What is Oscillatoty Trading?

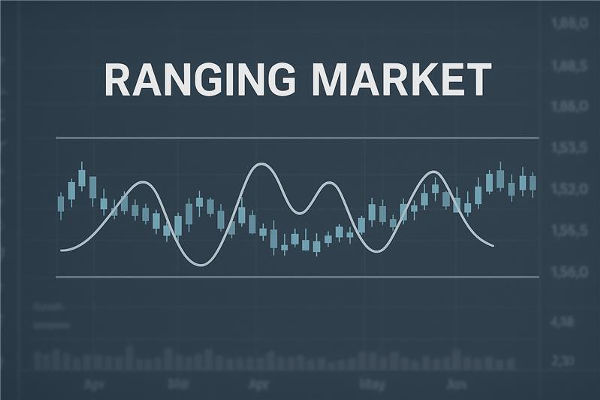

Oscillatory Trading refers to trading activities that occur when financial

market prices are relatively stable and fluctuate within a certain range. In

oscillatory markets, prices often fluctuate repeatedly between support and

resistance levels, lacking a clear trend direction. Oscillatory Trading focuses on

utilizing the volatility of prices within this range to buy and sell in order to

earn short-term profits.

A oscillatory market usually occurs when there is a lack of clear market drivers

or when the market is in a consolidation stage. In this market environment, the

rise and fall of prices will not last for too long but will fluctuate back and

forth between certain support and resistance levels. Oscillatory traders judge

entry and exit opportunities by observing the characteristics of price

fluctuations, technical indicators, and market trends in order to capture

opportunities for price fluctuations.

This type of trading strategy can be applied to stocks, forex,

futures, and other trading varieties. When conducting oscillatory trading, traders

usually set smaller profit targets and stricter stop-loss positions to control

risk and limit losses. At the same time, oscillatory markets also require traders

to have sharper market observation and the ability to make quick decisions in

order to fully seize rapidly changing trading opportunities.

The volatility trading strategy is a trading method suitable for markets in

oscillatory conditions (where prices fluctuate within a certain range). Oscillatory

markets typically lack clear trends, and prices fluctuate between support and

resistance levels. The goal of a oscillatory trading strategy is to buy and sell

within the range of price fluctuations to capture short-term fluctuations in

prices.

Common Trading Strategies

1. Support and resistance-level strategies

Determine the timing of buying and selling by observing the rebound and

retreat of prices between the support level (the level of resistance below the

price) and the resistance level (the level of resistance above the price).

2. Moving Average Strategy

Determine the timing of buying and selling by observing the intersection and

post-intersection movements of prices below the moving average. When prices

fluctuate near the moving average, intersections may provide trading

opportunities.

3. Swing indicator strategy

For example, relative strength indicators (RSI) and stochastic indicators

(Stochastic Oscillator) determine the timing of buying and selling by observing

the situation of overbought and oversold prices.

4. Interval trading strategy

Look for clear upper and lower limits on the price that have formed over a

period of time; sell when the price approaches the upper limit, and buy when the

price approaches the lower limit.

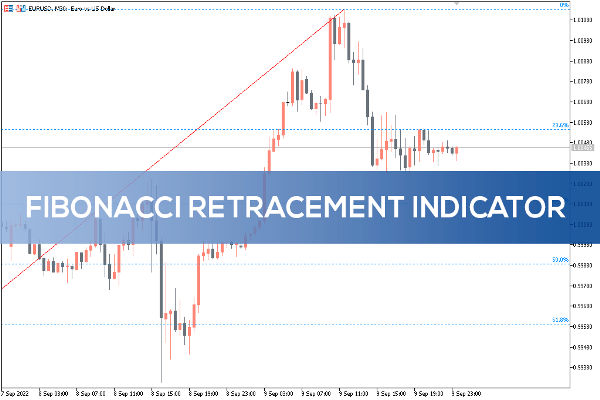

5. Trendline strategy

Observe the rebound and fall of prices near the upward or downward Trend Line to determine the timing of buying and selling.

Regardless of the volatility trading strategy used, traders need to closely

monitor market volatility and price changes to accurately grasp the timing of

buying and selling. In addition, risk management is also crucial, including

setting stop-loss and stop-gain positions to limit potential losses. It is best

to fully understand and test any trading strategy before using it to ensure that

it is suitable for an individual's trading style and risk tolerance.