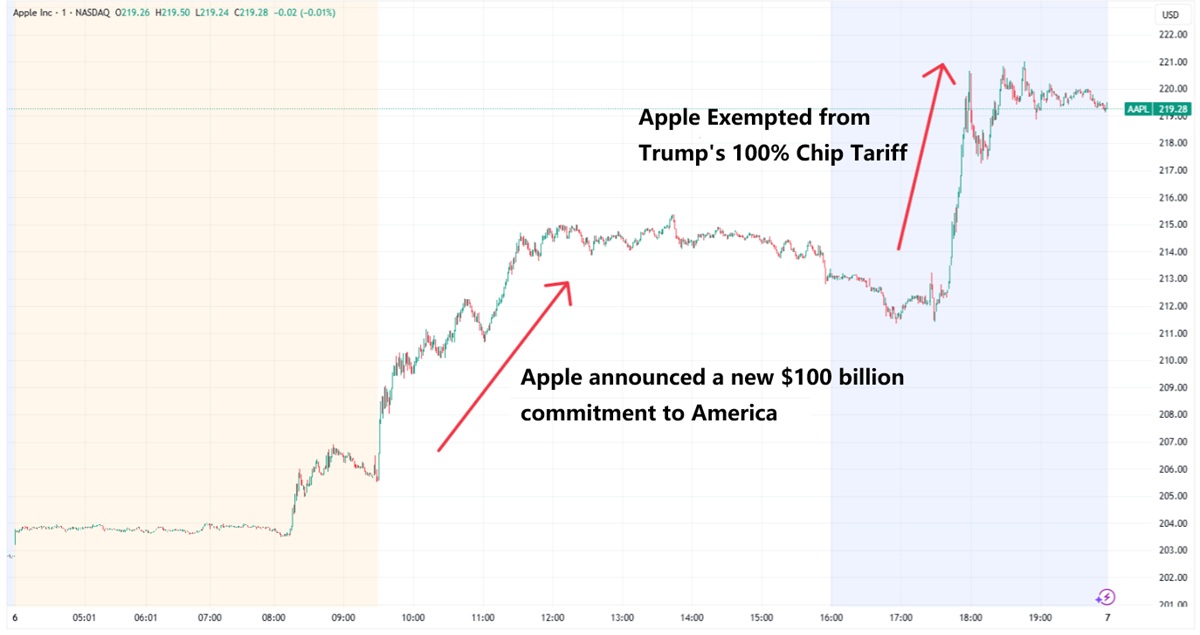

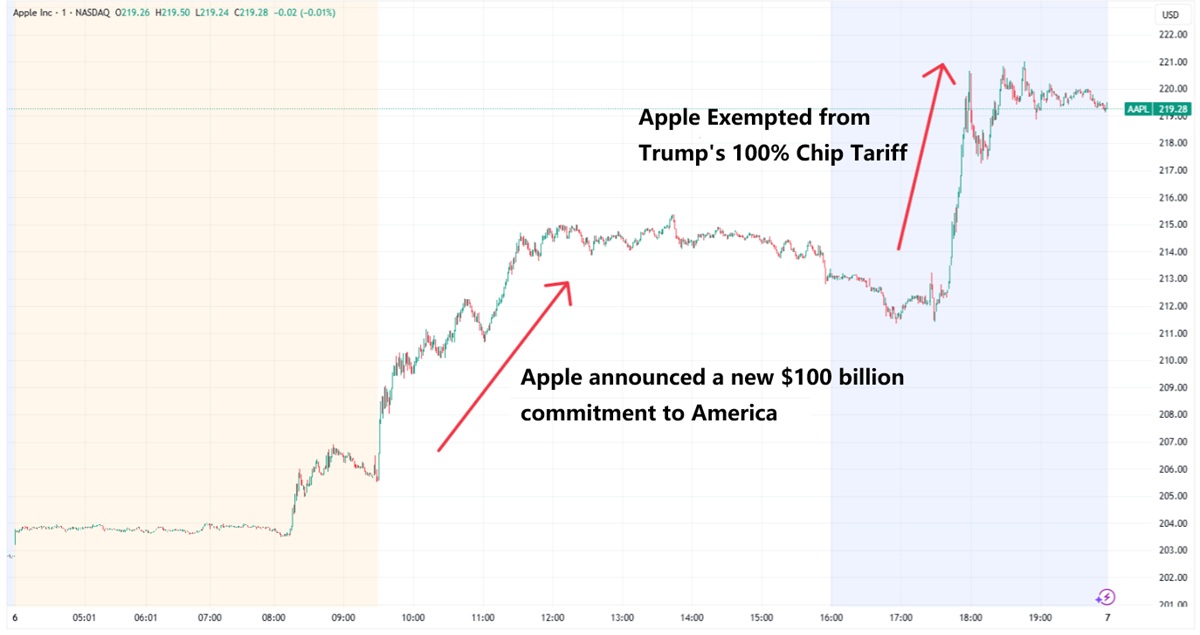

Apple's stock (AAPL) surged in after-hours trading following a major announcement by both the tech giant and former U.S. President Donald Trump. As the U.S. government prepares to impose a sweeping 100% tariff on imported chips, Apple has secured an exemption thanks to a new $100 billion investment commitment on American soil. The news sent AAPL stock price soaring, reflecting investor confidence in the company's strategic direction and domestic expansion.

Apple Secures Tariff Exemption Amid Sweeping Semiconductor Policy Shift

In a dramatic shift that shook the U.S. tech and equity markets, President Donald Trump announced on 6 August that the United States will impose a 100% tariff on imported chips and semiconductor products. However, in a significant caveat, Trump revealed that companies with existing or pledged manufacturing operations in the U.S. would be exempt from the tariff burden.

Apple Inc. (NASDAQ: AAPL) was one of the most prominent beneficiaries of this new policy. As the announcement broke, the AAPL stock price responded immediately, soaring 5.09% during regular trading hours, followed by a further 2.82% increase in after-hours trading, reaching $219.26 at the time of writing.

Apple's $100 Billion Boost: A Vote of Confidence in U.S. Manufacturing

On the same day, Apple CEO Tim Cook unveiled a fresh $100 billion investment into the company's U.S. operations. The new commitment will focus on domestic production of iPhone and Apple Watch glass components, which marks a strategic expansion of Apple's American supply chain.

This announcement brings Apple's total pledged investment in the United States to a staggering $600 billion.

President Trump lauded the move, stating, "Companies like Apple won't be taxed," reinforcing the administration's intention to reward firms that contribute to U.S. industrial infrastructure.

Why the AAPL Stock Price Reacted So Quickly

The sharp rise in the AAPL stock price can be attributed to multiple converging factors:

Tariff Exemption: Avoiding the 100% chip tariff means Apple will not face supply chain cost inflation, preserving its hardware profit margins.

Manufacturing Credibility: The scale of Apple's new investment demonstrates long-term confidence in its U.S. operations and insulates the company from future regulatory shocks.

Market Sentiment: Investors interpreted Apple's aggressive move as a sign of stability and forward-thinking—key qualities during a time of trade volatility.

Combined, these elements sparked a wave of buying interest in Apple shares, pushing the AAPL stock price to new short-term highs.

Analyst Reactions: AAPL Seen as a Strategic Winner

Market analysts were quick to highlight Apple's agility and foresight in responding to geopolitical risk. By aligning itself closely with the U.S. government's industrial policy, Apple has positioned itself not only as a consumer electronics leader but also as a model of strategic compliance and domestic investment.

"This is not just about avoiding tariffs—Apple is demonstrating global leadership," said one Wall Street strategist. "Their investment signals intent, stability, and resilience, which is exactly what the market wants in today's environment."

What This Means for Investors Watching the AAPL Stock Price

The recent jump in the AAPL stock price offers a glimpse of how sensitive the market is to government policy announcements. For short-term traders, this volatility may present opportunities; for long-term investors, Apple's reinforced domestic presence offers greater assurance of stability in an uncertain global trade landscape.

Moreover, with additional product releases expected later this year, including updates to the iPhone and Mac product lines, the fundamentals remain strong.

Conclusion: Apple Rides the Policy Wave with Confidence and Capital

Apple has once again proven its ability to adapt swiftly and decisively to shifting geopolitical landscapes. By pledging $100 billion in new U.S. investment and securing a tariff exemption, the company has not only protected its supply chain but also reinforced investor confidence.

As a result, the AAPL stock price continues to reflect strength, strategy, and the market's belief in Apple's long-term vision—even in a turbulent global environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.