The hegemony of the US dollar has angered the world, and de dollarization has become an inevitable trend. The tide of history is irreversible!

What exactly is US dollar hegemony? How did the US dollar become an international settlement currency? Why do countries around the world want to break free from the constraints of the US dollar? Today, let's talk in detail about this period of history.

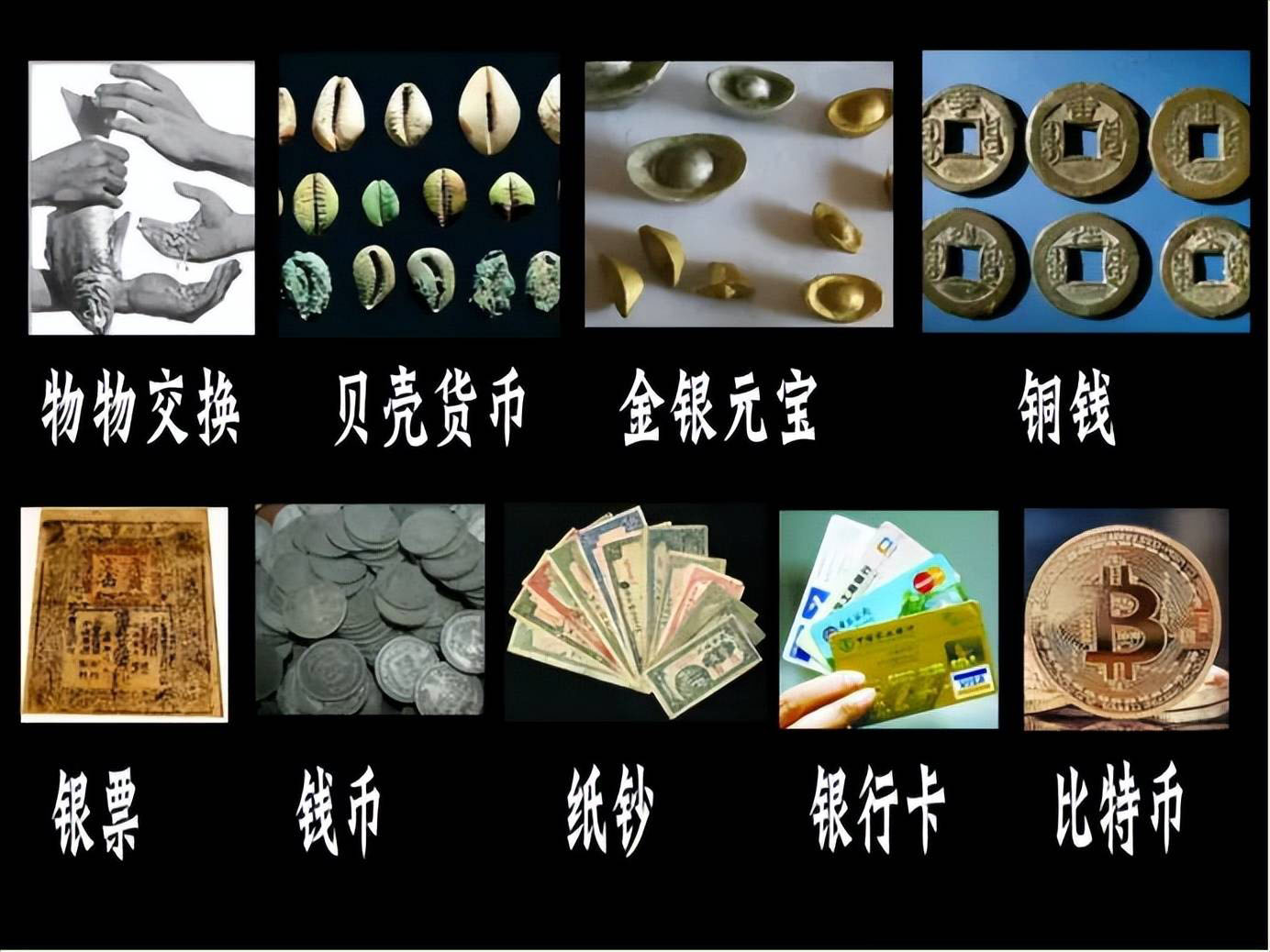

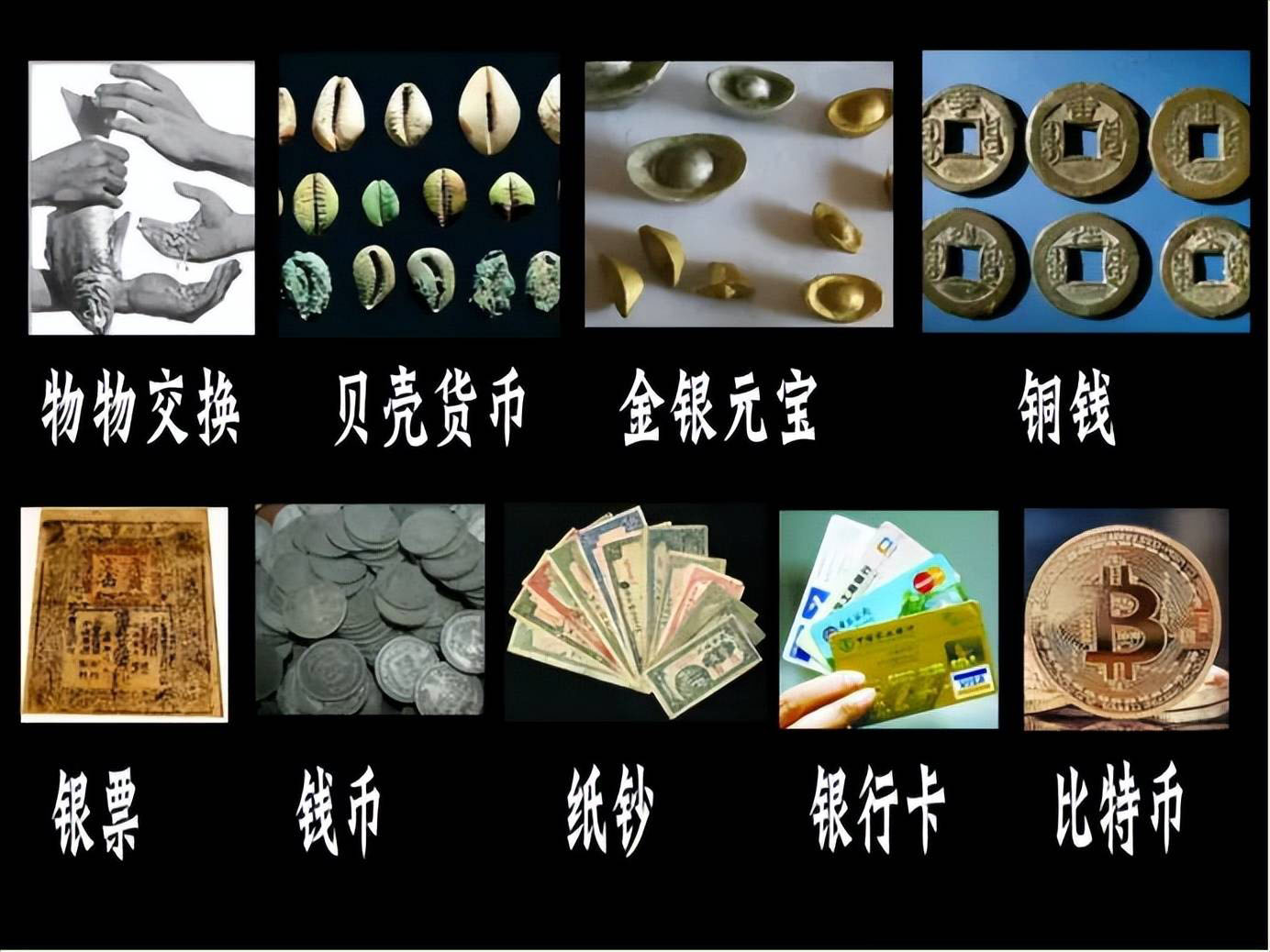

What exactly is money?

Firstly, we need to understand what money is.

Actually, everyone has heard that in ancient times, people grew potatoes, rice, and vegetables. Everyone didn't want to just eat what was in their hands, so they started exchanging with each other. But your second aunt has corn, and my uncle has vegetables. Unfortunately, your second aunt doesn't want to eat vegetables. My uncle doesn't want to eat corn, so he can only exchange it for your food first. You can exchange it with me, and I can exchange it with my uncle. This is too troublesome, so someone invented currency to measure the prices of different goods and then make purchases.

To put it more plainly, the so-called "money", to put it better, is the credit of a person/country. To put it more plainly, it means the same as "IOU". Just to ensure authority, this type of "IOU" is issued by the government. You took your second aunt's corn and used currency as an IOU, and then your second aunt can directly use this "IOU" to exchange food with my uncle. My uncle takes the "IOU" and then exchanges it with someone else for what he wants to eat.

After all, money is not actually a physical object, it cannot be eaten or worn, it only appears as a measure of the physical object.

For example, in a closed environment with only one hundred kilograms of rice and one hundred yuan, then one kilogram of rice is worth one yuan; If there is ten thousand yuan, then one hundred yuan can buy one kilogram of rice, which is called inflation, so the more money is printed, the better. If there are ten thousand catties of rice and ten thousand yuan in the room, although the unit price of rice remains the same, life will still be more prosperous.

With the development of human transportation technology, countries around the world have gradually become interconnected, and the environment has become no longer completely closed. As a result, currency is facing a new dilemma: you said that your family's money can buy one kilogram of rice for one yuan, but I think your family's money is not worth it. Only ten yuan can buy one kilogram of rice. What should we do?

Later, people decided to use the price of gold to measure the value of currencies in various countries. Because gold is a hard currency in all countries of the world, it can be used as a standard to measure the value of money just like the weight of a balance.

Bretton Woods System

After World War II, 44 countries from around the world gathered in the town of Bretton Woods in the United States. After a fierce debate, everyone ultimately decided to peg the US dollar to gold, with 1 ounce of gold=35 US dollars, hence the US dollar is also known as the US dollar. The currencies of other countries were thus linked to the US dollar, which became the international currency, known as the Bretton Woods system.

The example of the "closed environment" just now is no longer the case for the US dollar. It is an international currency, so it can circulate around the world. But American goods are relatively more closed, so while the United States prints a lot of money, the pressure of inflation is shared by the world.

Therefore, whether it was during previous wars or during the pandemic a few years ago, once the United States ran out of money, it could boldly print money. In other countries, printing money like this will inevitably lead to economic collapse, but the United States can rely on the global market to dilute, and the risk is much smaller.

In the same example as above, let's assume that the United States has one hundred catties of rice and one hundred dollars, and then he prints ten thousand dollars. This ten thousand dollars not only circulate in his own environment, but also go to other countries to exchange goods. The final result is that the "closed environment" in the United States may have already circulated 5000 dollars, but it has also exchanged 5000 kilograms of rice from abroad. Other countries lost 500 kilograms of rice for no reason, in exchange for 5000 US dollars.

You should still remember the saying: Money is just an "IOU", it is "credit", not physical goods. If I casually type an IOU and give my credit on the train, is this credit still worth it?

The United States did just that. After World War II, they not only lent money to other countries, but also went to war everywhere and engaged in arms and space races with the Soviet Union. How could they spend so little money? What if it's missing? Keep printing dollars! So, they printed a large amount of dollars and exchanged them with foreign countries for various materials.

With more and more dollars, they become less and less valuable. Who wants to keep the dollars? Gold can still maintain its value! So everyone went to the United States with worthless dollars to exchange for gold, and a large amount of gold reserves in the United States flowed out. By 1959, the combined amount of dollars in the hands of countries around the world was enough to exchange all of America's gold.

Then the United States played a rogue role and announced the abolition of the Bretton Woods system in 1971, allowing the market price of gold to fluctuate freely and no longer pegged to the US dollar.

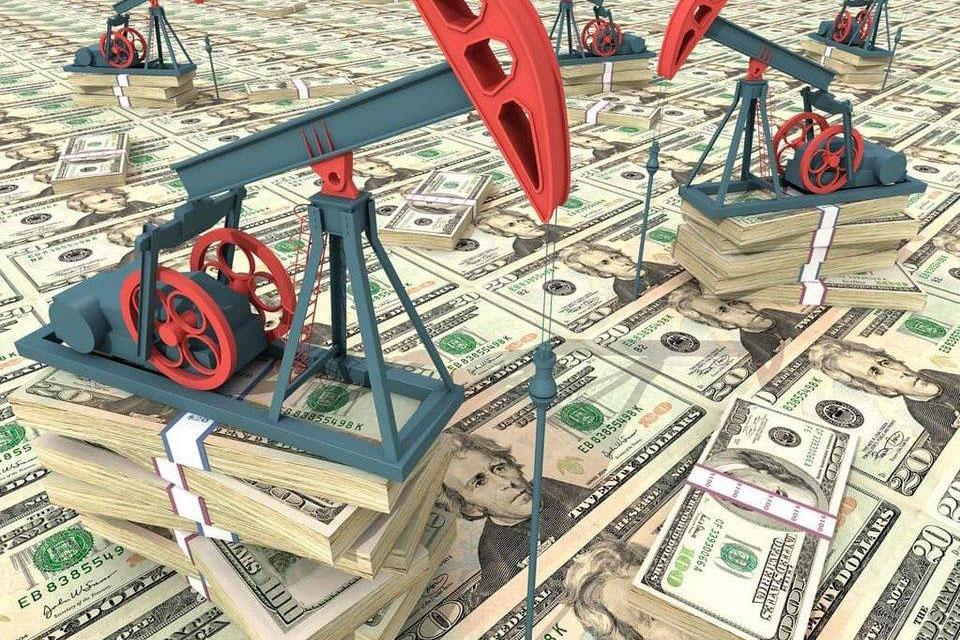

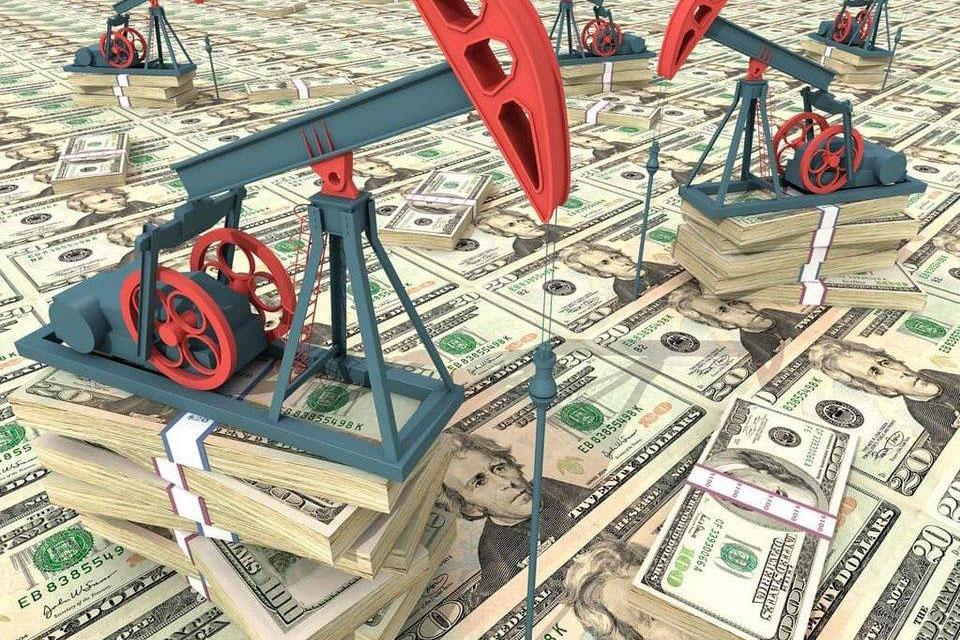

Petrodollars

Should the international monetary status of the US dollar be abolished at this time?

No, although the value of a currency heavily depends on the creditworthiness of the country's economy, it is still possible if the military is strong enough. Therefore, the United States only needs to find another hard currency and link it with the dollar.

Don't mention it, the Americans have really found oil. Oil is a resource to be used all over the world. There is only so much oil on the earth, and the output will not jump up and down. It is a standard hard currency.

So, the United States and Saudi Arabia, one of the world's highest oil producing countries, reached an agreement that buying their oil could only be paid in US dollars. After Saudi Arabia agreed, other countries also agreed that oil could only be purchased in US dollars.

In this way, even other countries have to reserve a large amount of dollars to buy oil. The US dollar is also linked to oil and continues to be used as an international currency, thus forming the dominance of the petrodollar.

The United States sends a large amount of dollars abroad, and then collects them for its own use in the form of treasury bond. The US dollar has circled the world as if nothing has been done, but goods from various countries around the world are constantly being transported to the United States. Therefore, as early as during the Bretton Woods system, French President Charles de Gaulle criticized: "The United States enjoys the arrogant privileges created by the US dollar and the deficit that does not shed tears. She uses worthless waste paper to plunder the resources and factories of other ethnic groups

With the establishment of a new dollar hegemony, the United States is naturally even more afraid of inflation. For example, during the COVID-19 epidemic, they sent a lot of dollars to the people. Where do these dollars come from? Isn't it printed yet? Anyway, many of these dollars can be exchanged for food, energy, and other commodities from other countries. Goods enter the United States and dollars flow abroad. Do you remember what money is? That's right, what countries around the world actually receive is a pile of "IOUs", causing inflation worldwide.

You may think: Does the US dollar still have credit for playing like this? Who is willing to use dollars in the future?

Dedollarization

You're right, many people also think the same way.

In fact, the hegemony of the US dollar is not limited to simply transferring the curse of inflation to the world. Americans are prone to imposing sanctions on certain individuals, businesses, and even countries, and the US dollar is also an important weapon for them. For example, countries such as Russia and Afghanistan, as well as their individuals, have their US dollar assets frozen by the United States without authorization. What is the difference between this and open robbery?

Therefore, in recent years, countries around the world have been considering breaking away from the US dollar and building a global multi currency system to reduce the global impact of single currency fluctuations.

This is not easy because people have inertia, and once they get used to it, it is difficult to change. But a series of economic turmoil in the United States has really caused other countries to be overwhelmed and have to embark on a process of de-dollarization. Therefore, both Americans and people from other countries say that this process of de dollarization was done by the United States itself.

If the United States still has absolute hegemony in the world, as it did in the 1970s, perhaps de dollarization would be even more difficult. But now there are many countries emerging in the world, such as the European Union, China, and so on. In addition, Brazil has always hoped to form institutions similar to the European central bank with countries such as Argentina to launch new currencies. When the United States was unable to form absolute rule in the military and technological fields, the status of currency also declined.

Taking China as an example, we have established corresponding currency settlement channels with Brazil, Russia, Türkiye, Pakistan and other countries, and can use RMB for trade settlement. Not long ago, India and Malaysia also established a settlement channel with Indian rupee. Even Saudi Arabia, which once helped the United States form US dollar hegemony, is now considering settling oil transactions in non US dollar currencies.

According to data from the International Monetary Fund, in the past 20 years, the proportion of the US dollar in the global reserve currency has decreased from 72% to almost 59%, with a significant decrease.

However, it is impossible to completely stop using the US dollar now. 80% of the global oil trade is still settled in US dollars. The US dollar is still the largest reserve currency in the world, and the US treasury bond bond market is still the largest bond market in the world.

Americans are not stupid either, naturally they will not ignore the process of global de dollarization. At the beginning, Saddam Hussein in Iraq did not want to settle oil in US dollars, which resulted in the consequences of an invasion. Japan wanted to compete with the United States by relying on the yen, but ended up being manipulated by the United States, causing a significant economic decline. This time, I don't know what other means the United States will use.

Speaking of it, de dollarization is the trend and the voice of the world. However, this process is quite lengthy and requires gradual progress. We will not see results in a short period of time, but we are currently in this historical process.