair

The euro is the second most traded currency globally and is used by 19 of the 27 European Union member countries. The Eurozone’s collective economic strength ensures the euro's stability and liquidity. The EUR/USD pair is the most traded currency pair in the forex market, known for its relatively tight spreads and strong liquidity.

Why trade EUR? The euro offers high liquidity, tight spreads, and is part of the most traded currency pair in the forex market, making it a reliable choice.

3. Japanese yen (JPY)

The Japanese yen is another highly traded currency, particularly among traders who focus on the Asia-Pacific region. It's known for its role as a safe-haven currency during times of economic uncertainty. The USD/JPY pair is one of the most popular forex currency pairs due to the large volumes traded and its volatility, which presents numerous opportunities for profit.

Why trade JPY? High liquidity, low spreads, and its position as a safe-haven currency make the yen appealing to many traders.

4. British Pound (GBP)

The British pound is a major global currency with significant historical importance. The GBP/USD pair, often referred to as "Cable", is one of the most traded pairs in the forex market. The pound is known for its volatility, particularly during political events such as Brexit, which presents opportunities for traders who thrive on price swings. Developing a robust trading strategy is crucial for navigating the volatile forex market and achieving better trading results.

Why trade GBP? The pound offers both volatility and liquidity, with significant movement in response to economic and political events.

5. australian dollar (AUD) - Commodity Currencies

The Australian dollar is popular among forex traders due to Australia's strong economic ties to commodities like iron ore, coal, and natural gas. The AUD/USD pair is highly traded, and the currency often experiences volatility due to commodity price changes. Traders who follow commodity markets often find the Australian dollar an attractive option.

Why trade AUD? Its ties to the commodities market offer unique trading opportunities, and the AUD/USD pair provides good liquidity.

6. Swiss Franc (CHF)

The Swiss franc is another safe-haven currency, favored by traders during times of global uncertainty. Switzerland's political neutrality, economic stability, and strong banking system make the CHF a reliable currency for risk-averse traders. The USD/CHF and EUR/CHF pairs are popular traded currency pairs for those seeking to hedge against risk.

Why trade CHF? Its reputation as a stable, safe-haven currency makes it attractive during times of market volatility.

7. canadian dollar (CAD)

The Canadian dollar, or "loonie", is closely tied to the country's abundant natural resources, particularly oil. As a result, the CAD is often influenced by fluctuations in oil prices. The USD/CAD pair is commonly traded, and its movements are closely watched by traders who monitor the global energy markets.

Why trade CAD? Traders interested in commodities like oil often trade the Canadian dollar for its correlation with the energy sector. When considering forex pairs, the CAD offers unique opportunities due to its strong link to oil prices and the broader commodity market.

8. New Zealand Dollar (NZD)

The New Zealand dollar is often traded by those who follow the commodities market, as New Zealand is a major exporter of agricultural products. The NZD/USD pair offers good liquidity and is influenced by both commodity prices and global risk sentiment.

Why trade NZD? Trading forex with the NZD is a good option for traders looking to diversify their currency exposure with ties to the agricultural market.

9. Chinese Yuan (CNY)

As China’s influence on the global economy continues to grow, the Chinese yuan is becoming an increasingly popular currency among forex traders. While not as widely traded as some of the other major currencies, the CNY is gaining traction due to Chinass economic strength. However, traders should be aware that the Chinese government more tightly controls the yuan than other currencies.

Why trade CNY? China’s economic growth makes the yuan a currency to watch, though it requires careful monitoring due to government controls.

Conclusion

Choosing the best currency for trading depends on your trading style, risk tolerance, and understanding of the global market. The U.S. dollar, euro, and Japanese yen remain top choices due to their liquidity and stability, but other currencies like the Australian and Canadian dollars offer opportunities tied to commodity markets. Safe-haven currencies like the Swiss franc and Japanese yen are appealing during times of uncertainty while emerging currencies like the Chinese yuan are gaining interest as global trade evolves.

Ultimately, successful currency trading involves staying informed about economic trends, geopolitical events, and market movements. By focusing on the best currencies for trading, you can enhance your chances of making profitable trades in the fast-paced world of forex.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.