MetaTrader 5 (MT5) is the most popular trading platform in the world, known for its flexibility and powerful tools. It supports trading in all financial markets: forex, stocks, commodities and futures. It's suitable for both beginners and advanced traders with advanced charting, trading tools and more. Built on the foundation of MetaTrader 4 (MT4), MT5 has added new features such as additional timeframes and an economic calendar, so it's a must have for any trader who wants to take their strategies to the next level. MetaQuotes, the developer of MetaTrader 5, is a software company and does not provide financial services or manage platform servers.

Popular Trading Platform for Financial Markets

MetaTrader 5 is a trading platform for trading in all financial markets: Forex, stocks and other instruments. It has all the tools and features for traders to analyse and trade efficiently. With user friendly interface and advanced technical indicators, MetaTrader 5 is popular among all types of traders.

Forex, Stocks and other Instruments Trading

MetaTrader 5 allows traders to trade many financial instruments: Forex, stocks, commodities and cryptocurrencies. The platform provides real time quotes, charts and technical indicators so traders can make informed decisions and trade fast. MetaTrader 5 also supports market and limit orders, stop-loss and take-profit orders and pending orders.

Technical Indicators and Tools

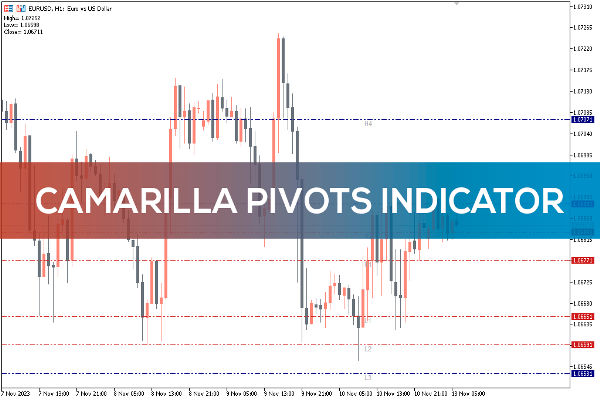

MetaTrader 5 has many technical indicator and tools: 80 built-in indicators and analytical objects, and 21 timeframes. With these tools traders can do deep technical analysis and find trading opportunities. The platform also supports automated trading through Expert Advisors (EAs) which can analyse the market and trade automatically.

MT5 Trading Robots Features and Benefits

One of the best features of MetaTrader 5 is the charting. Traders can analyse price movement with different chart types and 21 timeframes to identify trends and support and resistance levels. The platform also has the Depth of Market (DOM) tool which gives valuable information about market liquidity and helps in decision making especially during high volatility. MT5 also supports algorithmic trading, you can create your own indicators and trading robots using MQL5 language. With these features traders can trade efficiently, manage risk and automate their strategies.

Reuters news: One of the best features of MetaTrader 5 is the integrated Reuters news, giving traders real time information and updates about Forex and stock markets. This access to dozens of materials daily helps traders to make informed decisions in real time market situations.

Reuters News for Market Insights

MetaTrader 5 provides traders with integrated Reuters news, real time market analysis and insights. This feature helps traders to stay updated with market news and make trading decisions. The platform also supports push notifications so traders can receive alerts and updates on market events and trading activities.

Cross Device and Platform Experience

MetaTrader 5 provides seamless trading experience across different devices and platforms: desktop, mobile and web. The platform is designed to have a consistent and user friendly interface so traders can access their accounts and trade from anywhere, at any time. MetaTrader 5 also supports multiple languages so traders from all over the world can use it.

Trading with Technical Indicators

To succeed on MetaTrader 5, traders need to have good strategies. One popular strategy is trend following where traders ride the trend by entering in the direction of the trend. MT5 charting tools make it easy to spot the trend and determine entry and exit points. Another strategy is scalping where traders make multiple small trades to catch small price movements. MT5 has low latency order execution which is perfect for scalpers who need speed and precision. Breakout trading is also a strategy that can be done on MT5. By placing orders above resistance or below support levels, traders can profit from the sharp market movement after the breakout. These strategies involve real trading and high risk.

Risk Management and Backtesting in Financial Markets

Risk management is part of successful trading and MT5 has many tools to help traders to protect their investments. By setting stop loss and take profit orders, traders can limit potential losses and secure profits when their target levels are reached. MT5 backtesting allows traders to test their strategies with historical data which is very useful to refine and improve their trading plans before applying them in live markets. Whether you are a beginner or an experienced trader, backtesting and adjusting your strategy with real market data is a way to increase your chances of success.

Tips for success with MetaTrader 5

To be successful with MetaTrader 5, staying updated with global financial news is key. The built-in economic calendar in MT5 allows you to track market moving events in real time so you can plan your trades around major economic releases. Also, demo trading is highly recommended for beginners. This way traders can get familiar with the platform and develop their strategies without risking real money. By refining your skills, staying updated with market news and using MT5's tools you can improve your trading performance over time. But remember most retail investor accounts lose money so you need to understand the market and manage your risk.

Trade with MT5

MetaTrader 5 is a powerful platform that has everything a trader needs to trade in various markets. From advanced charting and automated trading to risk management tools, MT5 is designed to improve your trading strategies and long term profits. By learning MT5 and having good trading strategies, you can achieve your goals and trade to your full potential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.