Band trading is a trading method commonly used in many financial

trade. So what is band trading? Can forex trading also use

band trading? Today, let's introduce forex band trading to

everyone.

What is Band Trading?

Band trading was first applied in the stock market,

referring to the investment method of selling stocks at high prices and buying

stocks at low prices. In band trading, there is neither the frenzy of frequent

trading like short-term traders nor the long-term investors who rely on time for

space to wait. Band traders are engaged in mid-term market movements.

Usually, forex trading can be divided into two categories:

short-term trading and band trading. Short-term trading, also known as intraday

trading, is relatively common. In China's forex trading market, about

80% of investors are engaged in short-term trading. The second type of forex trading is called band traders, or position traders, because band

traders always do not close their positions in their accounts but constantly

reset their stop loss and stop loss ranges, as well as increase and decrease

positions, as the exchange rate in the market changes.

According to statistics, although short-term trading accounts for 80% of the

forex market in China, in terms of profitability, the opposite is

true. About 20% of investors' market profits account for as much as 90% of the

overall profits.

Next, we will explain specifically what forex band trading is.

Band trading requires a thorough preparation course before a trade. You

should have an overall grasp and understanding of the forex market

situation, such as the exchange rate trend, within a few months or a year.

Band trading has certain requirements for investors to master fundamental

knowledge. After preparing to predict the Market trend, find a suitable entry

point. At the same time, investors need to make careful plans in advance to

calculate the stop-loss position and reset the stop-loss protection for profit

in future market fluctuations. Band traders should always keep entry orders at

different points in their own positions, and the stop-profit and stop-loss

positions are also constantly changing.

Band trading is a trading method that follows the trend of the market

direction, and it is also a trading method that can achieve maximum capacity. Of

course, this trading method requires extremely high technical and psychological

resilience from traders.

If you are still frequently engaging in short-term trading, you can expand

your thinking to include band trading. This may be helpful for your current

situation and even open up a new perspective for your new trading path.

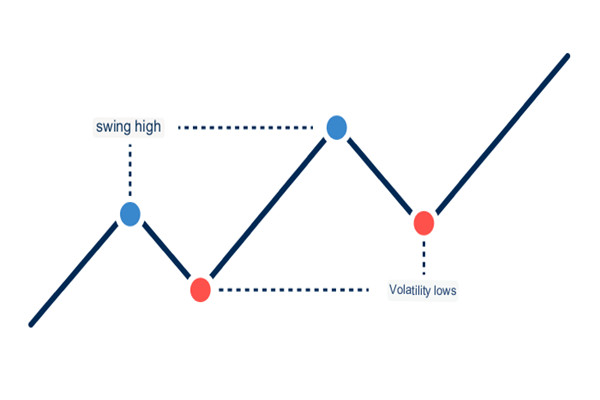

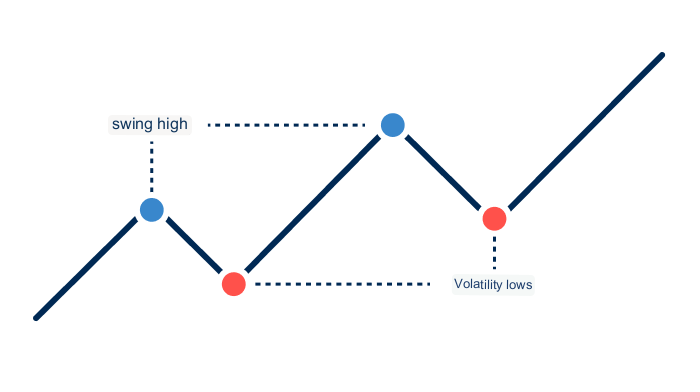

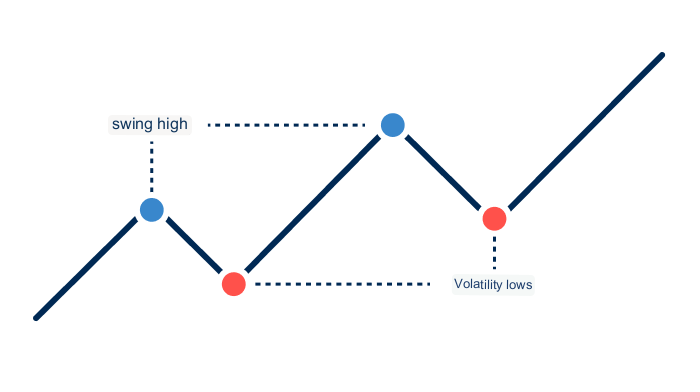

Band trading aims to utilize short-term fluctuations in financial market

prices to generate profits. Band traders attempt to capture short-term upward or

downward trends in asset prices by observing market trends, analyzing price

patterns, and using tools such as technical indicators, and then using these

fluctuations for buying and selling.

Band traders usually hold investment positions for several days to several

weeks and decide when to enter or exit the market based on short-term

fluctuations. They search for possible market breakthroughs, trend reversal

signals, or other technological forms to determine the best trading

opportunities.

The characteristics of band trading are frequent trading and sensitivity to

short-term market fluctuations. Band traders usually focus more on short-term

price trends than long-term trends. They usually do not hold investment

positions for too long to fully exploit opportunities for short-term

fluctuations.

However, band trading also carries certain risks. Market volatility may be

unstable, posing high risks and uncertainties for band traders. In addition,

band trading requires quick decision-making and execution of trades, requiring

high levels of technical analysis and quick reaction ability from traders.

Band trading is not suitable for all traders, as it requires strong market

analysis and quick decision-making abilities. But for traders who prefer to

pursue short-term profits and flexible trading strategies, band trading may be

an attractive strategy.