For day traders, timing is everything—and the standard MACD settings often aren't fast enough to keep up. By adjusting the MACD to respond more quickly, traders can capture momentum shifts as they happen. From selecting the right parameters to filtering false signals, mastering MACD for intraday setups requires precision, confirmation, and rigorous testing.

Fast (3-10-16) vs Ultra-Fast (5-34-1)

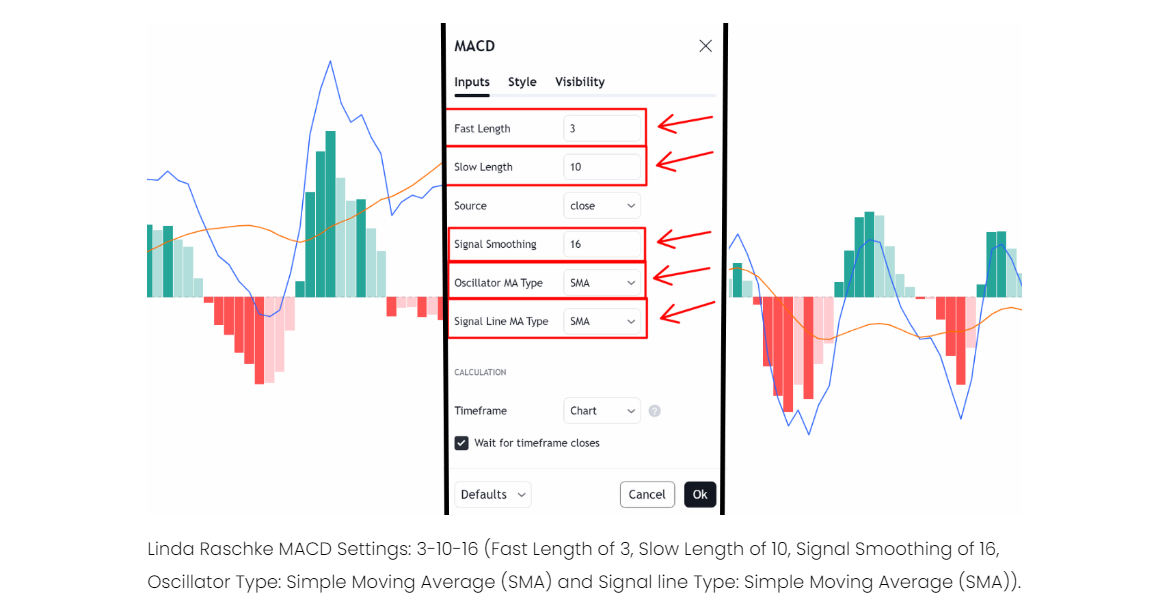

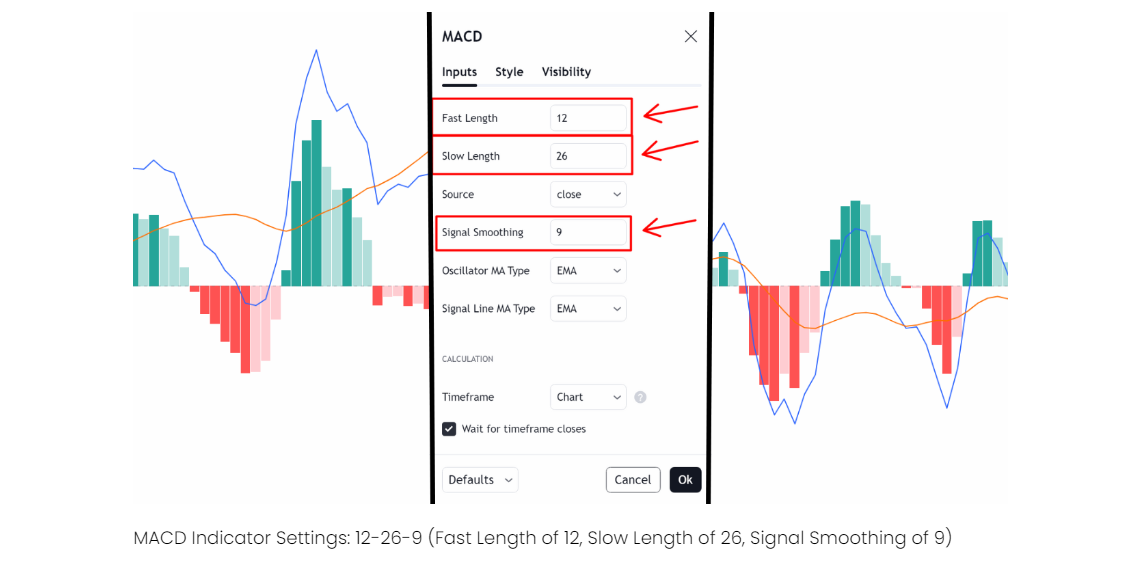

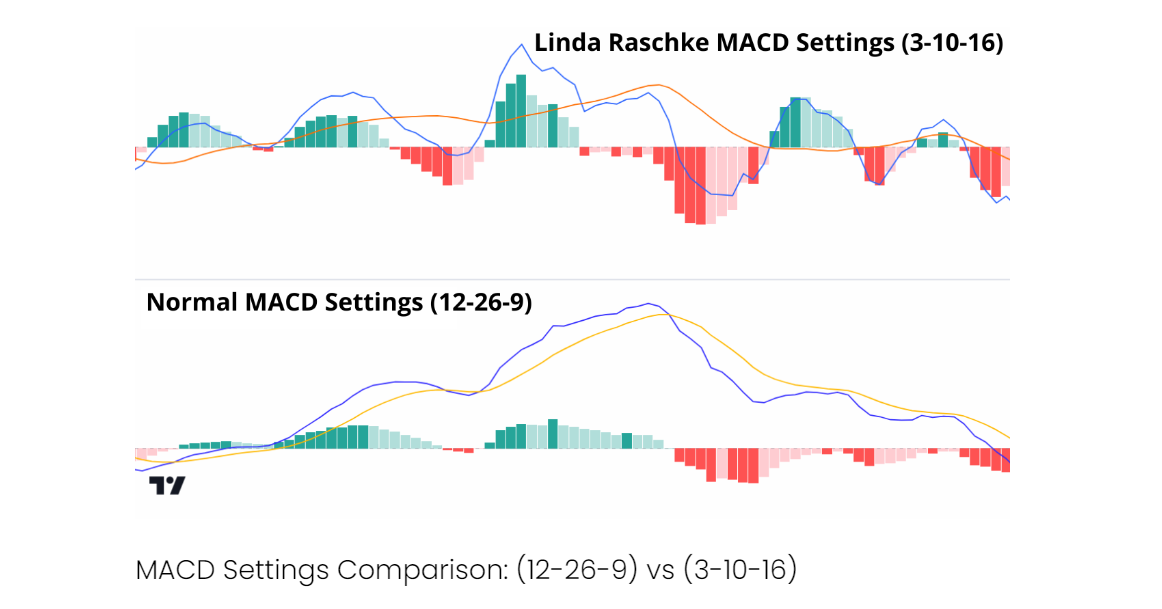

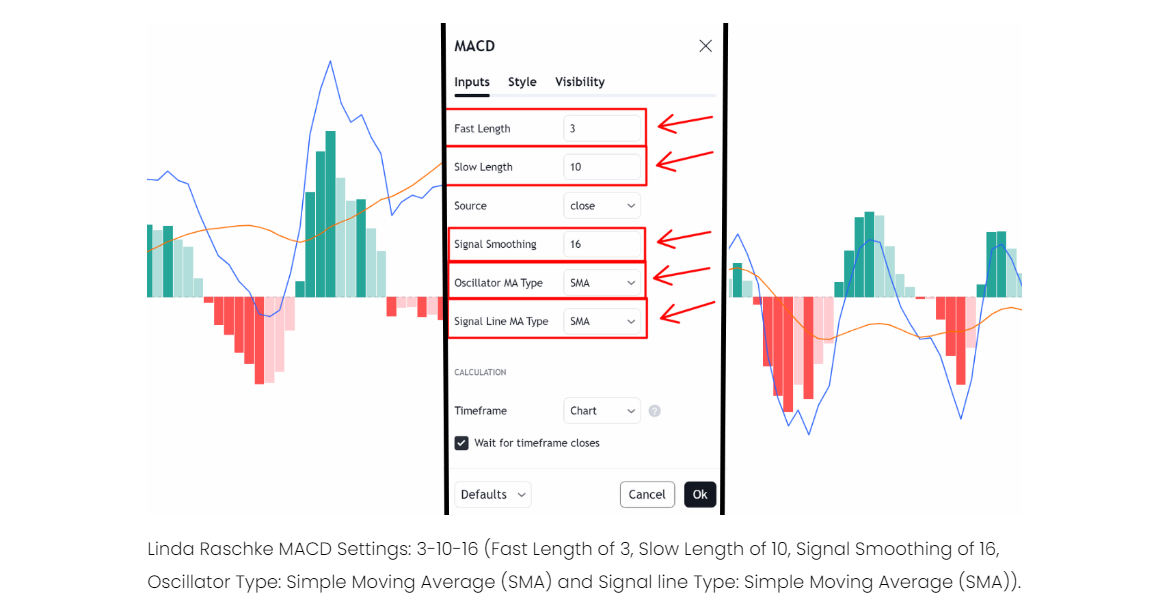

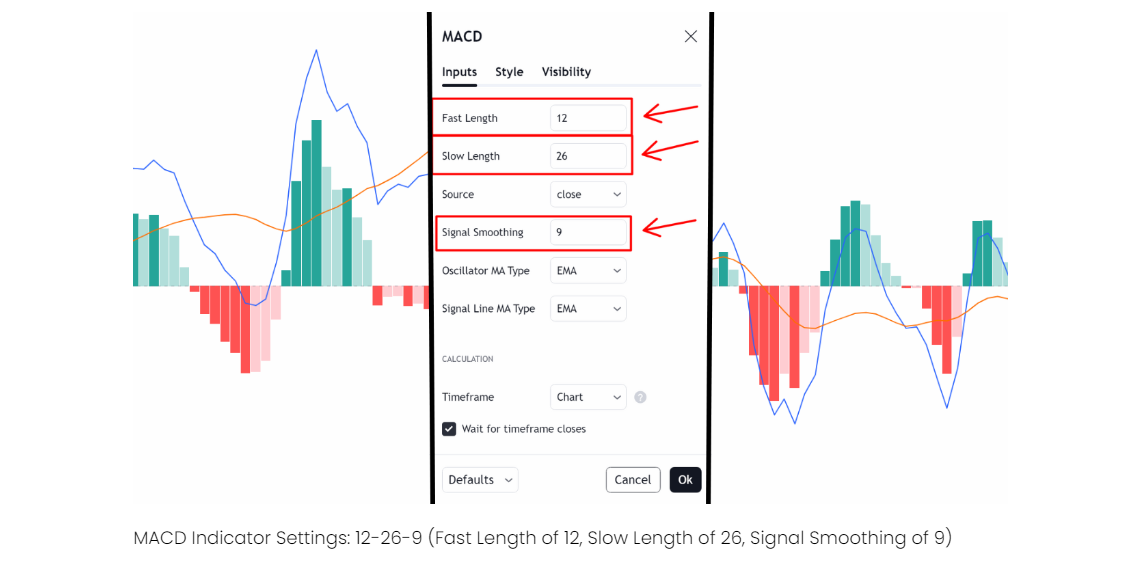

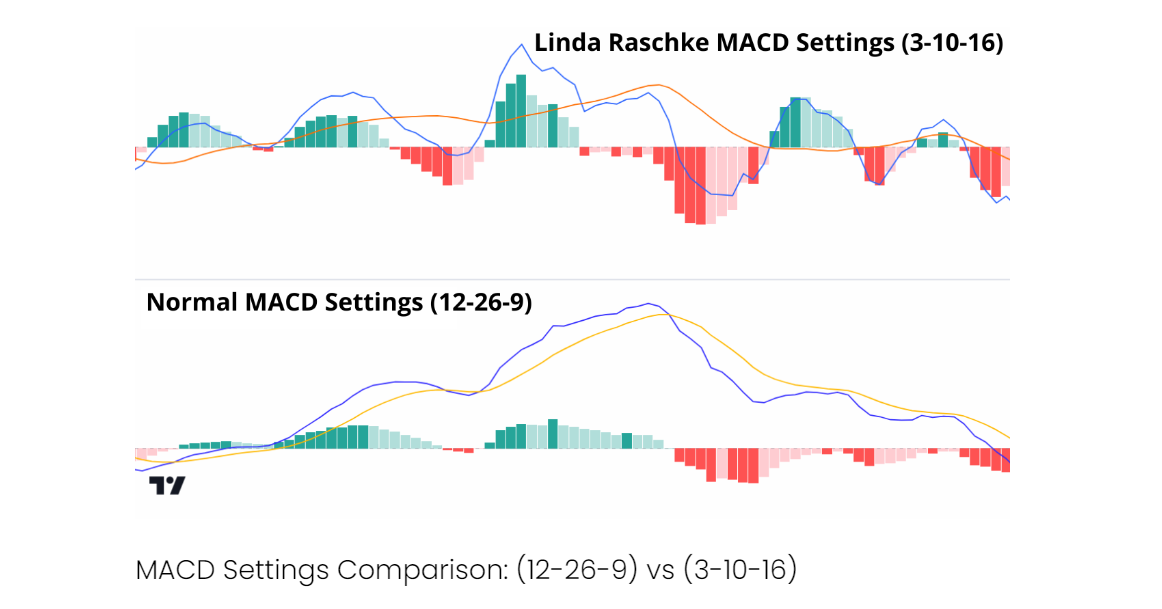

Standard MACD settings (12. 26. 9) are best suited for swing or position trading. However, in the context of day trading, faster settings can offer earlier signals. One of the most popular fast setups is 3-10-16. a configuration promoted by trader Linda Raschke, which uses simple moving averages (SMA) rather than the standard exponential moving averages (EMA). The shorter lookback periods help traders capture intraday momentum shifts more swiftly.

Standard MACD settings (12. 26. 9) are best suited for swing or position trading. However, in the context of day trading, faster settings can offer earlier signals. One of the most popular fast setups is 3-10-16. a configuration promoted by trader Linda Raschke, which uses simple moving averages (SMA) rather than the standard exponential moving averages (EMA). The shorter lookback periods help traders capture intraday momentum shifts more swiftly.

An even more aggressive variation is 5-34-1. where the signal line reacts almost instantly. The trade-off is that these ultra-fast settings can trigger frequent whipsaws in ranging or choppy conditions. Therefore, traders using such settings must be adept at filtering out noise and confirming signals through other means.

An even more aggressive variation is 5-34-1. where the signal line reacts almost instantly. The trade-off is that these ultra-fast settings can trigger frequent whipsaws in ranging or choppy conditions. Therefore, traders using such settings must be adept at filtering out noise and confirming signals through other means.

Timing Entries & Exits

When applying MACD to short timeframes (1-minute, 5-minute, or 15-minute charts), the timing of entries and exits becomes critical. In day trading, profits are often marginal, so precision matters.

A typical strategy involves buying when the MACD line crosses above the signal line, particularly when this occurs below the zero line (suggesting early bullish momentum). Conversely, a short position might be considered when the MACD line crosses below the signal line above the zero line. These setups work best when combined with price action patterns—such as breakouts from consolidation—or candlestick signals like pin bars or engulfing candles.

It's also effective to monitor the MACD histogram. A growing histogram can indicate that momentum is building in the current direction, helping traders ride the move rather than exiting too soon.

Whipsaw Risk Management

One of the main pitfalls of using fast MACD settings is the tendency to generate false signals during periods of low volatility or directionless price action. This is often referred to as whipsaw risk—where the indicator flips direction frequently and results in multiple losing trades.

To mitigate this, many day traders pair MACD with volume-based indicators such as VWAP (Volume Weighted Average Price) or On-Balance Volume (OBV). These tools help confirm whether a breakout or crossover is backed by real market participation.

Another method is to avoid trading during overlapping market sessions or ahead of major news releases, when volatility may spike unpredictably. Additionally, applying time-of-day filters—such as trading only during the opening hour of London or New York sessions—can improve signal reliability.

Confirmation Techniques

Relying on MACD alone can lead to overtrading. That's why professional scalpers often use it alongside other indicators to confirm signals. A popular pairing is with the Relative Strength Index (RSI), which measures overbought and oversold conditions. For example, if the MACD shows a bullish crossover and the RSI is rising from oversold territory (below 30), this alignment increases confidence in the trade.

Bollinger Bands can also be helpful. If price breaks above the upper band while the MACD confirms bullish momentum, this may suggest a high-probability continuation. Conversely, a price touch of the lower band with bearish MACD crossover may imply downside extension.

Some traders even combine MACD with moving average crossovers or trendlines to validate direction. The key is to look for confluence rather than using conflicting tools.

Backtesting & Optimisation

Before applying custom MACD settings in a live trading environment, it is essential to conduct backtesting. This involves running the chosen parameters (e.g. 3-10-16) through historical data on the specific asset and timeframe you intend to trade. The aim is to gauge win rate, average reward-to-risk ratio, and drawdown.

Day traders often discover that different settings perform better on different instruments. For example, what works on gold (XAU/USD) during the London session may fail miserably on Nasdaq futures during pre-market hours. This is why optimisation—adjusting the settings based on asset volatility, volume behaviour, and session timing—is a core part of the process.

Modern trading platforms like TradingView or MetaTrader offer built-in strategy testers, making it easier to refine MACD parameters. For those more technically inclined, tools such as Python's backtrader or R's quantstrat can be used to evaluate performance over thousands of data points.

Final Thoughts

MACD can be a powerful tool for day trading when settings are adjusted to suit the speed and volatility of the market. Fast configurations like 3-10-16 or 5-34-1 offer timely entry signals but must be used with caution to avoid being caught in whipsaws. Integrating volume filters, additional indicators, and strict entry/exit rules is essential for consistent performance.

Ultimately, no setting is universally perfect. The best MACD setup is the one thoroughly tested, adapted to your trading style, and aligned with how a particular market behaves during the session you trade.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.