Aussie firms ahead of RBA decision

2025-02-18

Summary:

Summary:

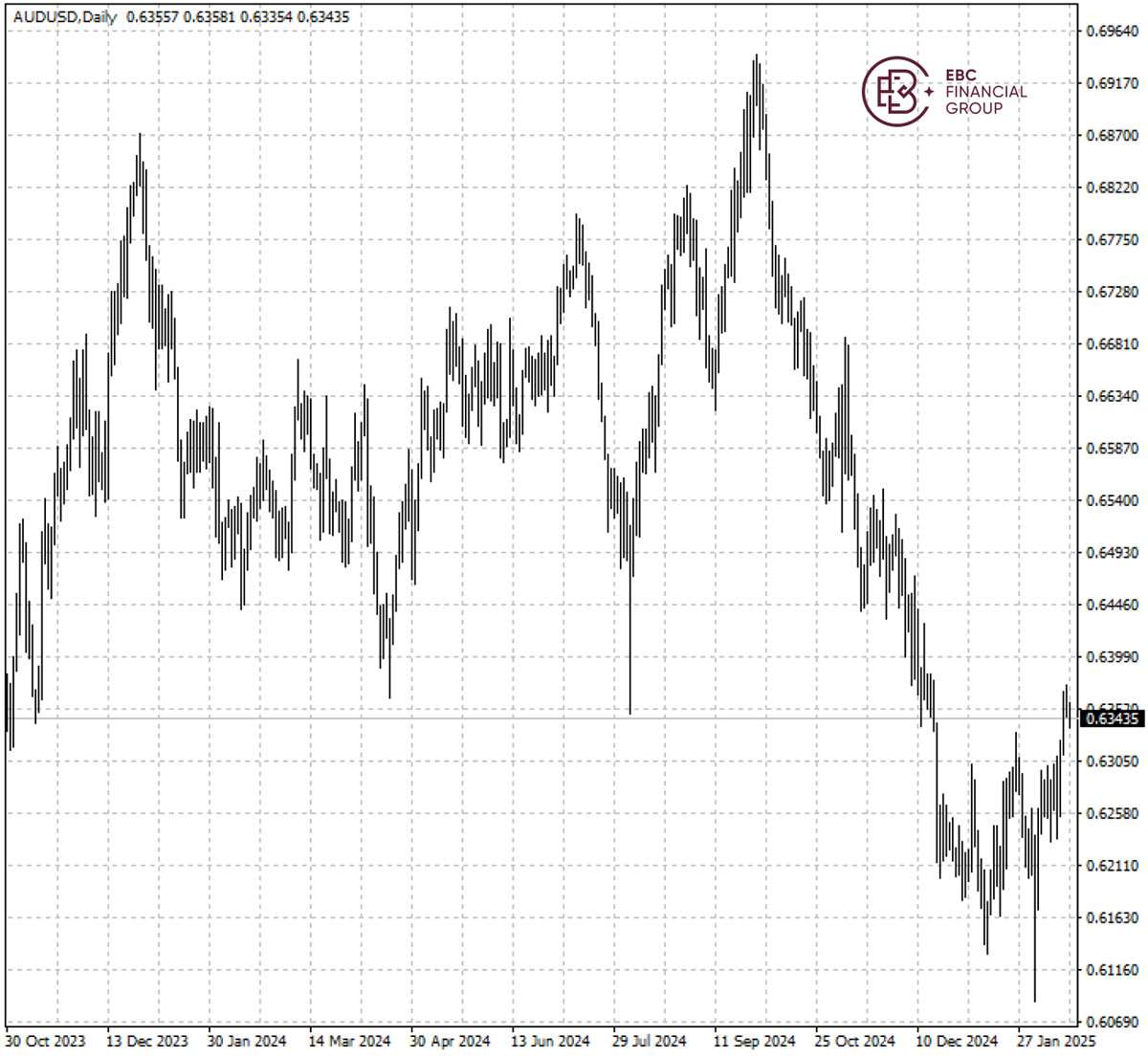

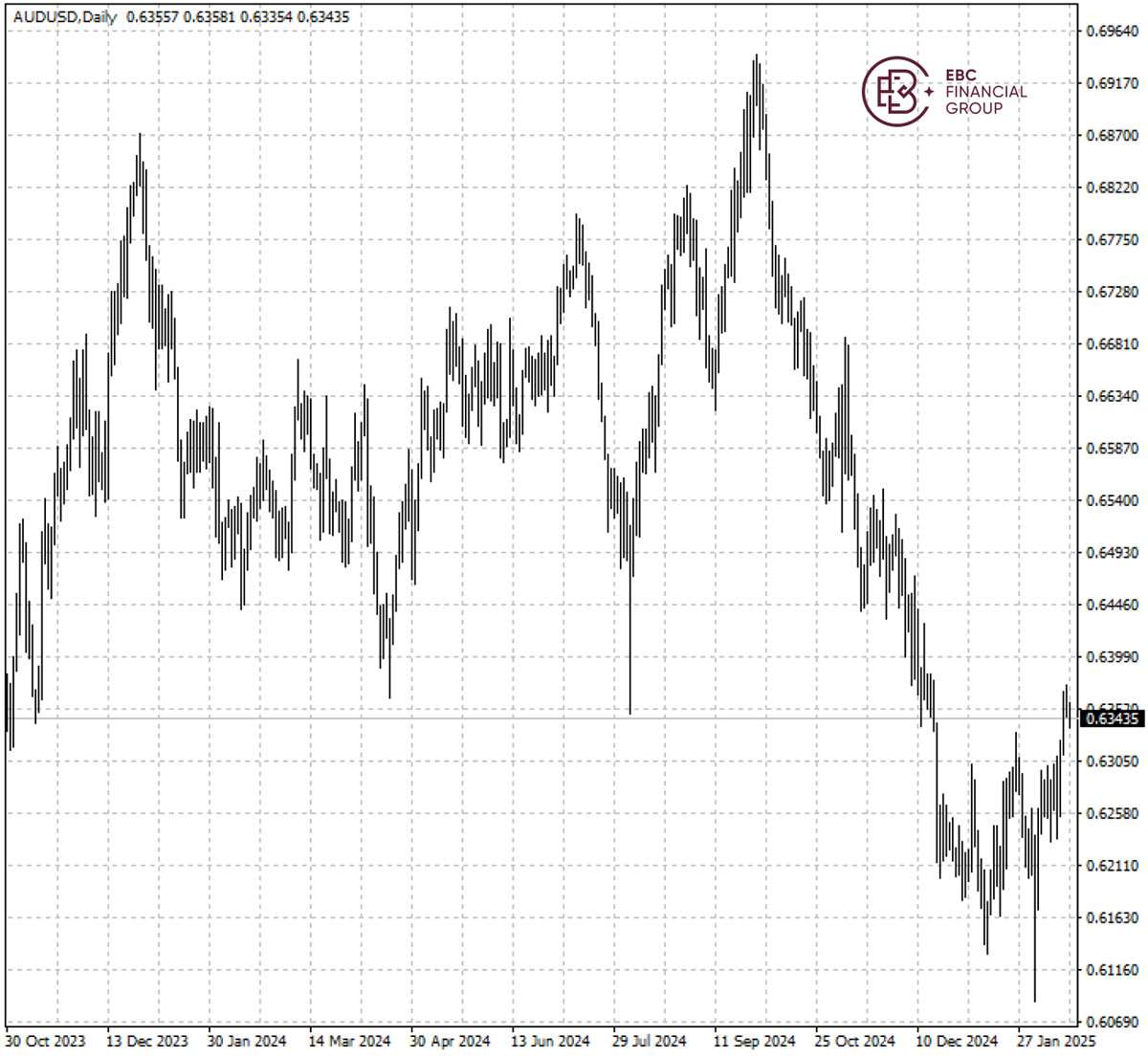

The Australian dollar stayed near a two-month high, with hedge funds at risk of losses on bearish positions as most negative news has been priced in.

The Australian dollar managed to stay close to its highest level in two

months. Hedge funds are in danger of losing money on their bearish positions as

a lot of the negative news have been priced in.

While the RBA is poised to lower its benchmark rate for the first time since

November 2020 on Tuesday, there is no guarantee that would spur any further

Aussie weakness.

The economy has slowed sharply since 2023, but a pick up in consumer spending

along with rising uncertainties about the impact of US trade policies may also

convince policymakers to stay cautious.

The Aussie is benefiting from an easing of worst-case fears of US tariffs and

may climb to as high as 0.6450 if the central bank surprises by keeping interest

rates on hold this week, according to RBC Capital Markets.

The central bank's level of policy restrictiveness remains broadly on par

with major counterparts because it did not tighten as aggressively in

2022-2023.

Australia has confirmed they are seeking exemptions from Trump's tariffs on

steel and aluminium, though Trump's senior counsellor Peter Navarro claimed that

Australia was "killing" the US aluminium market.

The Aussie dollar has broken above its recent trading range and uptrend

remains intact, so the risk is skewed towards the upside with the resistance

around 0.6380.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.