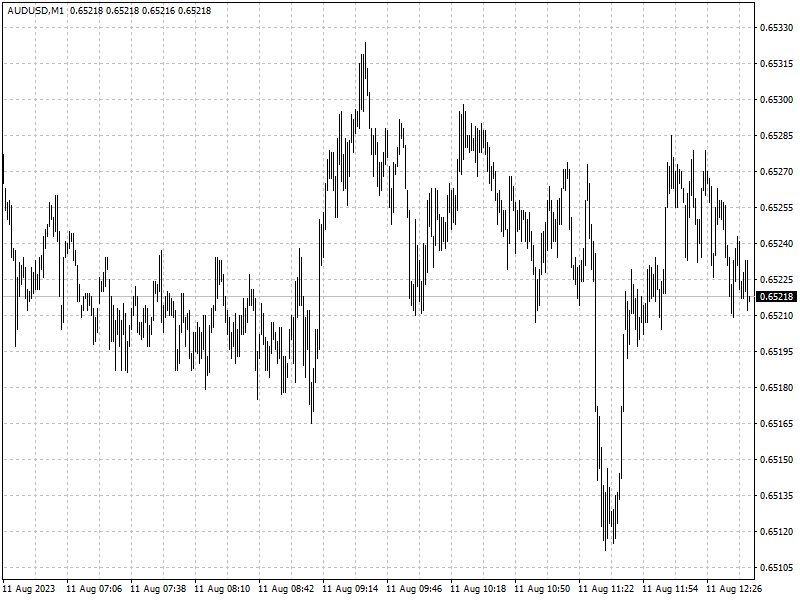

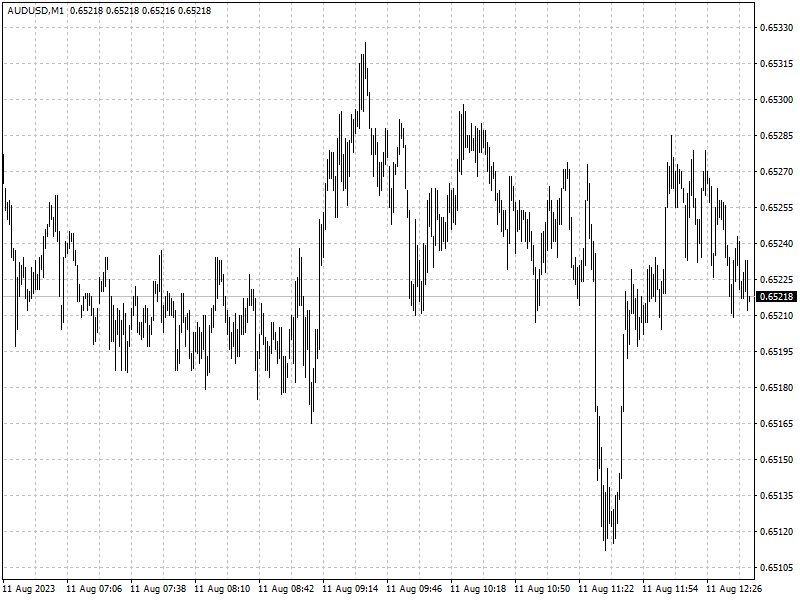

Aussie dollar sees no light at the end of the tunnel

2023-08-14

Summary:

Summary:

UBS said in March the currency would be benefited from the end of interest rate hikes by the Fed. But that will hardly play out with the expectation that the RBA is also nearly finished.

The Australian dollar is among the worst-performing developed-market

currencies in the past year, a trend that looks set to persist.

UBS said in March the currency would be benefited from the end of interest

rate hikes by the Fed. But that will hardly play out with the expectation that

the RBA is also nearly finished.

Australia’s central bank will stand pat for two more meetings and then hike

in November to take the cash rate to a 12-year high of 4.35%, a survey of

economists showed.

The RBA is expected to cut rates in the second quarter of 2024 to support

ailing economy as it sees unemployment rate climbing to around 4.5% next

year.

Australian economy grew at a quarterly rate of 0.2% in the first three months

of the year, well below 2.0% for the U.S., as China’s weak recovery weighs on

commodity demand.

Goldman Sachs predicts the decline in iron ore prices will extend this year

as the physical market tips into an imminent surplus. This is not good news for

the top iron ore exporting country.

Lowe has flagged that further interest rate increases may be required if

inflation remains above the target on Friday, but Commonwealth Bank of Australia

said the Aussie could soon break its year-to-date low at 0.6458.

Hedge funds bore the brunt of the slide after turning the most bullish on the

currency than they’ve been at any point this year.

Leveraged funds’ Aussie positioning swung to a net-long of 17,432 contracts

in the week ended 8 August from a net short in the previous week, according to

CFTC.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.