Palantir Technologies (NYSE: PLTR) has been one of the most closely watched tech stocks of 2025. With explosive revenue growth, soaring investor interest, and a share price that's climbed well past earlier-year levels, speculation is mounting that the company could soon announce its first-ever stock split.

However, is a split really on the horizon and does Palantir's latest earnings support that theory? Let's explore what's driving the chatter, what history suggests, and how investors might position themselves.

Why Palantir Stock Split Is in the Spotlight?

A stock split doesn't change the underlying value of a company; it simply increases the number of shares and lowers the price per share proportionally. The key effect is psychological and liquidity-based: it makes shares appear more affordable and increases market accessibility.

Historically, high-performing companies such as Apple, Amazon, and Nvidia have split shares to maintain liquidity and attract retail investors.

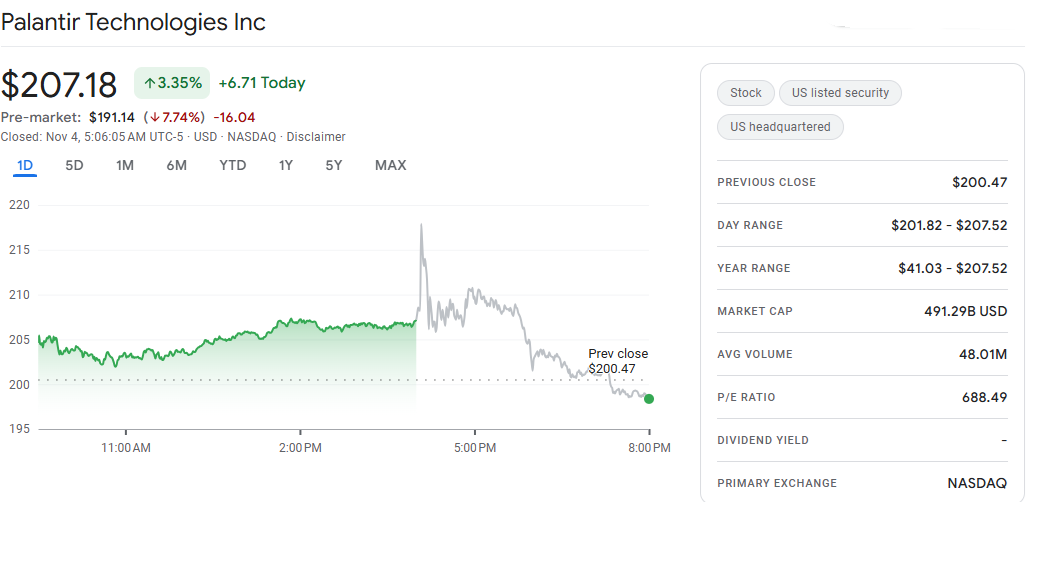

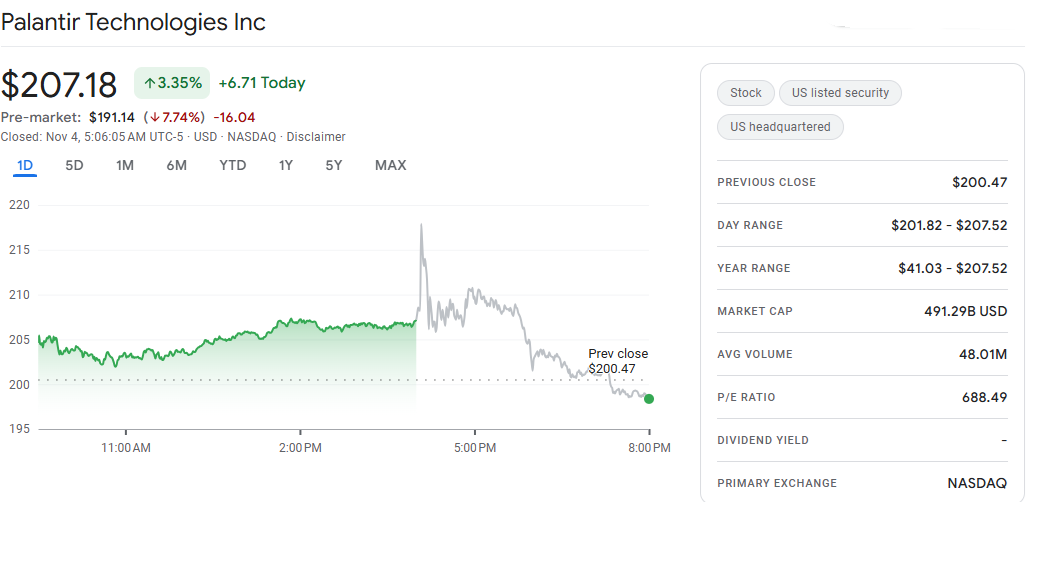

Palantir's stock has been one of 2025's strongest performers, up roughly +160–175% year-to-date, and trading around the low-to-mid $200s at the time of the Q3 print.

This powerful rally, driven by strong AI adoption, expanding commercial deals, and robust government contracts, makes it a natural candidate for a future split.

PLTR Q3 2025: Why the Strong Earnings Raise a Split Probability

PLTR's third-quarter results, released in early November 2025, offer a compelling backdrop to the split speculation. Here are the key facts and how they tie into the split narrative:

| Metric |

Q3 2025 Result |

Year-on-Year Change |

Key Notes |

| Revenue |

$1.18 billion |

+63% |

Beat expectations of ~$1.09 billion; driven by U.S. commercial growth |

| Adjusted EPS |

$0.21 |

+24% |

Exceeded consensus of $0.17 |

| U.S. Commercial Revenue |

$397 million |

+121% |

Explosive expansion among corporate clients [1]

|

| U.S. Government Revenue |

$486 million |

+52% |

Continued strength in defense and federal contracts |

| FY 2025 Revenue Guidance |

$4.396–$4.400 billion |

Up from ~$4.15 billion |

Reflects management confidence |

Why This Matters for the Split Narrative

1. The share price reached all-time highs recently, attracting headlines and retail interest; several media outlets and analyst notes have flagged Palantir as a plausible next split candidate. [2]

2. Influential analysts and sell-side commentators have stated publicly that they would "not be surprised" or that a split is "very likely," which heightens expectations leading to market activity before official confirmation.

3. Investors frequently urge well-known companies with elevated absolute prices (and significant retail ownership) to split shares, as lower per-share prices can enhance accessibility for small retail buyers.

All that said, rumour does not mean reality. Until the company files the ordinary-course board resolution or an 8-K, there is no official split. Multiple outlets continue to note that there is currently no formal indication from Palantir's management that a split is imminent.

The Current Facts: What We Know So Far About PLTR Stock

1. Share Price & Market Cap:

Palantir trades above $200 per share after a 2025 rally; market-cap estimates are in the high hundreds of billions (varies with intraday moves). Use your broker or a live quote for the exact minute-by-minute figure.

2. No Announced Split:

Palantir has not filed an 8-K or issued a press release announcing a split as of early November 2025. All public reports to date consist of speculation or analyst opinions.

3. Analyst Chatter:

Multiple analysts (RBC, Wedbush, D.A. Davidson, others) have publicly discussed the prospect of a split, and some have said they "would not be surprised" if management approved one around earnings or at a board meeting. Those comments are influential for retail-heavy stocks.

Stock splits are binary corporate events, causing rapid market reactions to even plausible rumours, as shares typically increase before a split announcement due to investor expectations of heightened retail involvement and enhanced liquidity afterwards.

However, keep in mind that the split does not alter revenue, profit, or overall value.

How Likely Is a Palantir Stock Split?

Nobody knows for sure until Palantir acts. Still, we can outline realistic scenarios based on precedent, company incentives, and market signals.

Scenario A: Split Announced Soon (Higher Probability in Market's View)

Trigger: Management wants to broaden retail access, simplify employee compensation, and capitalise on momentum (often timed around positive earnings).

Mechanics likely: A forward split (e.g., 5-for-1 or 10-for-1) that increases share count and reduces price proportionally. The board would declare record and distribution dates, and exchanges/options would be modified accordingly.

Market effect: Short-term positive reaction (retail buying, tighter spreads). Long term: no fundamental impact. Analysts who expect this scenario point to Palantir's retail base and large share run as the main drivers.

Scenario B: No Split This Year (Moderate Probability)

Trigger: Management decides the current price level is not a problem, wants to avoid distraction, or prefers to keep shares at current levels for strategic reasons.

Mechanics likely: No official action; price may continue to trade on fundamentals and sentiment. The stock could still experience volatility around earnings and macro events. Several objective analysts caution that a split is not guaranteed and the company has not signalled intent.

Scenario C: Split Teased but Deferred (Lower Probability)

Trigger: The board signals openness to a split later (e.g., after meeting certain operational milestones), or they set a policy to keep splits for later.

Mechanics likely: Management language that keeps the option open, which itself can support the stock but also create expectations that must be managed.

Which is likeliest? Market chatter and some sell-side notes make Scenario A the "priced" possibility. However, chatter is not a filing. Use position sizing prudently.

What History Suggests: Lessons from Other Tech Giants

| Company |

Split Year |

Pre-Split Price Range |

Reason for Split |

|

Apple (AAPL) |

2020 |

$400+ |

Broaden retail access amid growth momentum |

| Amazon (AMZN) |

2022 |

$2,000+ |

Liquidity boost, investor accessibility |

| Nvidia (NVDA) |

2021 |

$700+ |

Surge from AI and gaming boom |

| Alphabet (GOOG) |

2022 |

$2,800+ |

Broaden participation, tech sector optimism |

These companies often announced splits after strong earnings runs, just like Palantir's current streak.

The key takeaway is that a Palantir stock split is not guaranteed, but the conditions are strikingly similar.

How to Track Official Developments of Palantir Stock Splitting

If you want to be first to know (or confirm) whether Palantir will split, monitor these items:

SEC filings / 8-K

Company press release & investor relations page:

Broker & OCC memos:

Reliable financial press

Should you notice several sources like Reuters, Bloomberg, EBC, or others referencing an SEC filing or Palantir's 8-K, you can consider the split as validated. Until then, treat all talk as speculative.

Frequently Asked Questions

1. Has Palantir Officially Announced a Stock Split?

No. As of now, Palantir has not issued a press release or filed an SEC 8-K confirming a stock split.

2. Will Palantir Technologies Split Its Stock Soon?

Many investors are speculating that Palantir could announce a split in 2025 or 2026.

3. How Have Similar Companies Responded to Stock-Split Speculation?

Nvidia Corporation, Amazon.com, Inc. and others have executed splits after large price runs and strong growth, often citing broader accessibility and liquidity.

Conclusion

Whether or not Palantir executes a stock split soon, the Q3 2025 results make a compelling case for long-term strength. Revenue acceleration, record commercial growth, and consistent profitability position the company as one of the top AI players in the market.

A split, if announced, would symbolise confidence and accessibility, not create value on its own. Investors should focus on fundamentals, not headlines.

But make no mistake, if Palantir continues its upward trajectory through Q4 2025, the probability of a 2026 stock split announcement will rise sharply.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.investors.com/news/technology/palantir-stock-split-palantir-earnings/

[2] https://www.wsj.com/tech/palantir-earnings-report-q3-2025-pltr-b0c29ec6