The yen to AUD exchange rate is a key focus for currency traders, reflecting the dynamic interplay between Japan's safe-haven yen and Australia's risk-sensitive dollar.

As global markets shift in 2025, understanding the drivers and technical outlook for this pair is essential for anticipating the next big move.

Yen to AUD: Recent Performance and Current Rate

The yen to Australian dollar (JPY/AUD) rate has seen notable movement over the past year. As of early June 2025, the exchange rate stands at 0.0107 AUD per 1 JPY, marking an 11.46% increase from 0.0096 one year ago.

This upward trend reflects a period of yen strength and Australian dollar weakness, shaped by shifting monetary policies and global risk sentiment.

Key Drivers Shaping Yen to AUD

1. Interest Rate Differentials

The divergence in monetary policy between the Bank of Japan (BoJ) and the Reserve Bank of Australia (RBA) is a primary force behind yen to AUD fluctuations.

In 2025, the BoJ is expected to consider further rate hikes, buoyed by a stronger yen despite weak domestic economic data. In contrast, the RBA has already cut rates earlier in the year, with markets now anticipating a total of 75 basis points in cuts for 2025. This narrowing rate differential has favoured the yen, supporting its recent gains against the AUD.

2. Economic Data and Growth Prospects

Japan's Q1 2025 GDP contracted by 0.2% quarter-on-quarter and 0.7% annualised, signalling ongoing economic challenges. However, the yen remains resilient, partly due to expectations of further BoJ tightening and safe-haven flows.

Meanwhile, Australia's Q1 GDP growth slowed to 0.2% quarter-on-quarter, missing expectations, though the labour market remains a bright spot. Stronger jobs data has tempered expectations for aggressive RBA easing, providing some support for the AUD.

3. Risk Sentiment and Global Trade

The yen is traditionally considered a safe-haven currency, attracting flows during periods of global uncertainty. Conversely, the AUD is highly sensitive to risk appetite and commodity prices. Recent improvements in global trade sentiment, including tariff reductions between the US and China, have provided some tailwinds for the AUD.

However, any escalation in geopolitical tensions or a downturn in risk appetite could quickly reverse these gains, strengthening the yen against the AUD.

Technical Outlook: Where Next for Yen to AUD?

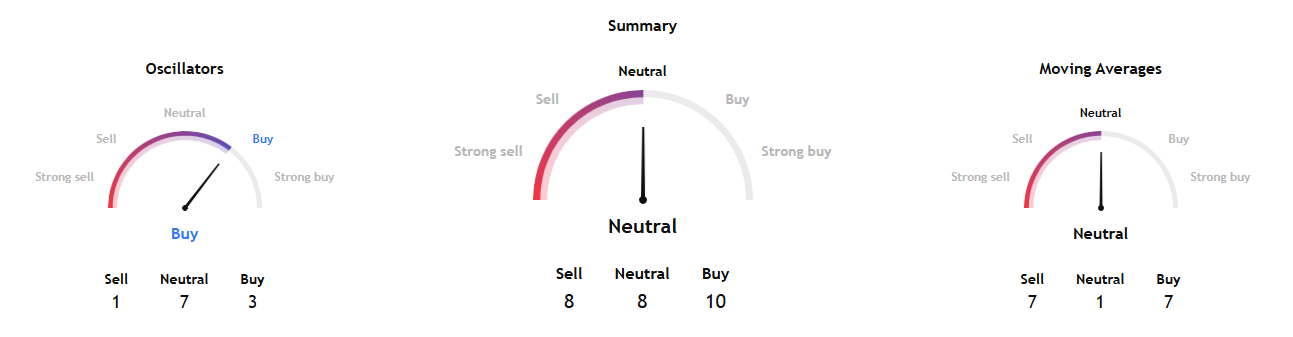

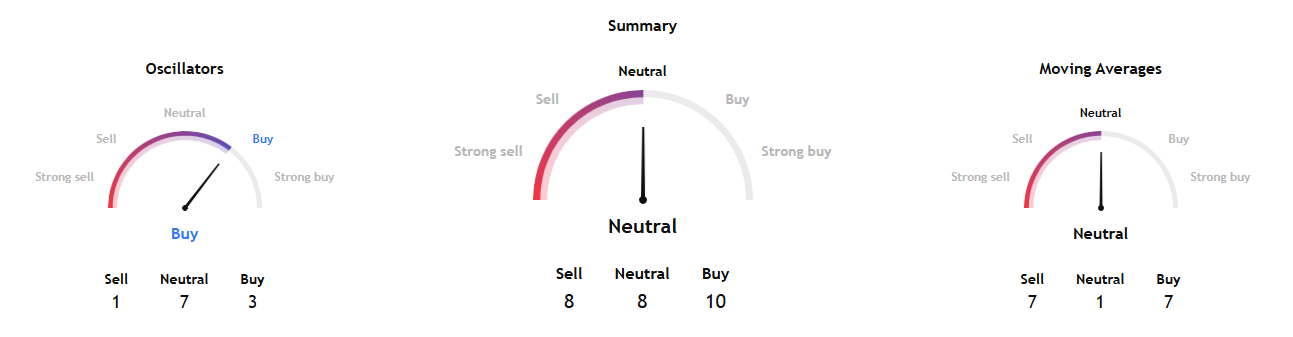

Technical analysis offers further insight into the yen to AUD's next move. The pair has shown a bullish trend over the past five months, rising from a low of 0.0101 in January to 0.0107 in June 2025, a gain of nearly 5%. Forecasts suggest the rate could reach 0.0111 by June, 0.0110 by September, and 0.0108 by December 2025. Short- and medium-term sentiment remains bullish, though the long-term view is more cautious.

Moving average signals are mixed. The yen to AUD rate is currently trading below its 8-day, 21-day, and 50-day exponential moving averages, indicating some short-term bearish momentum. However, bullish crossovers have occurred recently, suggesting the potential for renewed upside.

The MACD (Moving Average Convergence Divergence) line is below its signal line, confirming a downtrend, but any sustained move above resistance levels could shift momentum in favour of the AUD.

Key Support and Resistance Levels

For traders, monitoring key technical levels is crucial:

Support: The initial support for AUD/JPY is at 91.68, with further downside risk to 90.70 and the psychological 90.00 level. For yen to AUD, this translates to resistance against further AUD gains.

Resistance: Immediate resistance for AUD/JPY is at 93.90, then 94.78 and 95.65. For yen to AUD, a break above 0.0111 would signal further yen strength.

What to Watch in the Coming Months

1. Central Bank Decisions

The next policy meetings of the BoJ and RBA will be pivotal. Any surprise rate move or change in guidance could spark volatility in the yen to AUD pair.

2. Economic Releases

Keep an eye on Japanese and Australian GDP, employment, and inflation data. Better-than-expected data could support the respective currency, while disappointments may trigger sharp moves.

3. Geopolitical and Trade Developments

Progress in US-Japan and US-China trade talks, as well as any escalation in regional tensions, will influence risk sentiment and, by extension, the yen to AUD exchange rate.

Trading Strategies for Yen to AUD

Trend Following: With the pair in a medium-term uptrend, traders may look for pullbacks to support as buying opportunities, especially if technical indicators confirm a reversal.

Range Trading: If the pair consolidates, range-bound strategies around key support and resistance levels may be effective.

Event-Driven Trading: Be prepared for volatility around central bank meetings and major economic releases.

Conclusion

The yen to AUD currency pair is at a crossroads, shaped by diverging central bank policies, shifting economic data, and global risk sentiment. While the medium-term trend favours the yen, traders should remain nimble, watching for technical signals and macroeconomic developments that could trigger the next big move.

Staying informed and disciplined will be key to navigating this dynamic market in the months ahead.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.