The Zimbabwe dollar to USD exchange rate remains a focal point for traders and analysts as Zimbabwe's currency market undergoes yet another transformation. In 2024, the Reserve Bank of Zimbabwe replaced the Zimbabwean dollar with the Zimbabwe Gold (ZiG), a structured currency backed by gold, in an attempt to restore stability.

As 2025 unfolds, the market faces fresh volatility, persistent inflation, and significant depreciation pressures, making a close analysis essential for anyone monitoring this dynamic currency pair.

Zimbabwe Dollar to USD Current Exchange Rate

As of 9 June 2025, the official exchange rate for the Zimbabwe Gold (ZiG) stands at approximately 26.95 ZiG per US dollar, reflecting a marginal increase from previous sessions. Since its introduction in April 2024, the ZiG has experienced a steady decline in value, with a 49.8% drop against the US dollar over the past year. The currency opened 2025 at around 25.83 ZiG per USD and had slipped to 26.06 by 10 January, a 0.9% depreciation in just over a week.

However, the official rate only tells part of the story. The parallel market rate is significantly higher, reaching up to 45 ZiG per USD, with peer-to-peer exchanges ranging from 38 to 40. This premium of over 50% highlights the ongoing lack of confidence in official channels and the persistent shortage of US dollars in Zimbabwe's economy.

Historical Perspective: A Currency in Crisis

Zimbabwe's currency woes are deeply rooted. The original Zimbabwean dollar, introduced in 1980, was once at parity with the US dollar. However, decades of economic mismanagement, hyperinflation, and repeated currency redenominations led to the collapse of the local unit. By 2009, after a period of hyperinflation that saw denominations as high as $100 trillion, the Zimbabwean dollar was abandoned in favour of multiple foreign currencies, including the US dollar.

Subsequent attempts to revive a sovereign currency—including the RTGS dollar in 2019 and the most recent ZiG in 2024—have struggled to gain public trust. Each iteration has been marked by rapid depreciation, inflation, and the emergence of a thriving parallel market.

2025 Outlook: Forecasts and Policy Challenges

The outlook for the Zimbabwe dollar to USD exchange rate in 2025 is bearish. Government projections, as outlined in the national budget, anticipate a 52% depreciation of the ZiG this year, with the average official rate expected to reach 36 ZiG per USD, and some analysts forecasting rates exceeding 55 by year-end. This contrasts sharply with the 2024 average of 17.1, underscoring the scale of expected currency weakness.

Models predict the ZiG will fall to 0.035 USD by the end of Q2 2025 and to 0.030 USD within a year, implying further losses for the local currency. These forecasts reflect both structural economic challenges and the impact of continued money supply growth, which surged by nearly 100% at the M0 level between June and August 2024.

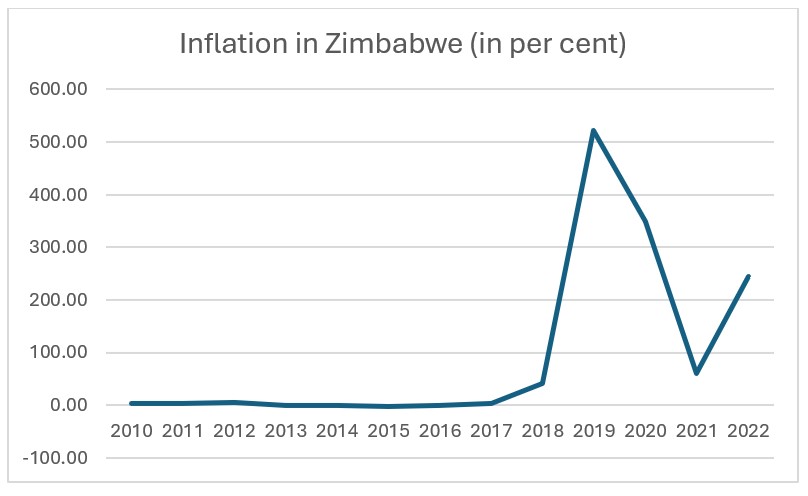

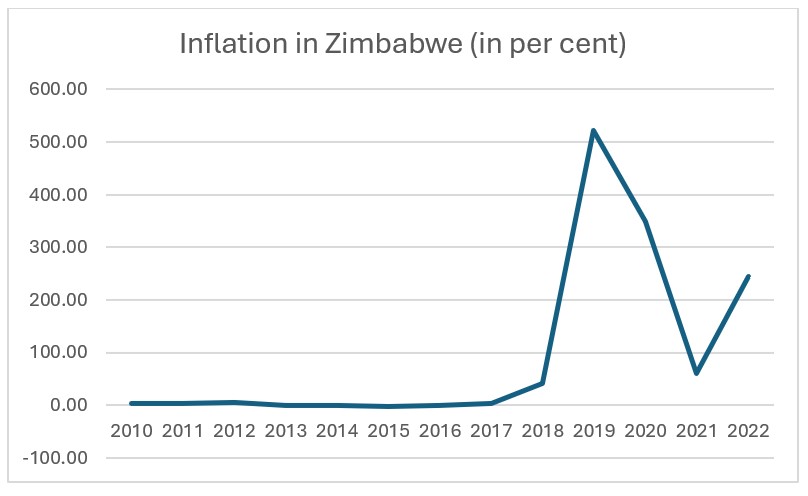

Inflation is another major concern. Zimbabwe's inflation rate soared to 85.7% in April 2025, and analysts expect it to remain above 50% for the rest of the year. This environment of rising prices and currency depreciation poses significant challenges for businesses and individuals alike, with suppliers already adjusting pricing models to rates above 40 ZiG per USD.

Comparing Official and Parallel Markets

The divergence between the official and parallel market rates is a longstanding feature of Zimbabwe's currency system. While authorities attempt to enforce the official rate, market participants often rely on the parallel market for real pricing, especially given the chronic shortage of US dollars. This gap not only fuels inflation but also undermines the credibility of monetary policy interventions.

Lessons from History: Hyperinflation and Policy Shifts

Zimbabwe's experience with hyperinflation in the late 2000s remains a cautionary tale. The government's decision to print money to finance deficits, combined with declining agricultural output and loss of investor confidence, led to one of the most severe currency collapses in history.

While the introduction of the ZiG was intended to break this cycle by backing the currency with gold reserves, market pressures and policy inconsistencies continue to challenge its stability.

What Traders Should Watch

Policy Announcements: Any changes from the Reserve Bank of Zimbabwe regarding exchange rate management or monetary policy can trigger sharp moves in the currency.

Money Supply Data: Continued expansion of the money supply is likely to drive further depreciation and inflation.

Parallel Market Rates: The premium over the official rate is a key indicator of market sentiment and liquidity constraints.

Inflation Trends: Persistent high inflation will erode the value of the ZiG, impacting both official and market rates.

Conclusion

The Zimbabwe dollar to USD exchange rate remains highly volatile and subject to significant downside risk in 2025. Historical patterns of currency depreciation, persistent inflation, and the widening gap between official and parallel market rates all point to ongoing challenges for Zimbabwe's monetary authorities.

For traders and analysts, staying informed about policy changes, market trends, and historical context is essential for navigating this unpredictable market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.