The Silicon Valley banking incident has come to a temporary end, but the pressure has come to the European banking industry.

Although Credit Suisse was eventually acquired by UBS for 3 billion Swiss francs with various efforts, it also led to the bank's $17.2 billion high-risk ATI bonds being "cleared overnight".

Simply put, the AT1 bond was completely written down by Credit Suisse. This means that all investment funds are directly converted into the capital reserves of Credit Suisse, but the investment institutions investing in Credit Suisse AT1 bonds will lose everything. This has caused a huge shock in global financial markets.

The relationship between investment and regulation may be reshaped

The Credit Suisse AT1 bond incident made the market realize that the return on AT1 investment is far lower than the risk, and prompted global asset management institutions to sell AT1 bonds.

As a Swiss financial regulatory agency, FINMA, although directly facilitating the merger of UBS and Credit Suisse and providing sufficient liquidity tools to alleviate the crisis, is also one of the contributing factors for the complete write down of AT1 bonds.

FINMA in its published ResolutionAccording to the report, creditors of systemically important banks have different procedural rights in restructuring compared to creditors of other banks. FINMA will approve the restructuring plan without prior consultation with creditors, and in order to protect the implementation of the restructuring and related financial stability goals, creditors must not refuse the restructuring plan.

This has also prompted the market to re-examine the relationship between investment and regulation.

Further highlighting the value of the FCA investor protection plan

For the foreign exchange market, regulation is an indispensable and crucial aspect.

Due to issues related to independent custody of funds, platform stability and liquidity, and deposit and withdrawal in foreign exchange transactions, if there is a lack of supervision in any aspect, it may be exploited by false platforms, resulting in losses for investors.

At present, there are a total of 10 major financial regulatory agencies worldwide, including the UK FCA, Australia ASIC, Switzerland FINMA, and the US NFA. Among them, FCA has the longest duration and strictest regulation.

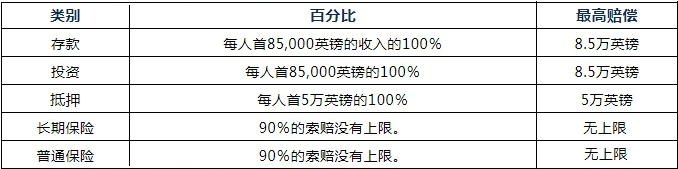

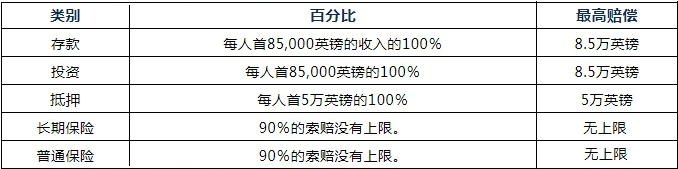

However, among the regulatory agencies mentioned above, only the FCA has a Financial Services Compensation Scheme (FSCS) specifically targeting investors - a platform regulated by the FCA, whose clients will automatically be included in the FSCS protection category; Once the platform breaches the contract and cannot pay the user's claim, their client will have the right to apply to FSCS and receive compensation. The general protection standards are as follows:

At present, the maximum compensation standard for FCA has reached £ 85000, which can cover the funding limit of most retail investors. From 2001 to 2021, FSCS assisted a total of 4.5 million people and paid over £ 26 billion, which is unique in the financial industry.

And this Credit Suisse ATI bond incident also highlights the importance of investor protection under strict regulatory mechanisms. This further demonstrates the value of FCA regulation.

How to identify FCA regulation?

As the value of FCA regulation highlights, FCA licenses are also being sought after by more and more investors.

However, the application for FCA licenses has always been known for its strictness, and with the strengthening of regulations in recent years, FCA has further reduced the issuance of licenses and even cancelled the qualification of non compliant platforms. So, some non compliant platforms will flaunt the market under the banner of FCA.

So it is particularly important to identify and distinguish between legitimate FCA licensed institutions.

Generally, FCA will update the regulatory status of the trading platform in real-time on its official website, specifying the effective date of regulation; And legitimate platforms will also provide FCA regulatory numbers for investors to check.

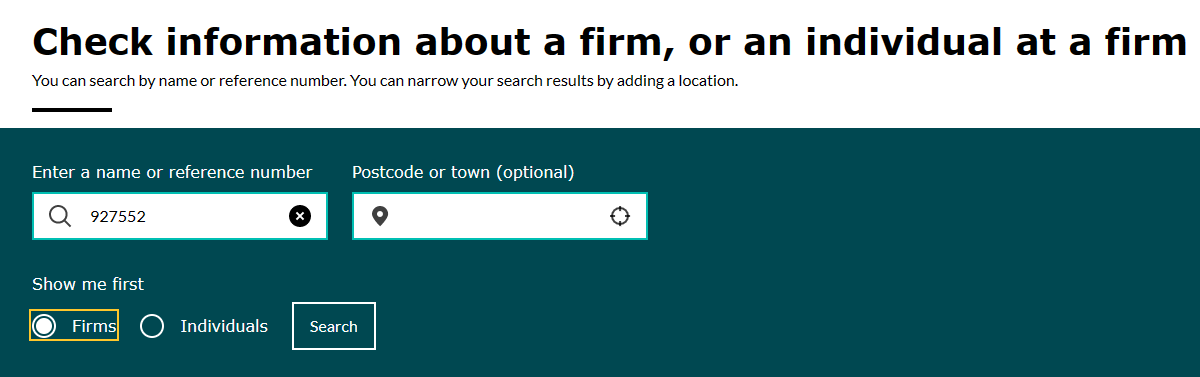

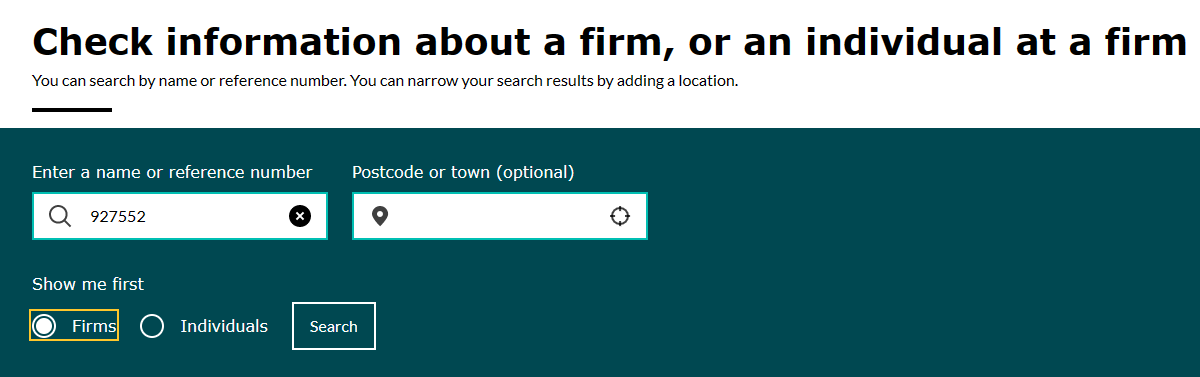

Taking the FCA licensed institution EBC as an example, open the FCA inquiry website: https://register.fca.org.uk/ Enter the regulatory number 927552 of EBC in the search bar and click on firms to search.

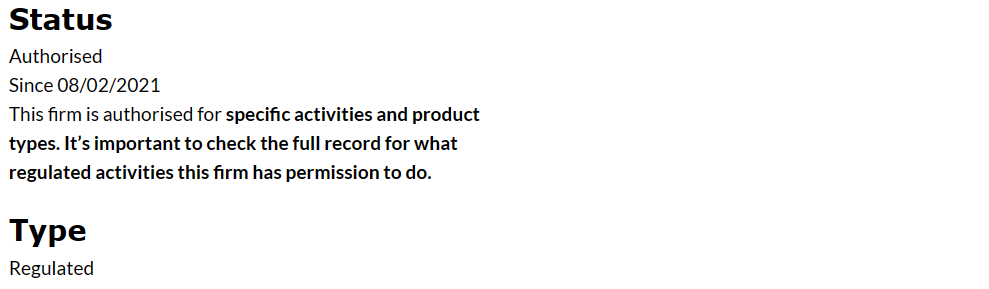

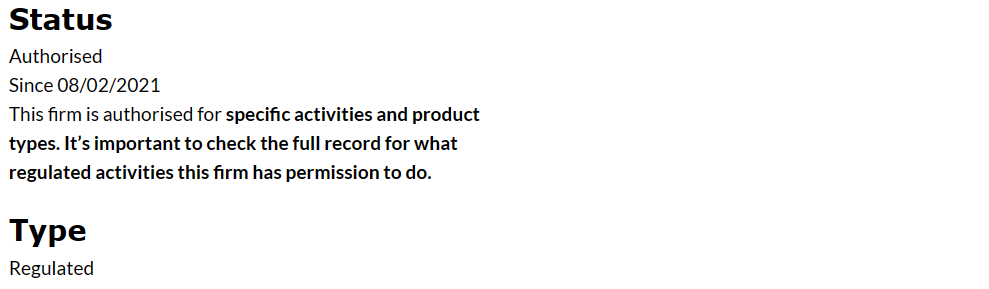

Then we can see all the detailed information about EBC, with Authorized and Regulated displayed in the Status and Type columns respectively, indicating that the company is under effective supervision by the FCA.

Please note that the Status column must only have the words' Authorized '. If it is an EEA Authorized (European Union license plate) or other words, it is not fully licensed supervision.

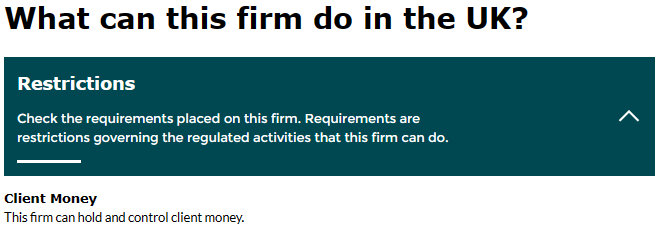

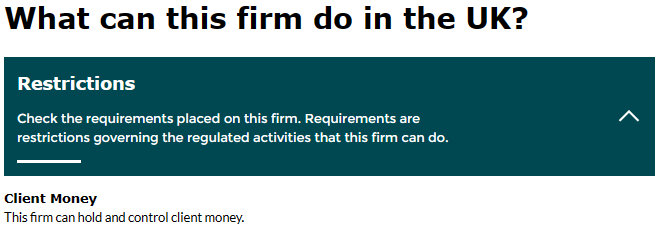

Step 2, check the Client Money column

比如EBC在这一栏上,显示的是“This firm can hold and control client

money”。只有全监管牌照会显示这样的字样。

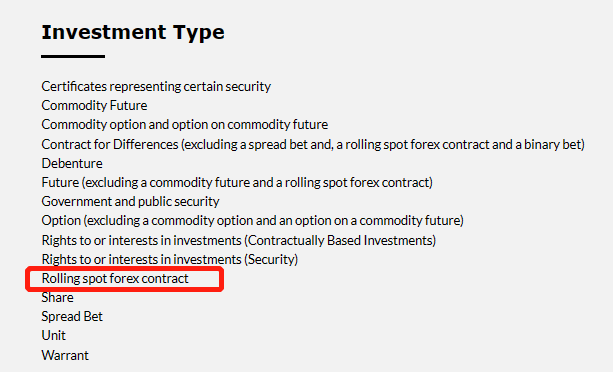

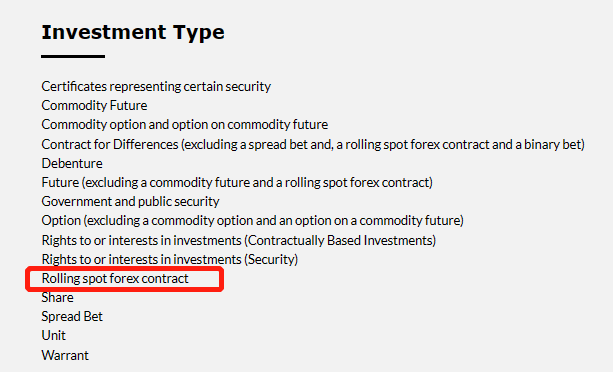

Step 3, check the Investment Type. If the platform information does not involve spot foreign exchange transactions (Rolling spot forex)Contract), then we need to quickly keep an eye on it.

After completing the above three stEPS, it is basically possible to determine whether a platform is a licensed institution under full FCA supervision.

Since the Silicon Valley banking incident, the global banking liquidity crisis has emerged. In uncertainty, investment is no longer about catching shallow fish in calm waters, but finding a calm harbor amidst the waves.

The Credit Suisse AT1 bond event also reflects the importance of reshaping supervision and investment protection under the wave of Financial innovation.

When the era is at such a singularity, the FCA, as the leader of the global regulatory system, appears even more commendable.